Payroll and compensation policy (North Dakota): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

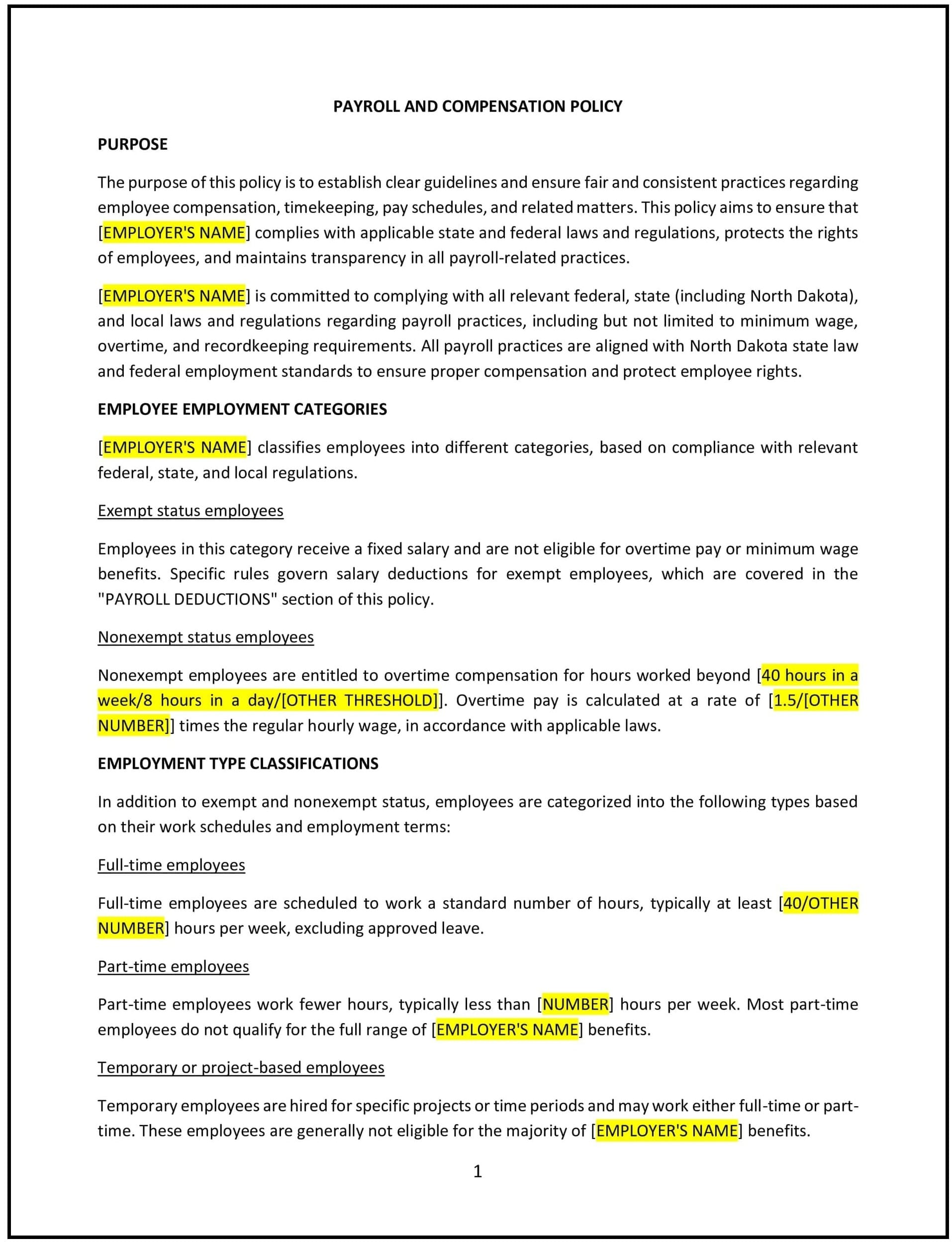

Payroll and compensation policy (North Dakota)

This payroll and compensation policy is designed to help North Dakota businesses establish clear guidelines for paying employees, including wage calculations, pay schedules, and benefits. It outlines procedures for ensuring accuracy, transparency, and compliance with state and federal laws.

By adopting this policy, businesses can maintain trust, reduce disputes, and ensure fair and timely compensation for employees.

How to use this payroll and compensation policy (North Dakota)

- Define pay structure: Clearly explain how employee wages are calculated, including hourly rates, salaries, and overtime.

- Establish pay schedules: Specify when employees will be paid, such as bi-weekly or monthly, and the methods of payment (e.g., direct deposit, checks).

- Outline overtime rules: Describe how overtime is calculated and paid, in compliance with the Fair Labor Standards Act (FLSA) and North Dakota laws.

- Address benefits: Include details about additional compensation, such as bonuses, commissions, or retirement contributions.

- Set recordkeeping requirements: Explain how payroll records will be maintained and for how long, in compliance with legal requirements.

- Train managers: Educate supervisors on payroll procedures and their responsibilities in ensuring accurate and timely payments.

- Review and update: Assess the policy annually to ensure it aligns with evolving laws and business needs.

Benefits of using this payroll and compensation policy (North Dakota)

This policy offers several advantages for North Dakota businesses:

- Ensures accuracy: Reduces errors in wage calculations and payments, maintaining employee trust.

- Promotes transparency: Provides clear guidelines for employees on how their pay is calculated and when they will be paid.

- Enhances compliance: Aligns with state and federal wage and hour laws, reducing the risk of legal disputes.

- Reduces disputes: Clarifies pay structures and schedules, minimizing misunderstandings or conflicts.

- Builds trust: Demonstrates a commitment to fair and timely compensation for employees.

Tips for using this payroll and compensation policy (North Dakota)

- Communicate clearly: Ensure all employees understand the policy and their rights regarding pay and benefits.

- Provide training: Educate managers on payroll procedures and their role in ensuring accurate and timely payments.

- Monitor compliance: Regularly review payroll practices to ensure adherence to the policy and legal requirements.

- Encourage feedback: Seek input from employees and managers to identify areas for improvement.

- Update regularly: Review the policy annually to ensure it remains effective and aligned with current laws and business needs.