Pay advances and loan policy (Washington): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

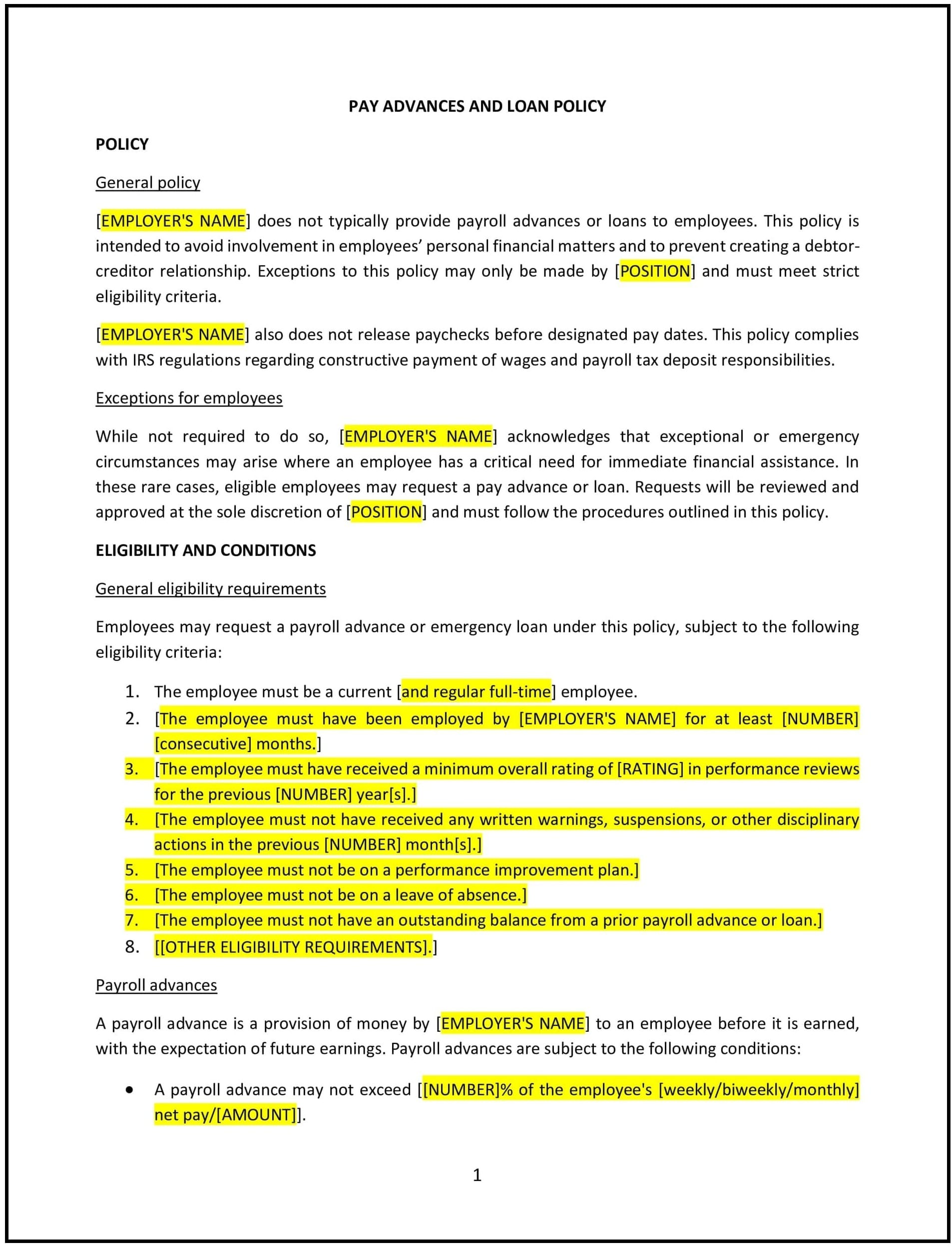

This pay advances and loan policy is designed to help Washington businesses manage employee requests for pay advances and loans. The policy outlines the circumstances under which employees may request a pay advance or loan, the process for requesting such financial assistance, and the terms and conditions for repayment. It aims to ensure fairness and transparency in how these requests are handled while maintaining compliance with Washington state labor laws.

