Payroll and compensation policy (Michigan): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Payroll and compensation policy (Michigan)

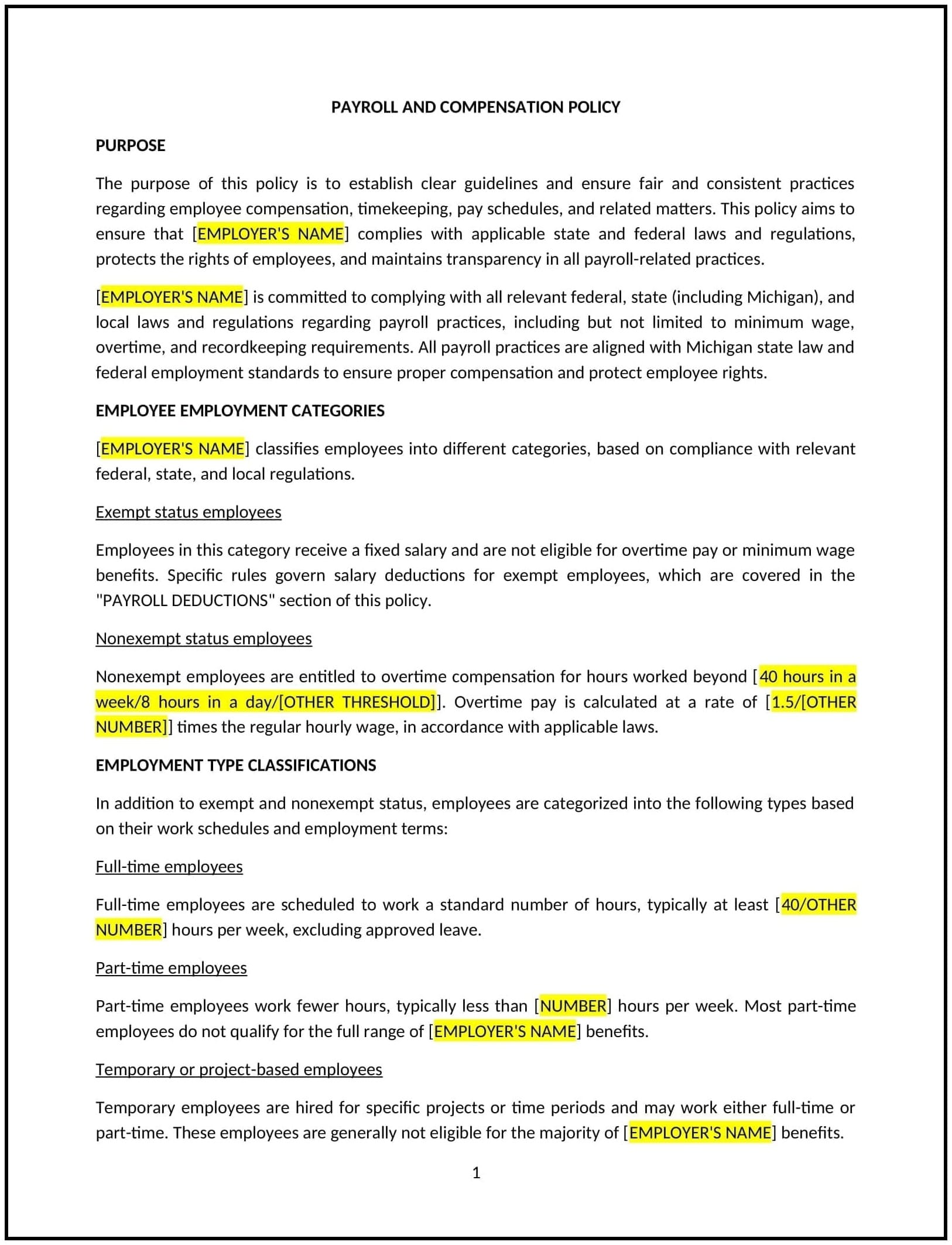

A payroll and compensation policy provides Michigan businesses with clear guidelines regarding employee pay, salary structures, and the overall compensation process. This policy outlines how wages are calculated, when and how payments are made, and the various forms of compensation, including overtime, bonuses, and benefits.

