Payroll and compensation policy (New Jersey): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Payroll and compensation policy (New Jersey)

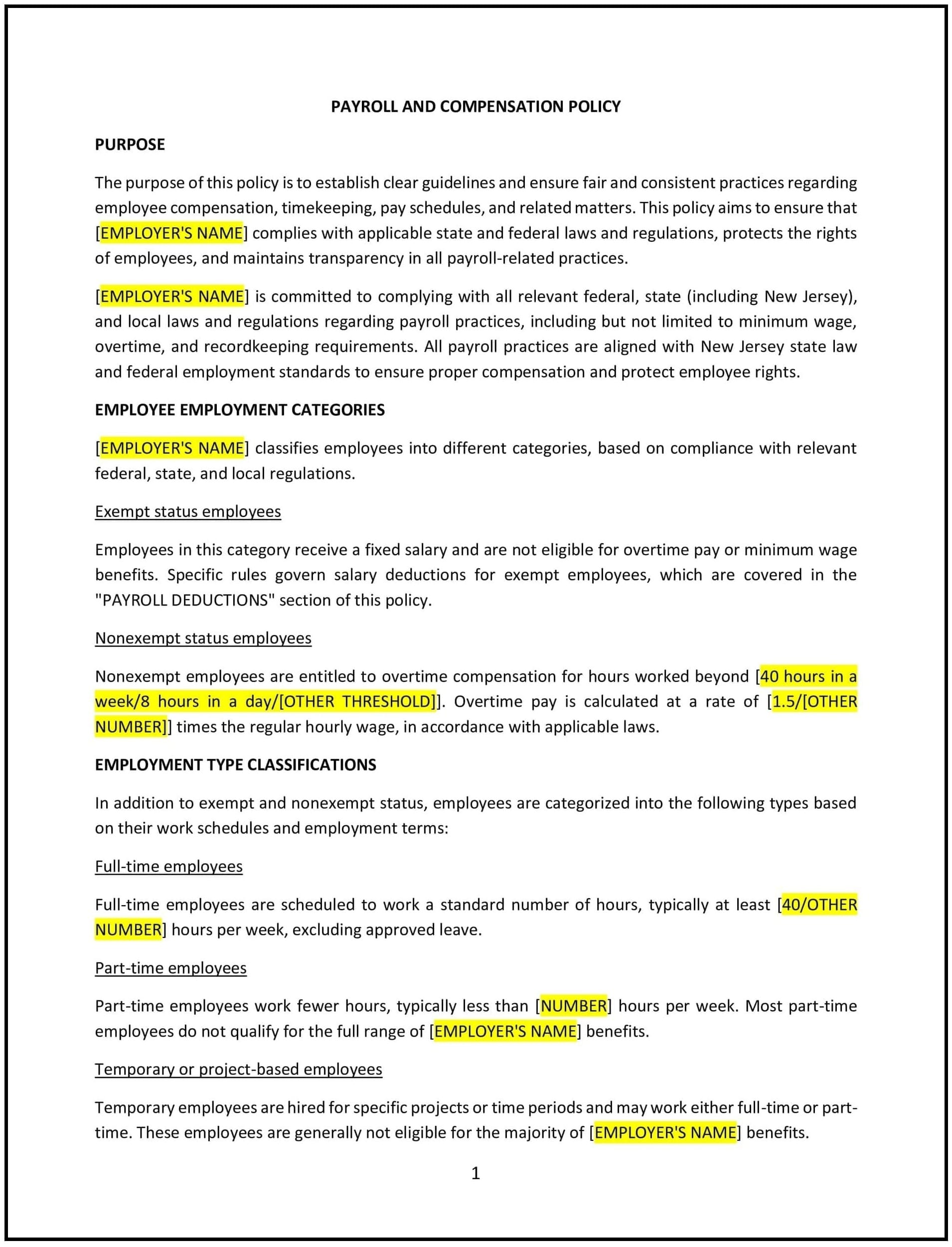

A payroll and compensation policy helps New Jersey businesses establish clear and fair guidelines for employee compensation, pay frequency, and payroll practices. This policy outlines pay structures, methods of payment, overtime eligibility, and any applicable deductions or withholdings. It also addresses legal requirements and company expectations regarding timekeeping, bonuses, and raises.

By adopting this policy, businesses in New Jersey can maintain consistency in compensation practices, ensure transparency, and promote fair pay across the organization.

How to use this payroll and compensation policy (New Jersey)

- Define compensation structure: Specify salary, hourly, or commission-based pay models, and how compensation is determined for each employee type.

- Set pay frequency: Outline the frequency of pay, such as weekly, bi-weekly, or monthly, and specify when employees should expect to receive their wages.

- Outline overtime and additional compensation: Provide guidelines for paying overtime in accordance with New Jersey labor laws and clarify the rates for overtime, bonuses, and commissions.

- Address timekeeping requirements: Ensure employees understand expectations for recording their work hours, including clocking in and out, meal breaks, and paid time off (PTO).

- Address deductions and withholdings: Specify what deductions will be made from employees' wages, such as taxes, benefits, or garnishments, and clarify how these deductions are calculated.

- Set guidelines for raises and bonuses: Explain how pay raises and bonuses are awarded, including any performance-based criteria and company-specific processes.

- Review payroll records regularly: Ensure that all payroll records are accurate and that employees are paid according to company policies and legal requirements.

- Review and update: Regularly assess the policy to ensure it aligns with New Jersey wage laws and company needs.

Benefits of using this payroll and compensation policy (New Jersey)

This policy provides several benefits for New Jersey businesses:

- Promotes fairness and consistency: Ensures all employees are compensated according to transparent and standardized criteria.

- Reduces legal risks: Helps businesses comply with New Jersey state and federal wage laws, avoiding penalties for non-compliance.

- Enhances employee satisfaction: Creates a sense of fairness and trust by providing clear expectations around pay.

- Supports efficient payroll management: Provides a streamlined approach to managing payroll, making it easier to track and process payments.

- Improves business operations: Ensures that payroll processes are aligned with the business’s overall financial practices and goals.

Tips for using this payroll and compensation policy (New Jersey)

- Communicate the policy clearly: Ensure all employees are aware of payroll and compensation processes, including how they will be paid and when.

- Ensure accurate timekeeping: Monitor time tracking to ensure that all employee hours are properly recorded and compensated.

- Regularly audit payroll: Conduct periodic audits to verify accuracy and resolve any discrepancies in pay.

- Provide training to managers: Educate managers on how to handle payroll-related questions, deductions, and compensation matters.

- Review the policy regularly: Update the policy to reflect changes in New Jersey labor laws, business needs, or compensation practices.