Payroll and compensation policy (Maryland): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

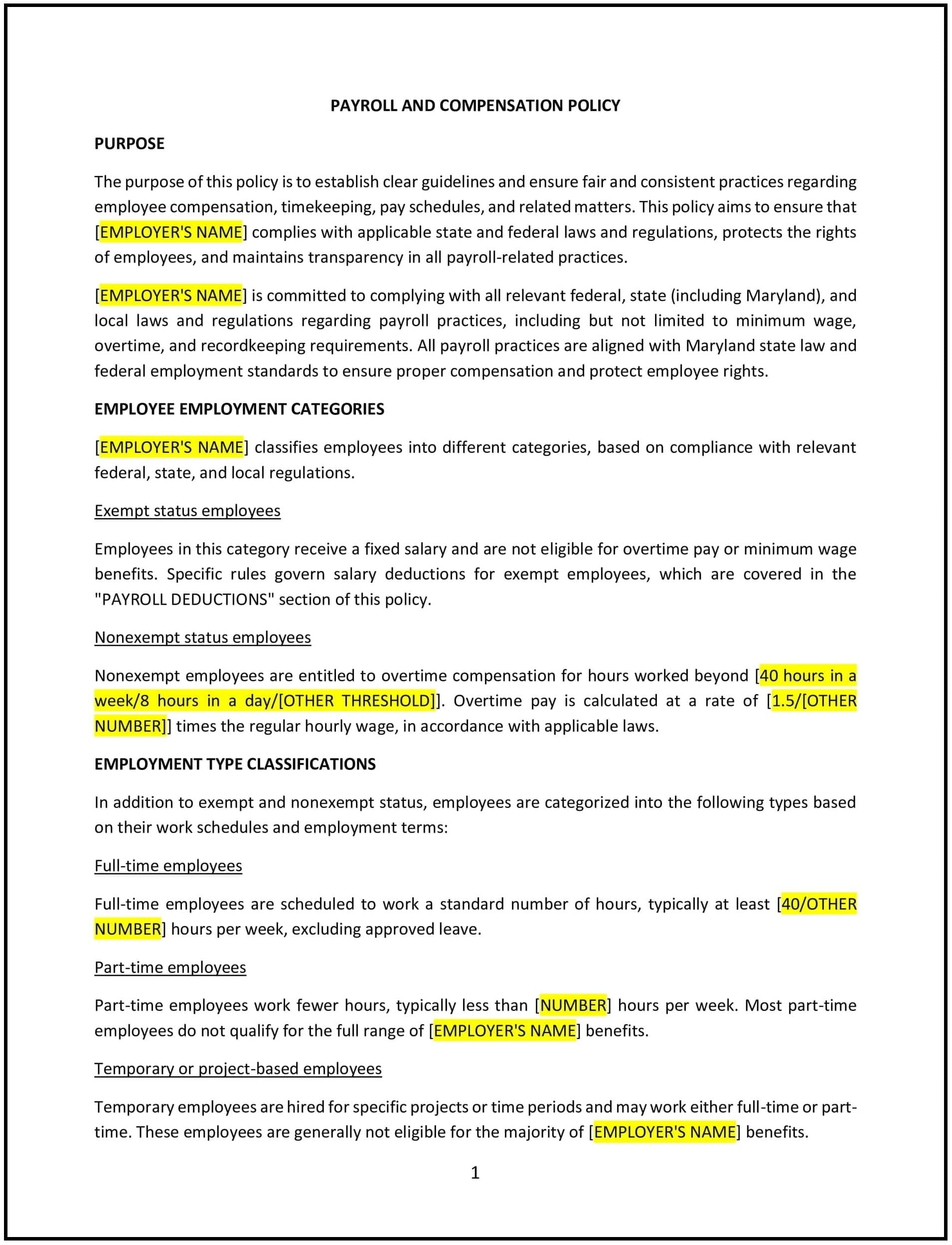

Payroll and compensation policy (Maryland)

This payroll and compensation policy is designed to help Maryland businesses establish clear guidelines for managing employee wages, salary structures, and payroll practices. It outlines procedures for payment schedules, deductions, and adjustments while adhering to Maryland-specific labor laws and federal regulations.

By adopting this policy, Maryland businesses can promote transparency, ensure accurate compensation, and maintain employee trust.

How to use this payroll and compensation policy (Maryland)

- Define pay structure: Clearly outline salary or hourly pay structures, including overtime eligibility and bonuses.

- Establish payment schedules: Specify the frequency of payroll, such as weekly, bi-weekly, or monthly, in compliance with Maryland regulations.

- Detail deductions: Provide a list of allowable deductions, such as taxes, benefits, or garnishments, and ensure compliance with state laws.

- Include overtime and holiday pay: Outline rules for calculating overtime and holiday pay, adhering to Maryland and federal labor standards.

- Address errors and corrections: Specify procedures for reporting and correcting payroll errors, such as underpayments or overpayments.

- Reflect Maryland-specific considerations: Incorporate state requirements, such as minimum wage laws, wage notice requirements, and paystub transparency.

Benefits of using this payroll and compensation policy (Maryland)

Implementing this policy provides Maryland businesses with several advantages:

- Ensures accuracy: Reduces errors in payroll processing and compensation calculations.

- Promotes transparency: Builds employee trust by clearly outlining pay practices and expectations.

- Enhances compliance: Aligns payroll practices with Maryland labor laws and federal wage standards.

- Reduces disputes: Provides a framework for addressing payroll-related concerns or issues.

- Supports employee satisfaction: Demonstrates a commitment to fair and consistent compensation practices.

Tips for using this payroll and compensation policy (Maryland)

- Train payroll staff: Ensure employees handling payroll are knowledgeable about Maryland-specific labor laws and regulations.

- Communicate pay policies: Share the policy with employees during onboarding and make it easily accessible for reference.

- Use reliable systems: Invest in payroll software to automate calculations, ensure accuracy, and maintain compliance.

- Monitor compliance: Regularly review payroll practices to ensure alignment with state and federal laws.

- Address issues promptly: Resolve payroll concerns, such as disputes or errors, quickly to maintain trust and morale.