Payroll and compensation policy (New Hampshire): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Payroll and compensation policy (New Hampshire)

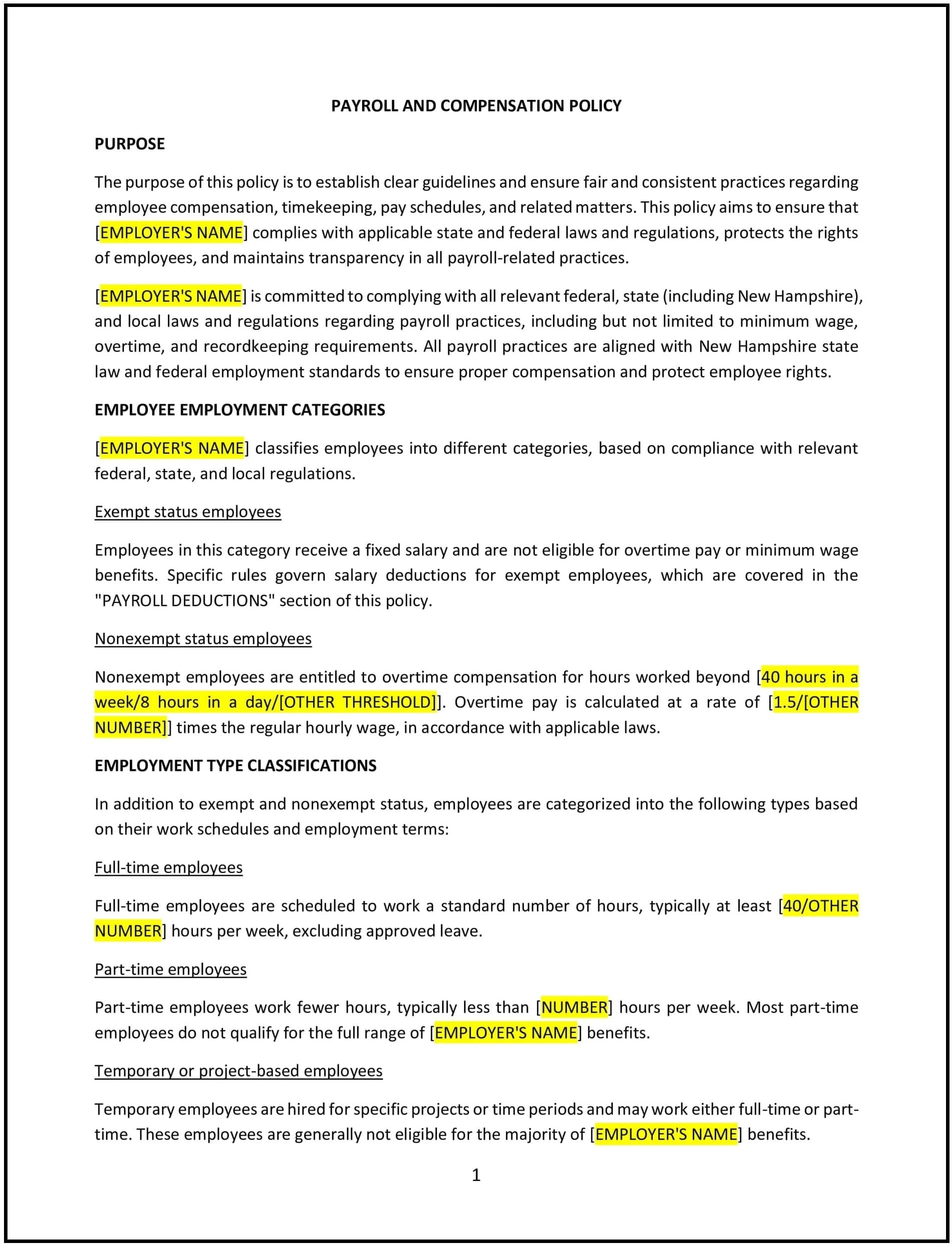

A payroll and compensation policy helps New Hampshire businesses define the processes and guidelines for employee pay, salary structures, and compensation practices. This policy outlines how employees are paid, the frequency of pay, any overtime provisions, and any benefits that are tied to compensation. It also sets expectations for compliance with applicable wage laws and promotes fairness, transparency, and consistency in compensation decisions.

By adopting this policy, businesses can ensure a clear understanding of employee compensation, improve employee satisfaction, and avoid potential legal issues related to payroll practices.

How to use this payroll and compensation policy (New Hampshire)

- Define payroll schedule: Specify the frequency of pay periods (e.g., weekly, bi-weekly, semi-monthly, or monthly) and the pay dates. Ensure that employees are aware of when they can expect to receive their compensation.

- Outline salary structures: Define how salaries or hourly wages are determined, including how starting salaries are set, any potential raises or bonuses, and criteria for salary increases.

- Address overtime and bonuses: Clarify how overtime pay is calculated (e.g., time and a half for hours worked over 40 per week), as well as any bonuses, commissions, or performance-based pay employees may be eligible for.

- Provide for deductions: Clearly state any deductions from employees’ paychecks, such as federal and state taxes, retirement contributions, health insurance premiums, garnishments, or other authorized deductions.

- Define paid time off (PTO): Detail the policies for paid time off, including vacation days, sick leave, and personal days, and explain how PTO accrues, is requested, and is compensated.

- Establish recordkeeping requirements: Specify how compensation records should be maintained, ensuring that all pay, overtime, and benefits information is recorded accurately and retained in accordance with legal requirements.

- Address employee classifications: Define different employee classifications (e.g., exempt vs. non-exempt) and explain how this classification affects pay and overtime eligibility.

- Review and update: Regularly review and update the policy to align with changes in state or federal wage laws, business needs, or other relevant regulations.

Benefits of using this payroll and compensation policy (New Hampshire)

This policy offers several benefits for New Hampshire businesses:

- Promotes fairness: By establishing clear guidelines for pay and compensation, businesses ensure that all employees are paid fairly based on their role, experience, and performance.

- Increases transparency: Employees understand how their pay is determined, which reduces confusion, builds trust, and encourages open communication.

- Reduces legal risks: A well-defined payroll and compensation policy helps businesses comply with wage and hour laws, reducing the risk of legal issues such as wage disputes or claims of unequal pay.

- Enhances employee retention: Clear and competitive compensation practices, including benefits like PTO and overtime, help retain employees by demonstrating that the business values their contributions.

- Streamlines payroll processes: A defined policy ensures that payroll processes are handled consistently and efficiently, minimizing errors and delays in payment.

Tips for using this payroll and compensation policy (New Hampshire)

- Communicate the policy clearly: Ensure that all employees understand the payroll and compensation policy, especially new hires, so they are aware of their compensation structure, pay dates, and any other relevant details.

- Be consistent with pay practices: Apply the policy consistently to avoid discrepancies in employee pay, ensuring that salary decisions are based on merit and company-wide standards.

- Address changes in compensation proactively: If there are changes to compensation practices (e.g., pay raises, bonus structures), communicate these changes clearly to employees and provide sufficient notice.

- Regularly assess the competitiveness of compensation: Review industry compensation standards to ensure your pay rates and benefits remain competitive and help attract and retain top talent.

- Ensure compliance with wage laws: Stay informed about New Hampshire’s wage laws and federal regulations, making necessary adjustments to your policies or pay practices to remain compliant.