Payroll and compensation policy (Nevada): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

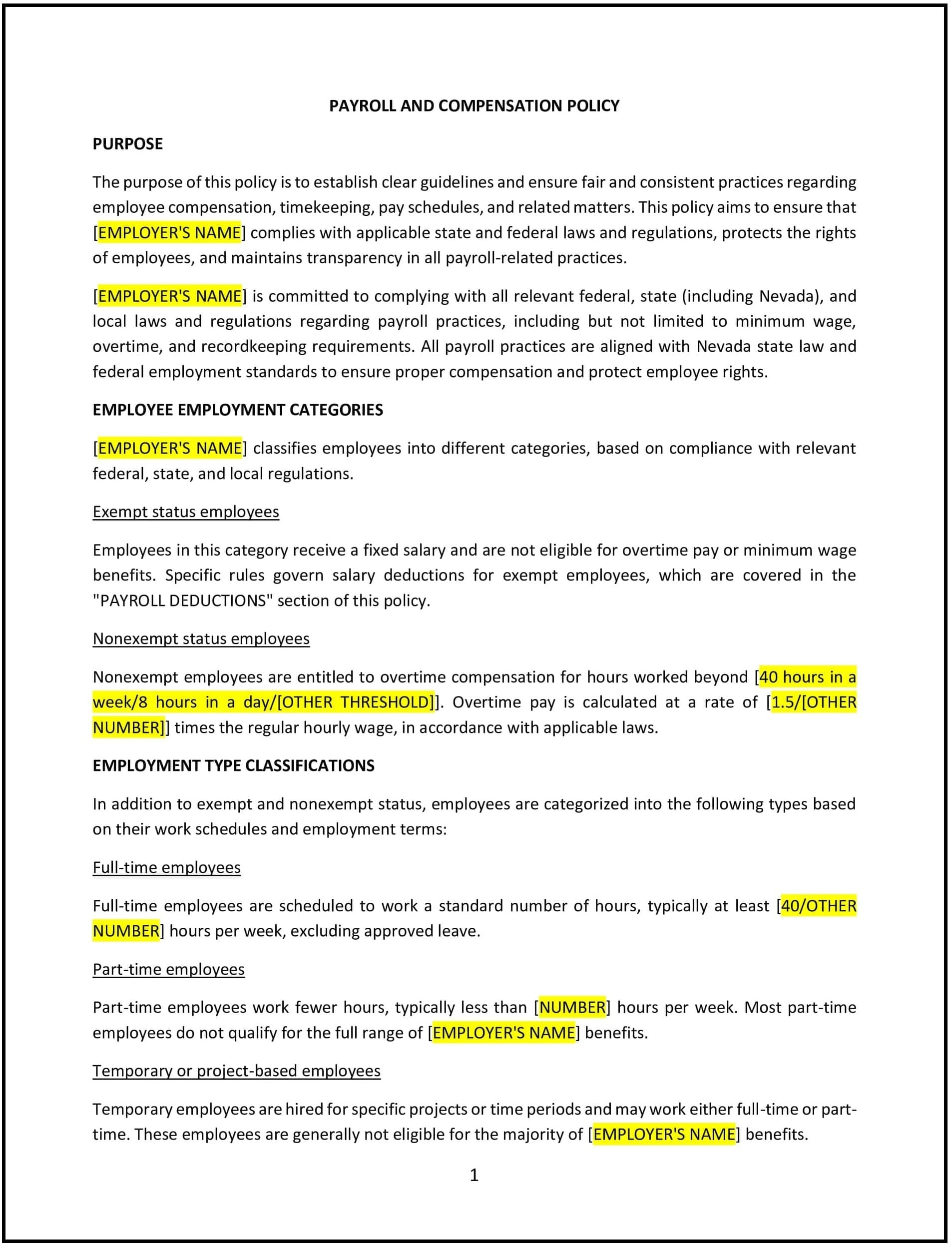

Payroll and compensation policy (Nevada)

This payroll and compensation policy is designed to help Nevada businesses provide clear guidelines for managing employee pay and benefits. It outlines procedures for payroll processing, compensation structures, and compliance with Nevada and federal labor laws to ensure fair and consistent practices.

By adopting this policy, businesses can promote transparency, ensure timely payment, and maintain compliance with legal requirements.

How to use this payroll and compensation policy (Nevada)

- Define pay periods and schedules: Specify the frequency of pay (e.g., weekly, bi-weekly, or monthly) and the method of payment, such as direct deposit or checks.

- Establish overtime pay guidelines: Detail how overtime is calculated and compensated in compliance with Nevada and federal laws, including the minimum threshold for overtime eligibility.

- Address wage deductions: Outline permissible deductions, such as taxes, insurance premiums, or retirement contributions, and prohibit unauthorized deductions.

- Include compensation structures: Explain how salaries, hourly wages, bonuses, and commissions are determined and communicated to employees.

- Provide wage increase guidelines: Clarify the process for determining pay raises, including performance evaluations or periodic reviews.

- Outline payroll dispute resolution: Offer steps for employees to report and resolve discrepancies in pay, ensuring timely corrections.

- Address final paychecks: Specify procedures for issuing final paychecks upon termination or resignation, including timelines required by Nevada law.

- Ensure compliance: Emphasize adherence to Nevada and federal labor laws, including minimum wage requirements, record-keeping obligations, and tax reporting.

Benefits of using this payroll and compensation policy (Nevada)

This policy provides several benefits for Nevada businesses:

- Ensures timely payments: Establishes clear payroll schedules to prevent delays in employee compensation.

- Promotes legal compliance: Aligns with Nevada and federal labor laws, reducing the risk of fines or legal disputes.

- Enhances transparency: Provides employees with a clear understanding of payroll and compensation practices.

- Supports employee satisfaction: Ensures fair and accurate pay, contributing to higher morale and retention.

- Simplifies dispute resolution: Offers a structured process for addressing payroll discrepancies promptly.

Tips for using this payroll and compensation policy (Nevada)

- Communicate the policy: Share the policy with employees during onboarding and provide access to it through internal systems.

- Maintain accurate records: Keep detailed records of hours worked, wages paid, and deductions to ensure compliance and simplify audits.

- Train managers and HR staff: Ensure personnel responsible for payroll understand the policy and legal requirements.

- Monitor compliance: Regularly review payroll practices to ensure they align with Nevada and federal labor laws.

- Update the policy: Revise the policy as needed to reflect changes in labor laws, company practices, or employee feedback.