Payroll and compensation policy (North Carolina): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Payroll and compensation policy (North Carolina)

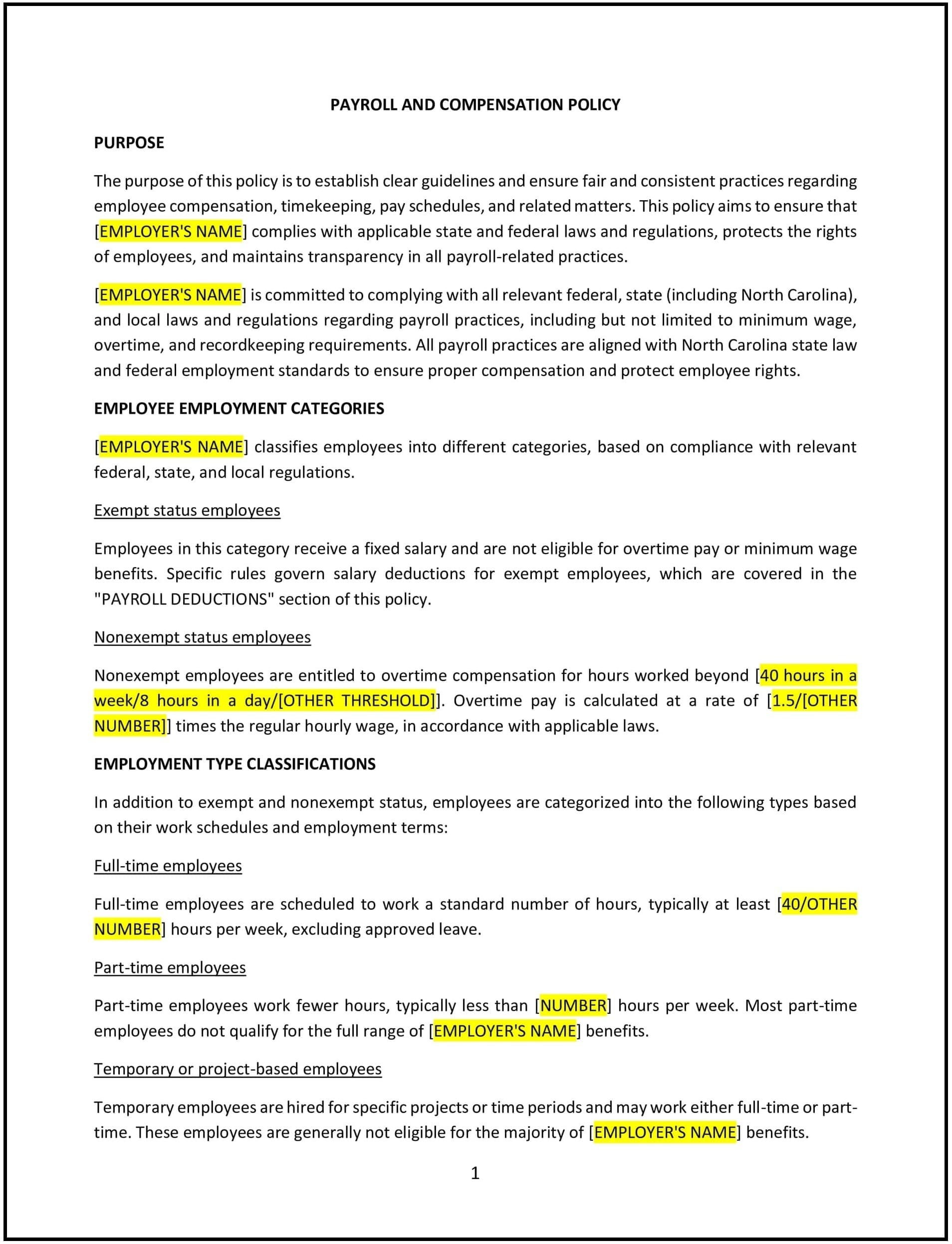

A payroll and compensation policy helps North Carolina businesses establish clear guidelines for compensating employees and managing payroll processes. This policy outlines how employees are paid, the frequency of pay periods, payroll deductions, overtime, and any other compensation-related procedures. It ensures that employees are paid accurately and on time while complying with federal and state wage laws.

By adopting this policy, businesses can ensure payroll accuracy, maintain employee satisfaction, and avoid compliance issues related to compensation.

How to use this payroll and compensation policy (North Carolina)

- Define pay periods: Specify how often employees will be paid, whether weekly, bi-weekly, semi-monthly, or monthly.

- Set compensation structure: Outline the company's approach to employee compensation, including salary, hourly rates, bonuses, commissions, and any other forms of compensation.

- Address overtime: Clearly explain the company’s policy regarding overtime, including how overtime is calculated and which employees are eligible for overtime pay.

- Define payroll deductions: Specify any mandatory payroll deductions, such as taxes, insurance premiums, retirement contributions, and voluntary deductions such as garnishments or charitable contributions.

- Reflect North Carolina-specific considerations: Ensure the policy complies with North Carolina’s wage laws, including minimum wage requirements, overtime laws, and any state-specific payroll regulations.

Benefits of using this payroll and compensation policy (North Carolina)

This policy provides several benefits for North Carolina businesses:

- Ensures accuracy: A clear and consistent payroll process ensures that employees are paid correctly and on time.

- Reduces legal risks: The policy ensures that the business complies with North Carolina’s wage and hour laws, minimizing the risk of legal disputes or fines.

- Enhances employee satisfaction: Timely and accurate compensation boosts employee morale and helps retain top talent.

- Improves payroll efficiency: Standardizing payroll procedures helps streamline the process and reduce errors.

- Supports compliance: By adhering to North Carolina’s labor laws and wage requirements, businesses can avoid costly mistakes and ensure their payroll practices are lawful.

Tips for using this payroll and compensation policy (North Carolina)

- Communicate the policy clearly: Ensure all employees understand their compensation structure, including how pay is calculated, when they are paid, and how deductions are applied.

- Stay updated on wage laws: Regularly review changes in North Carolina and federal wage laws to ensure the company remains compliant with current regulations.

- Monitor overtime: Track employee hours carefully to ensure compliance with overtime laws and prevent unintentional violations.

- Review the policy regularly: The policy should be reviewed annually to ensure it reflects any changes in compensation practices or legal requirements.