By adopting this policy, businesses can promote employee satisfaction, ensure legal compliance, and maintain a consistent, efficient payroll system.

How to use this payroll and compensation policy (Michigan)

- Define compensation structures: Outline the types of compensation offered by the business, such as hourly wages, salaries, commissions, or piece-rate pay. Specify the criteria for each compensation type and how it is determined.

- Set pay periods: Clearly define the pay schedule, including how often employees are paid (e.g., weekly, bi-weekly, or monthly) and the pay dates. Ensure that employees understand when to expect their payments.

- Address overtime pay: Specify how overtime pay is calculated for non-exempt employees, in compliance with Michigan state and federal wage laws. Typically, employees are entitled to overtime pay for hours worked over 40 hours in a workweek at a rate of 1.5 times their regular hourly wage.

- Discuss deductions: Outline any deductions that will be made from employee pay, such as taxes, retirement contributions, health insurance premiums, or wage garnishments. Ensure that employees are aware of these deductions and how they will be applied.

- Provide benefits: Include information about employee benefits, such as health insurance, retirement plans, paid time off (PTO), and any other compensation-related perks. Specify how employees can enroll in benefits and any eligibility requirements.

- Bonus and incentive pay: Outline how bonuses or incentive pay are awarded, such as performance-based bonuses, annual bonuses, or sales commissions. Specify the criteria for earning these bonuses and how they will be paid.

- Explain payroll errors: Provide a process for employees to report payroll errors or discrepancies, and describe how these will be addressed promptly.

- Ensure compliance with Michigan and federal laws: Ensure that the payroll system and compensation practices comply with all applicable wage and hour laws, including minimum wage, overtime, and benefits requirements under both Michigan state laws and the Fair Labor Standards Act (FLSA).

- Review and update the policy regularly: Periodically review and update the payroll and compensation policy to ensure it aligns with changes in Michigan state laws, federal regulations, and business practices.

Benefits of using this payroll and compensation policy (Michigan)

This policy provides several key benefits for Michigan businesses:

- Complies with legal requirements: The policy helps businesses comply with Michigan state laws and federal regulations related to wages, overtime, taxes, and employee benefits, reducing the risk of legal challenges or penalties.

- Promotes fairness and transparency: A clear compensation policy ensures that all employees are treated fairly and equitably, fostering trust between employees and management.

- Reduces payroll errors: By establishing clear processes for payroll calculations, deductions, and reporting, the policy minimizes the risk of payroll errors, which can lead to employee dissatisfaction or legal issues.

- Enhances employee satisfaction: A well-defined payroll and compensation policy ensures that employees understand their compensation structure, including pay rates, benefits, and bonuses, which can lead to increased job satisfaction and retention.

- Streamlines payroll management: The policy provides a structured framework for managing payroll, making it easier for HR or payroll departments to process payments, handle benefits, and address employee concerns efficiently.

Tips for using this payroll and compensation policy (Michigan)

- Communicate the policy clearly: Ensure that all employees are aware of the payroll and compensation policy by including it in the employee handbook, during onboarding, and through regular communications about pay dates, benefits, and other compensation-related topics.

- Offer regular training: Provide training for HR and payroll staff to ensure they understand the policy, including how to handle pay calculations, benefits enrollment, and payroll errors.

- Regularly audit payroll processes: Conduct periodic audits of payroll processes to ensure compliance with the policy and applicable laws. This helps identify any discrepancies or areas for improvement in the payroll system.

- Monitor changes in legislation: Stay informed about any changes to Michigan state or federal wage laws, tax regulations, or employee benefits requirements to ensure the policy remains compliant with evolving legal standards.

- Review the policy regularly: Periodically review the payroll and compensation policy to ensure it remains relevant and up to date with changes in business practices, industry standards, and legal requirements.