Pay advances and loan policy (West Virginia): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (West Virginia)

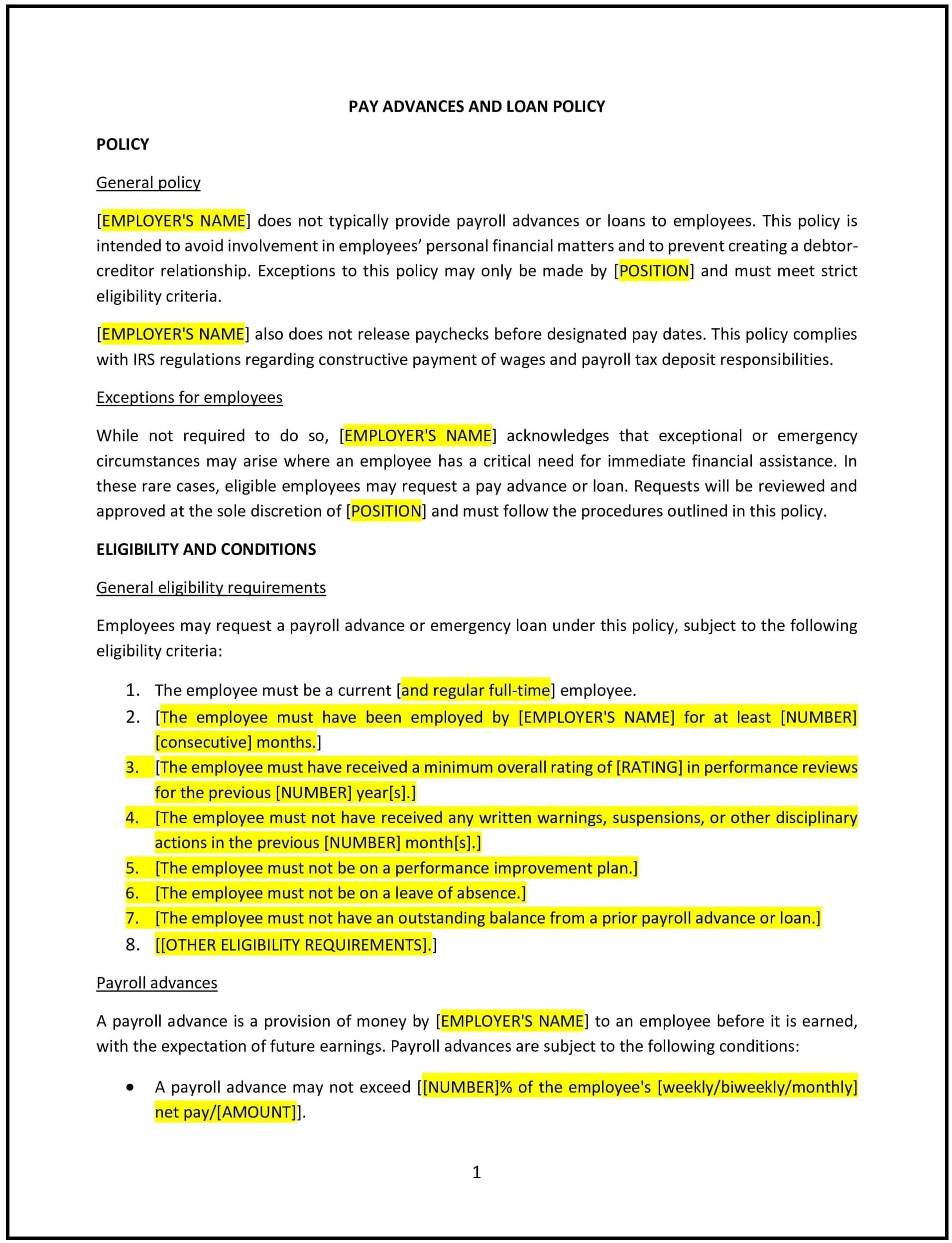

In West Virginia, a pay advances and loan policy outlines the organization’s approach to providing financial support to employees in the form of salary advances or loans. This policy ensures transparency, fairness, and consistency in managing employee requests while safeguarding the organization’s financial resources.

The policy defines eligibility criteria, application procedures, repayment terms, and responsibilities for both the employer and the employee.

How to use this pay advances and loan policy (West Virginia)

- Define eligibility: Specify which employees qualify for pay advances or loans based on factors such as tenure, role, and financial need.

- Outline application procedures: Provide clear instructions for requesting a pay advance or loan, including required documentation and approval steps.

- Establish repayment terms: Detail the repayment process, such as deductions from future paychecks or other agreed-upon methods, and include timelines.

- Address limits and restrictions: Specify the maximum amount available for advances or loans and any restrictions, such as frequency of requests.

- Support compliance: Ensure the policy aligns with West Virginia labor laws and federal wage regulations to avoid legal risks.

Benefits of using a pay advances and loan policy (West Virginia)

- Supports employees: Provides financial relief to employees facing unexpected expenses or financial hardship.

- Promotes transparency: Establishes clear guidelines for managing pay advances and loans, reducing confusion or favoritism.

- Encourages accountability: Ensures employees understand their responsibilities for repayment and compliance with policy terms.

- Protects organizational resources: Safeguards the company’s financial stability by setting clear limits and repayment terms.

- Enhances compliance: Helps adhere to West Virginia labor laws and federal wage regulations to ensure lawful implementation.

Tips for using a pay advances and loan policy (West Virginia)

- Communicate the policy: Share the policy with employees during onboarding and ensure it is accessible for reference.

- Train managers: Provide training to supervisors and HR staff on evaluating requests and ensuring compliance with the policy.

- Document agreements: Use written agreements for all advances or loans, detailing repayment terms and signed by both parties.

- Monitor repayments: Regularly track repayment progress to ensure adherence to the agreed-upon terms.

- Review periodically: Update the policy to reflect changes in West Virginia laws, organizational practices, or employee feedback.