Pay advances and loan policy (Wisconsin): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Wisconsin)

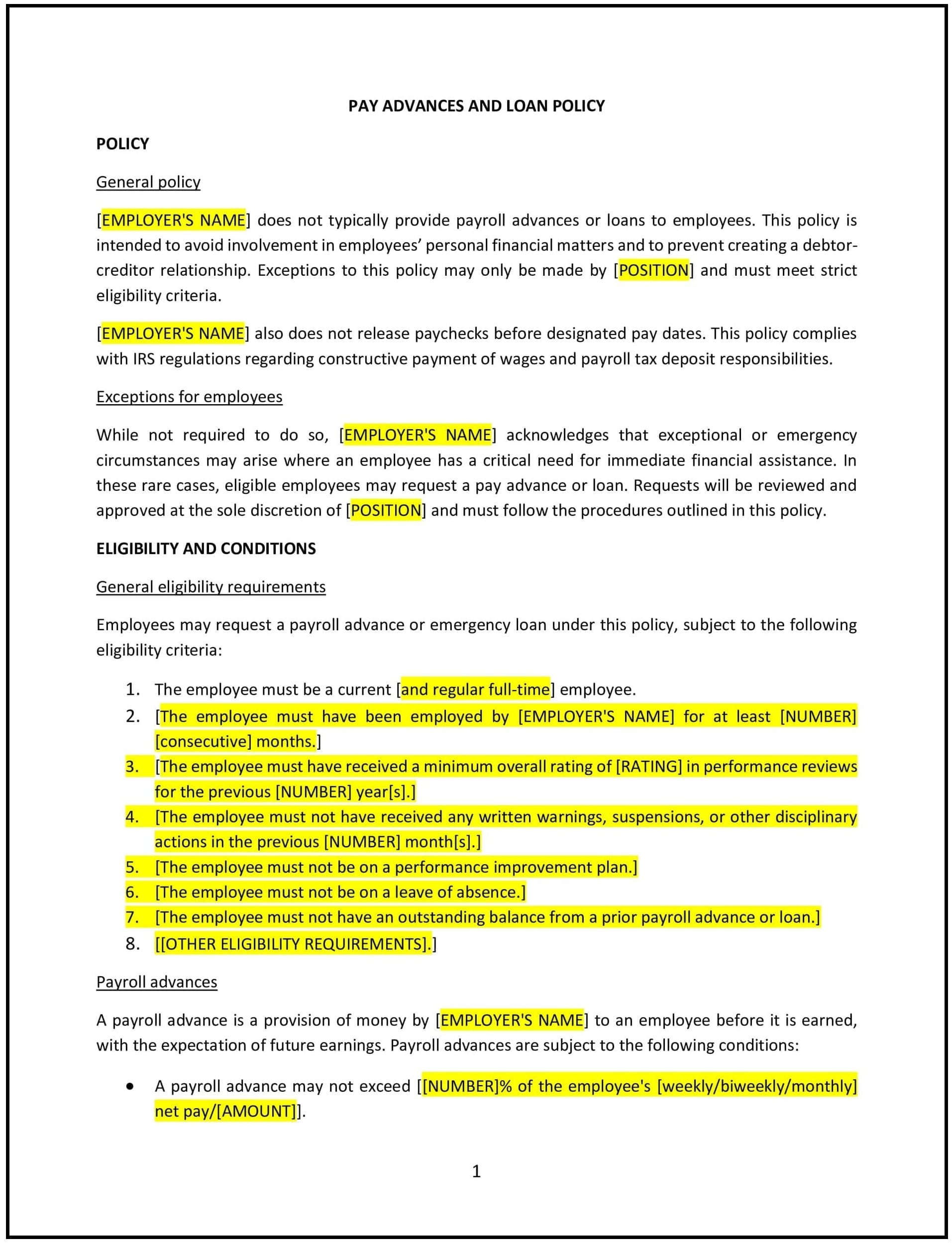

A pay advances and loan policy helps Wisconsin businesses establish clear guidelines for granting pay advances or loans to employees. This policy outlines the conditions under which pay advances or loans may be offered, the repayment terms, and the process for requesting and approving such financial support, ensuring fairness and transparency.

By implementing this policy, businesses can provide financial support to employees in need while protecting the company from financial risk and ensuring clear, consistent practices.

How to use this pay advances and loan policy (Wisconsin)

- Define eligibility: Specify which employees are eligible to request pay advances or loans, considering factors like tenure, employment status, or specific circumstances of need.

- Set limits on amounts: Detail the maximum amount an employee may receive as a pay advance or loan and ensure the amounts are reasonable and aligned with company policies.

- Outline repayment terms: Clearly specify the repayment terms, such as payroll deductions, repayment schedules, or any interest that may apply, to ensure clarity and avoid misunderstandings.

- Include approval procedures: Establish clear procedures for requesting and approving pay advances or loans, including the necessary documentation and steps for submitting requests.

- Address consequences of non-repayment: Outline the steps the company will take if an employee fails to repay the loan or pay advance, such as deductions from future wages or legal action.

- Achieve compliance with laws: Make sure the policy complies with Wisconsin and federal labor laws regarding pay advances and loans, including applicable interest rate limits and deductions from wages.

Benefits of using this pay advances and loan policy (Wisconsin)

This policy offers several benefits for Wisconsin businesses:

- Provides employee support: Offers employees financial assistance during times of need, helping to maintain morale and employee satisfaction.

- Promotes fairness: Ensures that all employees are treated equally and transparently when requesting financial support.

- Reduces financial risks: Establishes clear terms and repayment schedules, reducing the risk of non-repayment and financial strain on the business.

- Improves operational efficiency: Provides a structured process for employees to access financial assistance, which can streamline decision-making and approval.

- Supports legal compliance: Reduces the risk of legal issues by adhering to Wisconsin and federal labor laws regarding pay advances, loans, and wage deductions.

Tips for using this pay advances and loan policy (Wisconsin)

- Communicate the policy clearly: Ensure that employees understand the guidelines for requesting pay advances or loans, including eligibility, repayment terms, and the approval process.

- Maintain documentation: Require employees to submit formal written requests for pay advances or loans, along with any necessary supporting documentation (e.g., proof of financial need).

- Monitor repayment: Track repayment schedules and ensure that employees adhere to agreed-upon terms, including deductions from wages if necessary.

- Offer financial counseling: Consider providing employees with financial planning resources or counseling to help them avoid recurring financial hardship.

- Update regularly: Review and revise the policy as needed to reflect changes in Wisconsin laws, company practices, or employee feedback.