Pay advances and loan policy (Virginia): Free template

This pay advances and loan policy is designed to help Virginia businesses establish clear guidelines for providing employees with pay advances or loans. The policy outlines the conditions under which employees may request financial assistance, the process for approval, and the terms for repayment. It also provides clarity on the business’s role in offering this benefit while ensuring financial stability and supporting compliance with Virginia state and federal laws.

By adopting this policy, businesses can support their employees during times of financial need while maintaining control over payroll expenses and ensuring fair treatment across the workforce.

How to use this pay advances and loan policy (Virginia)

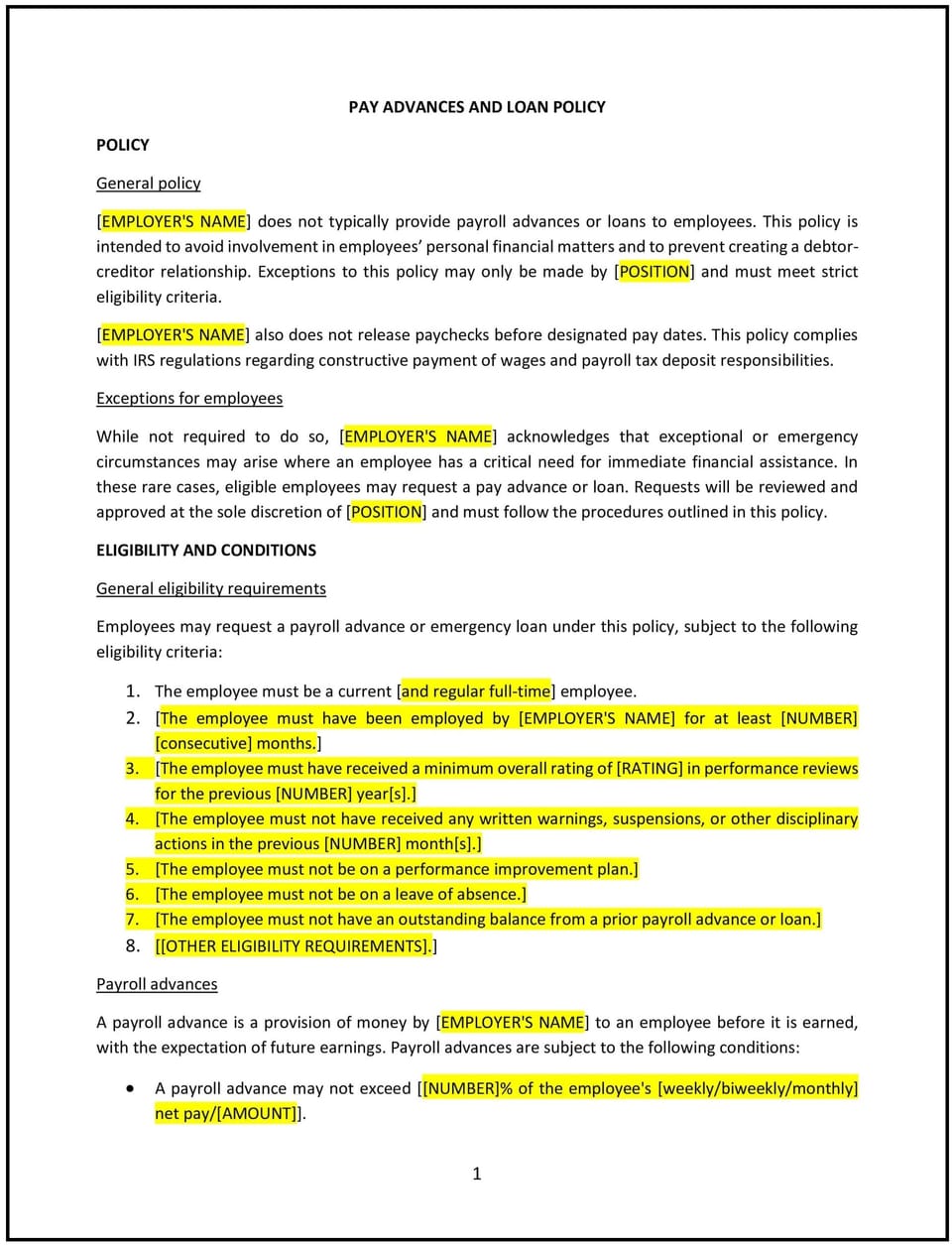

- Define eligibility criteria: The policy should outline the criteria for employees to be eligible for pay advances or loans. This might include factors such as length of service, job position, and previous work performance. The policy should also specify whether all employees are eligible or if it applies to certain roles or departments.

