Payroll and compensation policy (Montana): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

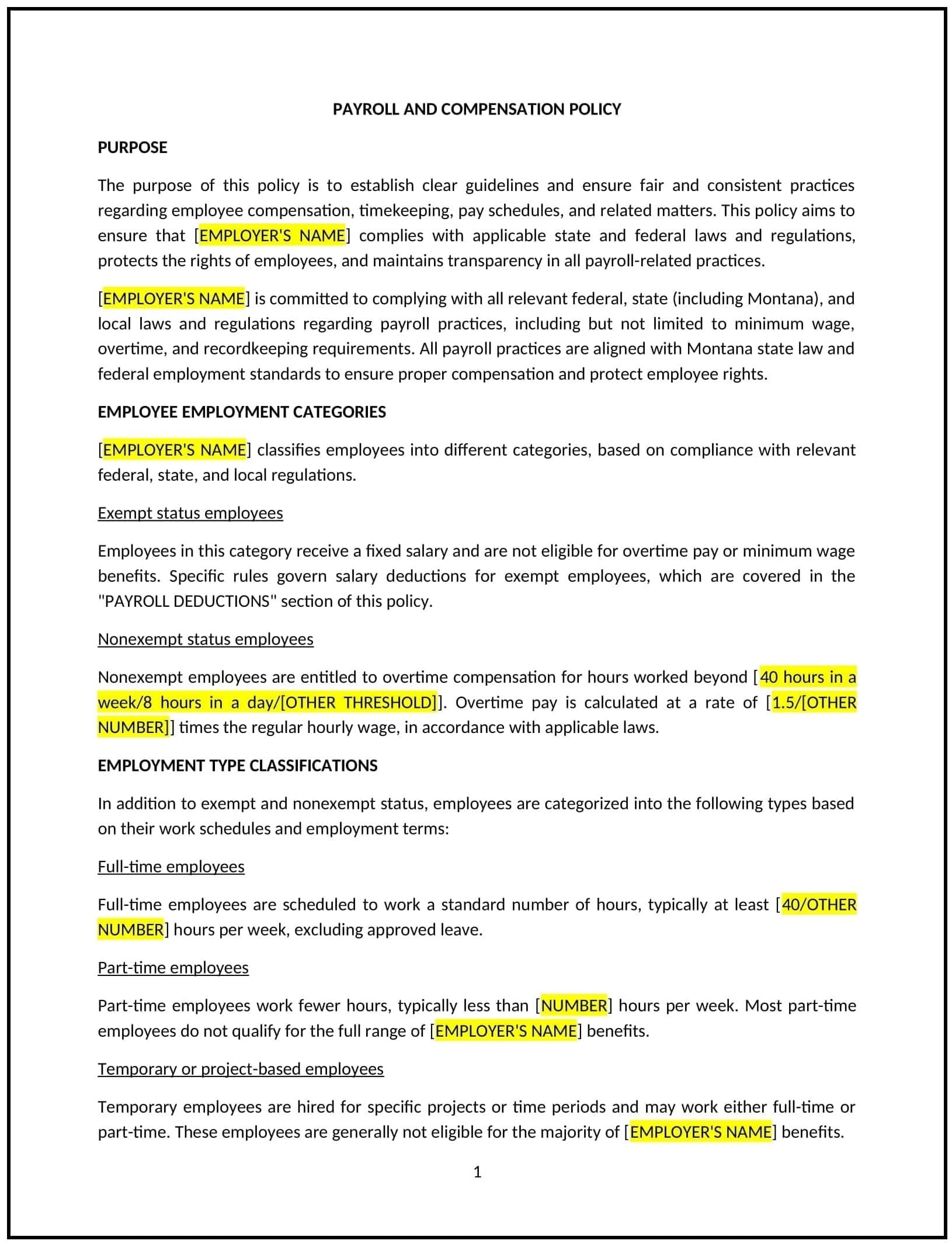

Payroll and compensation policy (Montana)

A payroll and compensation policy helps Montana businesses establish clear, consistent guidelines for employee compensation, pay structures, and payroll practices. This policy outlines how employees will be paid, the frequency of payments, and the procedures for addressing pay discrepancies, overtime, and deductions.

By implementing this policy, businesses can ensure fairness, transparency, and legal compliance in their payroll processes, while providing employees with clear expectations regarding compensation.

How to use this payroll and compensation policy (Montana)

- Define pay structure: The policy should clearly outline the company’s compensation structure, including the types of pay (e.g., hourly, salaried, commission-based), pay grades, and any performance-related incentives or bonuses.

- Set payroll frequency: The policy should specify how often employees will be paid, whether it is weekly, bi-weekly, semi-monthly, or monthly, and when they can expect to receive their pay.

- Outline deductions: The policy should define allowable payroll deductions, such as taxes, retirement contributions, insurance premiums, garnishments, and any voluntary deductions (e.g., for charitable donations).

- Address overtime pay: The policy should explain how overtime pay will be calculated for non-exempt employees under the Fair Labor Standards Act (FLSA) and Montana’s state labor laws, including the overtime rate and qualifying hours.

- Establish pay periods and deadlines: The policy should define the pay period (e.g., the start and end of each pay cycle) and the deadlines for submitting timesheets or payroll information to ensure timely and accurate payment.

- Specify reporting procedures for pay discrepancies: The policy should provide guidelines for employees to report pay discrepancies or errors, including who to contact, how to document issues, and the steps for resolving disputes.

- Review and update regularly: The policy should be reviewed periodically to stay in line with any changes to federal or state wage laws, benefits, or business practices.

Benefits of using this payroll and compensation policy (Montana)

This policy provides several key benefits for Montana businesses:

- Promotes transparency: A clear payroll and compensation policy ensures employees understand how their pay is calculated, when they will be paid, and what deductions may apply, fostering trust and transparency.

- Prevents payroll disputes: By outlining clear procedures for pay calculations, overtime, and deductions, the policy helps minimize misunderstandings or disputes regarding employee compensation.

- Supports legal compliance: The policy helps ensure that the business complies with both federal and state wage laws, including minimum wage, overtime, and pay transparency requirements, reducing the risk of legal issues or penalties.

- Increases employee satisfaction: Employees are more likely to be satisfied with their compensation when there are clear expectations and a consistent, fair process for determining pay and addressing issues.

- Enhances payroll efficiency: Establishing consistent payroll procedures improves the accuracy and efficiency of payroll processing, reducing administrative errors and delays.

- Supports business scalability: A well-defined compensation policy makes it easier for businesses to scale by establishing standardized pay structures and processes as the company grows.

Tips for using this payroll and compensation policy (Montana)

- Communicate the policy clearly: Ensure all employees are aware of the payroll and compensation policy, including how their pay is determined, when they will be paid, and how to report discrepancies.

- Review payroll information regularly: Ensure that payroll data is accurate and up-to-date, and that employees submit their timesheets or other required documentation within established deadlines.

- Offer training on payroll procedures: Provide training for employees and HR staff on how payroll works, how to handle discrepancies, and how to interpret the policy, ensuring everyone is on the same page.

- Implement a consistent review process: Regularly review payroll and compensation practices to identify potential improvements, address any emerging issues, and ensure the company remains competitive in terms of compensation.

- Use automated payroll systems: Leverage payroll software to streamline the payroll process, reduce human error, and ensure that employees are paid accurately and on time.

- Be proactive about changes: If there are changes to pay rates, bonuses, or benefits, communicate them clearly to employees in advance, ensuring that everyone is informed about upcoming changes.