By adopting this policy, businesses can provide financial assistance to employees in need while protecting the company’s interests and ensuring that financial support is managed responsibly.

How to use this pay advances and loan policy (Washington)

- Define eligibility for pay advances and loans: The policy should specify which employees are eligible to request pay advances or loans, including any minimum employment requirements (e.g., length of service, full-time status). It should also outline any specific financial hardship criteria that must be met for approval.

- Set clear procedures for requesting an advance or loan: The policy should outline the process for requesting pay advances or loans, including the necessary documentation, forms, or approvals. It should specify how employees should make their requests (e.g., through HR or payroll) and the information required.

- Establish repayment terms: The policy should clearly define the repayment terms, including the repayment schedule (e.g., deductions from future paychecks), interest rates (if applicable), and any other conditions tied to the repayment of advances or loans. The policy should ensure that these terms are fair and manageable for employees.

- Determine the maximum amount of pay advances or loans: The policy should specify the maximum amount that can be advanced to an employee at one time. This limit should be reasonable and based on the employee's salary or financial need.

- Address situations where repayment is not possible: The policy should address situations where an employee is unable to repay the loan or advance as agreed. This may include options for renegotiating repayment terms or handling unpaid balances through other means (e.g., deductions over a longer period).

- Ensure compliance with Washington state laws: The policy should comply with Washington state laws regarding employee loans and pay advances, including wage and hour laws, interest rate limits, and any other applicable regulations. The policy should also ensure that advances or loans do not violate state labor laws regarding wage deductions.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this pay advances and loan policy (Washington)

This policy offers several benefits for Washington businesses:

- Provides financial support to employees: The policy allows businesses to offer financial assistance to employees facing temporary financial hardship, which can improve employee satisfaction and loyalty.

- Reduces the risk of financial disputes: By setting clear expectations for the request and repayment process, the policy helps reduce the risk of misunderstandings or conflicts related to pay advances and loans.

- Supports compliance with state laws: The policy ensures that the company remains compliant with Washington state laws governing pay advances, loans, and wage deductions, reducing the risk of legal complications.

- Enhances transparency and fairness: The policy ensures that the process for requesting and approving pay advances or loans is transparent, fair, and consistent across the organization.

- Protects the company’s financial interests: The policy ensures that pay advances and loans are managed in a responsible manner, including clear repayment terms, to protect the company’s financial stability.

- Promotes employee well-being: By offering a structured approach to pay advances and loans, the policy helps employees manage financial challenges, contributing to their overall well-being and job satisfaction.

Tips for using this pay advances and loan policy (Washington)

- Communicate the policy clearly: Ensure that all employees are aware of the pay advance and loan policy and understand how to request financial assistance. Include the policy in the employee handbook, review it during onboarding, and provide periodic reminders.

- Set reasonable repayment terms: When establishing repayment terms, ensure they are fair and manageable for employees. The terms should not create undue financial hardship or cause employees to fall further into debt.

- Maintain clear records of advances and loans: Keep detailed records of all pay advances and loans, including amounts, repayment schedules, and any agreements made with employees. This will help track the outstanding balances and ensure accountability.

- Review employee requests carefully: When reviewing employee requests for pay advances or loans, assess the employee’s financial need and ability to repay the amount requested. The policy should ensure that advances or loans are granted responsibly and only when necessary.

- Address non-payment promptly: If an employee is unable to repay a loan or advance as agreed, address the situation promptly by renegotiating the repayment terms or exploring other options. Open communication can help resolve issues without negatively affecting the employee’s financial situation.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s operations. Regular updates will help keep the policy relevant and effective.