- Set limits on pay advances and loan amounts: The policy should set clear guidelines on the maximum amount of pay advances or loans that can be provided to employees. This may be a percentage of the employee’s salary or a fixed amount, based on the company’s financial policies.

- Establish the approval process: The policy should define the steps employees need to take to request a pay advance or loan, including submitting a formal request, providing supporting documentation (if necessary), and gaining approval from the relevant manager or HR department. It should also include timelines for approval and disbursement.

- Outline repayment terms: The policy should specify the terms of repayment, including whether the amount will be deducted from future paychecks or repaid through a separate agreement. The repayment schedule should be clear and reasonable, with an understanding of how long it will take to repay the loan or advance.

- Address interest rates and fees: If applicable, the policy should explain whether interest will be charged on the loan or pay advance. It should also state any fees associated with late repayments or missed payments. If no interest is charged, this should be clearly stated in the policy.

- Clarify repayment in case of employment termination: The policy should specify how pay advances or loans will be handled if the employee’s employment ends before the full repayment is made. This may include deducting any remaining balance from the final paycheck or requiring the employee to repay the balance within a specified time frame.

- Ensure compliance with Virginia state and federal laws: The policy should ensure that the process for providing pay advances and loans complies with Virginia state laws and federal regulations, including wage and hour laws, lending laws, and any other applicable financial regulations.

- Review and update regularly: Periodically review and update the policy to ensure it is compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this pay advances and loan policy (Virginia)

This policy offers several benefits for Virginia businesses:

- Supports employee financial well-being: By offering pay advances or loans, businesses can help employees manage unexpected financial needs or emergencies, leading to greater job satisfaction and financial stability for employees.

- Reduces employee stress and turnover: Financial difficulties can cause stress and distract employees from their work. Offering financial support through pay advances or loans helps reduce these concerns, improving employee morale and reducing turnover.

- Ensures fair and consistent treatment: By setting clear guidelines and procedures, the policy ensures that all employees are treated fairly when requesting financial assistance, preventing favoritism or misunderstandings.

- Helps manage cash flow: The policy allows businesses to manage payroll expenses more effectively by establishing clear repayment terms and avoiding excessive advances that could disrupt the company’s cash flow.

- Complies with legal requirements: By adhering to Virginia state laws and federal regulations, the business minimizes the risk of legal issues related to financial transactions, including pay advances and loans.

- Strengthens employer-employee trust: Offering financial support demonstrates a commitment to employee well-being and fosters trust between employees and management, which can lead to a more engaged and loyal workforce.

Tips for using this pay advances and loan policy (Virginia)

- Communicate the policy clearly: Ensure that all employees are aware of the pay advances and loan policy, including the process for requesting financial assistance, eligibility requirements, and repayment terms. Include the policy in the employee handbook and review it during onboarding and training.

- Set reasonable repayment terms: Establish repayment schedules that are fair and manageable for employees, taking into account their financial situation and the company’s financial capabilities.

- Maintain clear records: Keep accurate records of all pay advances and loans issued, including amounts, repayment schedules, and any changes made to the terms of the loan. This will help ensure transparency and prevent confusion.

- Be consistent: Apply the policy consistently to all employees to ensure fairness and avoid any perception of favoritism. Ensure that all requests for pay advances or loans are reviewed and approved according to the same criteria.

- Review and update regularly: Periodically review and update the policy to ensure it is compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

Q: Who is eligible to request a pay advance or loan?

A: Employees who meet the eligibility criteria specified in the policy, such as length of service and job position, may request a pay advance or loan. The policy should clearly define the requirements for eligibility.

Q: How much can an employee request for a pay advance or loan?

A: The policy will set a limit on the amount that can be requested for a pay advance or loan, typically based on a percentage of the employee’s salary or a fixed amount. Employees should refer to the policy to understand the maximum allowable amount.

Q: How is the repayment of pay advances or loans structured?

A: Repayment terms are outlined in the policy and may include deductions from future paychecks, a separate repayment agreement, or another mutually agreed-upon arrangement. The repayment schedule should be reasonable and clearly defined.

Q: Are there any interest rates or fees associated with pay advances or loans?

A: The policy should specify whether interest will be charged and if any fees apply for late payments. If no interest is charged, this should be explicitly stated in the policy.

Q: What happens if an employee’s employment ends before the loan is repaid?

A: If an employee leaves the company before the loan or pay advance is fully repaid, the remaining balance may be deducted from their final paycheck, or the employee may be required to repay the balance within a specified time frame.

Q: How often should this policy be reviewed?

A: The policy should be reviewed periodically, at least annually, to ensure it is compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.