Payroll and compensation policy (New Mexico): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Payroll and compensation policy (New Mexico)

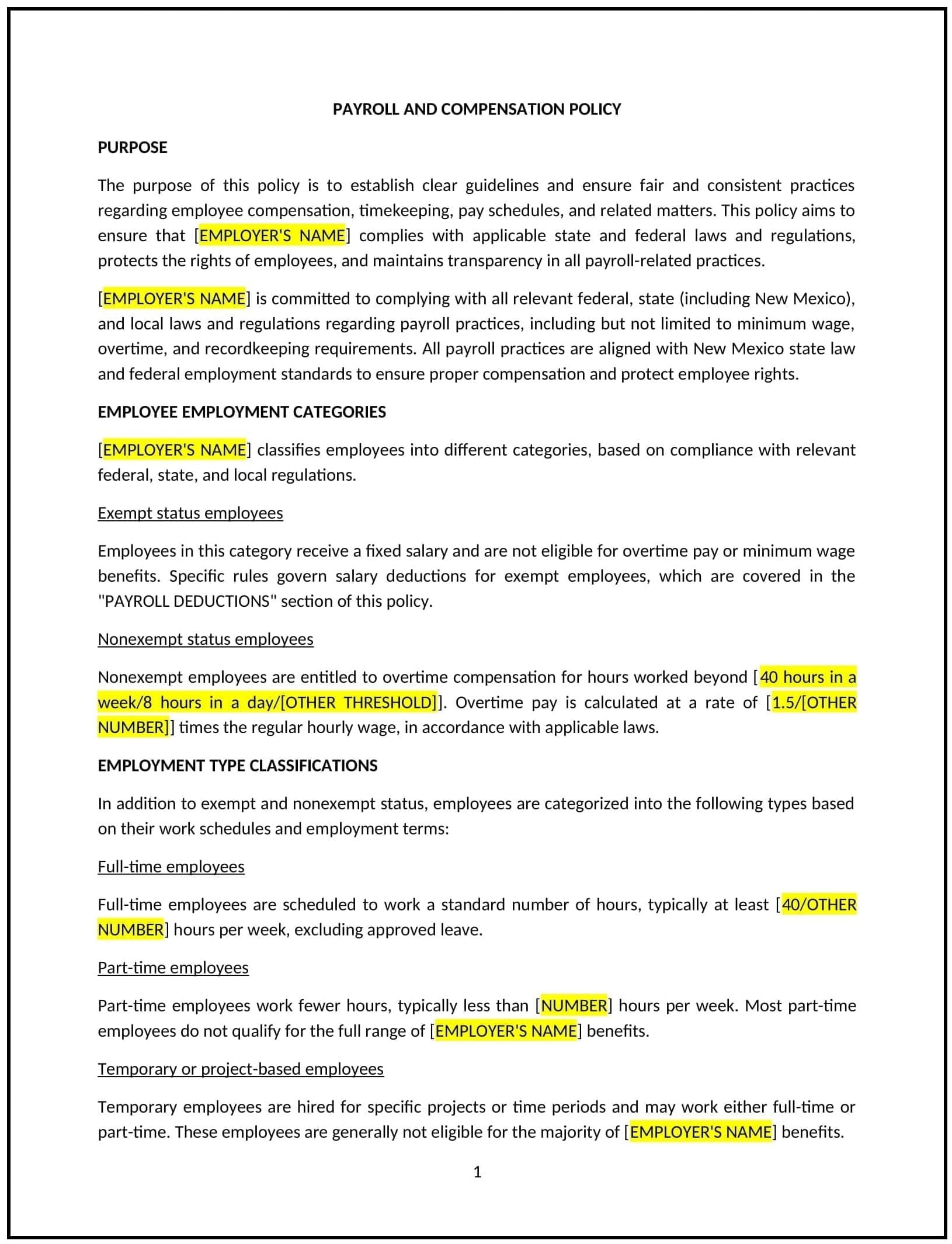

This payroll and compensation policy is designed to help New Mexico businesses manage employee pay and compensation in a fair and transparent manner. It outlines how salaries, wages, bonuses, and other forms of compensation will be determined, paid, and reviewed. The policy ensures that the company compensates its employees fairly while adhering to legal requirements and internal practices.

By adopting this policy, New Mexico businesses can maintain consistency in compensation, support employee satisfaction, and ensure that payroll processes are efficient.

How to use this payroll and compensation policy (New Mexico)

- Define compensation structure: Specify the different forms of compensation, including hourly wages, salaries, commissions, bonuses, and benefits. The policy should clarify how compensation is determined for different roles, including any pay scales or salary bands used by the business.

- Set pay frequency: Clearly define how often employees will be paid, whether it’s weekly, bi-weekly, semi-monthly, or monthly. The policy should also specify the cutoff date for payroll processing and when employees can expect to receive their pay.

- Outline deductions and withholdings: Explain the types of deductions that may be made from employee paychecks, including taxes, insurance premiums, retirement contributions, and other mandatory deductions required by New Mexico and federal law.

- Address overtime and bonuses: Specify how overtime will be calculated for eligible employees, as well as the criteria for earning performance bonuses, signing bonuses, or other incentive-based pay.

- Reflect New Mexico-specific considerations: Include any state-specific laws or regulations, such as minimum wage requirements, mandatory paid leave benefits, or specific payroll processing rules that businesses in New Mexico must adhere to.

Benefits of using this payroll and compensation policy (New Mexico)

Implementing this policy provides New Mexico businesses with several advantages:

- Promotes fairness and transparency: A well-structured payroll and compensation policy ensures that all employees are paid fairly and consistently, reducing the risk of misunderstandings and disputes.

- Supports employee satisfaction: By providing clear guidelines on compensation, businesses can help employees understand how their pay is determined and what benefits they are entitled to, leading to increased morale and job satisfaction.

- Reduces legal risks: The policy helps businesses comply with New Mexico’s wage and hour laws, including minimum wage, overtime, and other labor regulations, reducing the risk of legal challenges.

- Enhances business efficiency: A clear and consistent payroll process ensures that employees are paid on time and that payroll-related administrative tasks are handled efficiently, freeing up resources for other business operations.

- Increases retention: Offering competitive compensation and clearly communicating it to employees can help retain top talent, as employees are more likely to stay with an employer who provides fair pay and benefits.

Tips for using this payroll and compensation policy (New Mexico)

- Communicate the policy clearly: Ensure that all employees understand the payroll and compensation process. Include the policy in the employee handbook and review it during onboarding or orientation.

- Regularly review compensation: Conduct regular reviews of compensation structures to ensure that employee pay remains competitive within the industry and in line with New Mexico’s labor market. Adjust salaries as needed to reflect changes in the cost of living, company performance, or employee contributions.

- Monitor payroll accuracy: Regularly audit payroll to ensure that all pay and deductions are processed accurately and in a timely manner. Address any discrepancies immediately to maintain trust and avoid errors in employee compensation.

- Stay updated on New Mexico laws: Keep the policy up to date with any changes to state or federal laws regarding minimum wage, paid leave, and other compensation-related regulations.

- Be transparent about bonuses and incentives: Ensure employees understand the criteria for earning bonuses or incentive-based pay. Provide clear guidelines for how bonuses are calculated and the performance metrics used to determine eligibility.