Pay advances and loan policy (Wyoming): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Wyoming)

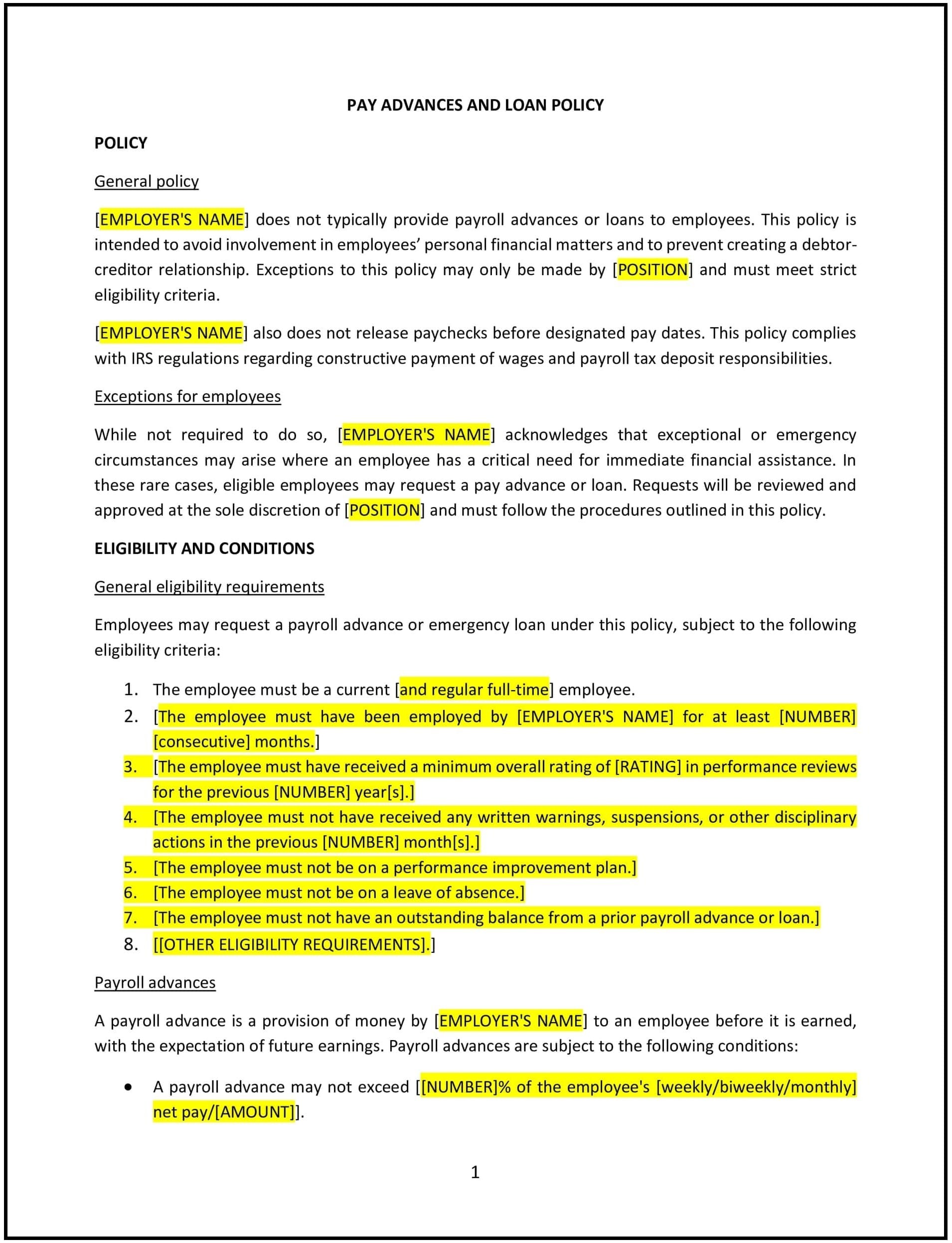

In Wyoming, a pay advances and loan policy provides employees with clear guidelines for requesting financial assistance through pay advances or loans from their employer. This policy ensures transparency, fairness, and promotes compliance with applicable laws while supporting employees facing financial challenges.

This policy outlines eligibility criteria, procedures, and repayment terms for pay advances or loans, creating a structured approach to workplace financial assistance.

How to use this pay advances and loan policy (Wyoming)

- Define eligibility: Specify which employees are eligible for pay advances or loans, such as those with a certain tenure or in good standing with the company.

- Outline application procedures: Include steps for requesting financial assistance, such as submitting a written request or completing a specific form.

- Detail repayment terms: Clearly explain repayment options, including payroll deductions, timelines, and any applicable interest or fees.

- Set limits: Define the maximum amount that can be requested and any restrictions on the frequency of pay advances or loans.

- Support compliance: Align the policy with Wyoming labor laws and federal regulations to ensure fair and legal implementation.

Benefits of using a pay advances and loan policy (Wyoming)

A pay advances and loan policy provides several advantages for Wyoming businesses:

- Supports employees: Helps employees manage financial emergencies or unexpected expenses, improving morale and loyalty.

- Promotes transparency: Establishes clear guidelines, reducing misunderstandings or disputes about financial assistance.

- Promotes compliance: Aligns with state and federal laws, minimizing the risk of legal challenges.

- Enhances retention: Demonstrates a commitment to employee well-being, fostering long-term engagement.

- Adapts to workforce needs: Reflects Wyoming’s unique workforce dynamics and community-oriented values.

Tips for using a pay advances and loan policy (Wyoming)

- Communicate clearly: Share the policy with employees during onboarding and ensure it is accessible for future reference.

- Maintain confidentiality: Handle all requests for financial assistance discreetly to protect employee privacy.

- Monitor repayment: Regularly review repayment schedules to ensure compliance and address any issues promptly.

- Encourage responsibility: Educate employees about financial planning and resources to complement the policy.

- Review periodically: Update the policy to reflect changes in laws, organizational practices, or workforce needs.