Payroll and compensation policy (Ohio): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Payroll and compensation policy (Ohio)

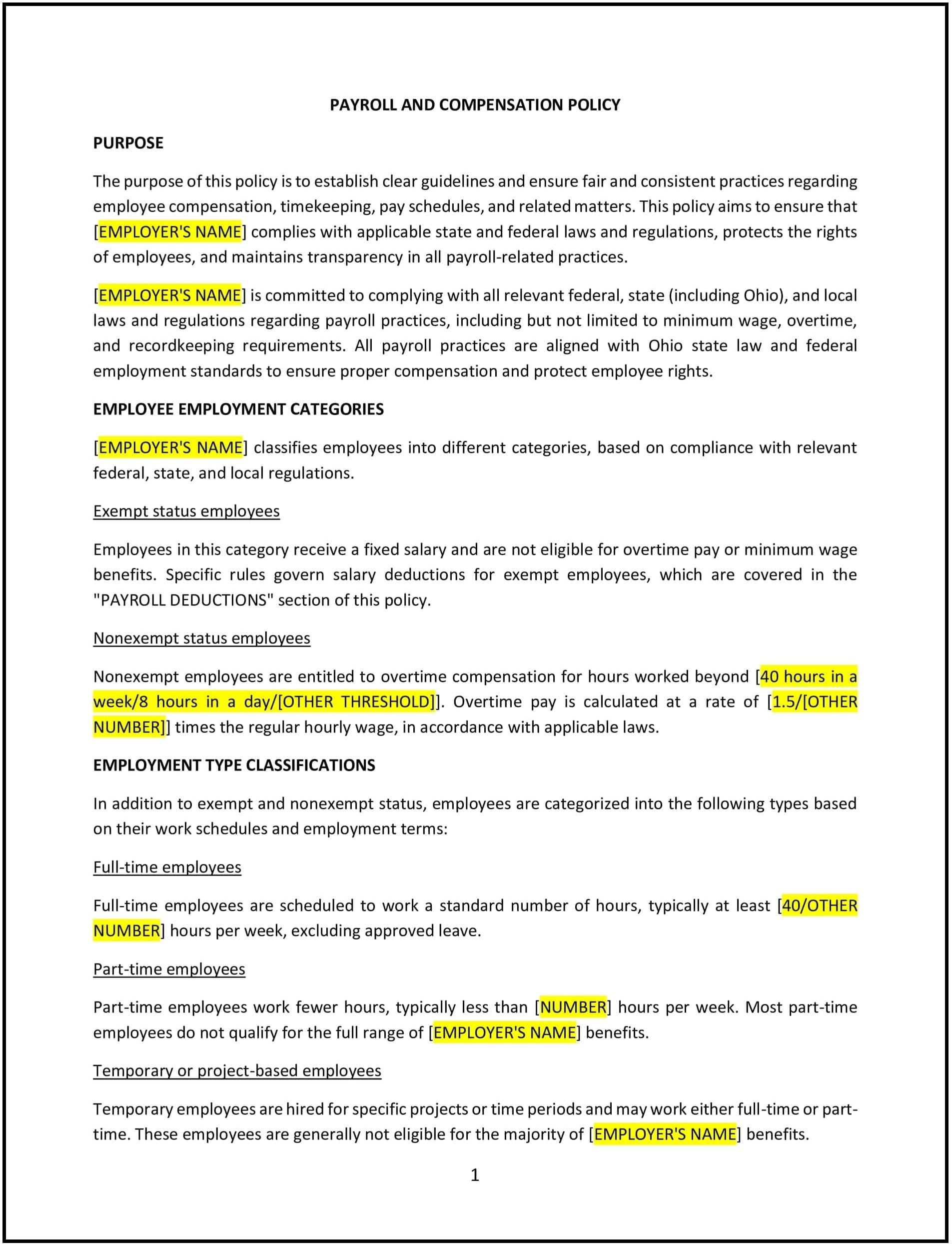

A payroll and compensation policy provides Ohio businesses with clear guidelines regarding the payment of employee wages, salary structure, bonuses, and benefits. This policy outlines the methods of payment, frequency, and the calculation of employee compensation, ensuring that all compensation is compliant with federal and state wage laws. It also specifies the process for handling deductions, overtime, and any additional bonuses or incentives that employees may be eligible for.

By implementing this policy, Ohio businesses can ensure transparency in compensation practices, meet legal obligations, and foster employee trust and satisfaction.

How to use this payroll and compensation policy (Ohio)

- Define compensation structure: The policy should specify the various components of employee compensation, including base salary, hourly wage, overtime, bonuses, and commissions. It should also outline any benefits such as health insurance, retirement contributions, and paid time off (PTO).

- Outline pay periods and methods: The policy should state the frequency of employee payments (e.g., weekly, bi-weekly, or monthly) and the method of payment (e.g., direct deposit, paycheck). It should also address how employees will be informed of their pay schedule.

- Address overtime and exempt status: The policy should clarify the difference between exempt and non-exempt employees, in accordance with the Fair Labor Standards Act (FLSA). It should explain how overtime will be calculated for non-exempt employees and what rate will be paid.

- Specify deductions: The policy should outline any deductions that will be taken from employee pay, such as taxes, benefits, retirement contributions, garnishments, and other voluntary or involuntary deductions.

- Set guidelines for bonuses and incentives: The policy should define any criteria for eligibility for bonuses, profit-sharing, or other incentives. It should explain how bonuses will be calculated and distributed, and any conditions that apply to the bonus payouts.

- Include payroll error correction: The policy should explain how payroll errors (e.g., incorrect pay, missing deductions) will be handled, including how employees should report issues and how quickly corrections will be made.

- Address confidentiality and transparency: The policy should ensure that employees’ compensation information is kept confidential, while also emphasizing that pay rates and pay periods will be communicated clearly and transparently to employees.

- Review and update regularly: The policy should be reviewed periodically to ensure it remains compliant with Ohio state laws, federal regulations, and the business’s evolving needs and practices.

Benefits of using this payroll and compensation policy (Ohio)

This policy provides several key benefits for Ohio businesses:

- Ensures legal compliance: The policy helps ensure that compensation practices comply with federal and Ohio state wage and hour laws, including overtime and minimum wage requirements.

- Fosters transparency: By providing clear and accessible information on compensation, the policy helps employees understand their pay structure and eliminates confusion around wages, deductions, and benefits.

- Promotes fairness: The policy ensures that all employees are paid equitably and fairly, in accordance with their role, experience, and job performance, reducing the risk of discrimination or favoritism.

- Enhances employee trust: Clear and consistent compensation practices help build trust between the business and its employees, which can lead to increased job satisfaction and loyalty.

- Improves business reputation: Businesses that follow best practices for payroll and compensation are viewed as fair and reliable employers, which can help attract and retain top talent.

- Reduces legal risks: By adhering to Ohio state laws and federal regulations, the policy helps mitigate the risk of legal disputes over wage and hour issues, such as overtime pay and wage theft claims.

- Supports employee retention: Offering competitive compensation and benefits packages increases employee retention by ensuring that employees feel fairly compensated for their work.

Tips for using this payroll and compensation policy (Ohio)

- Communicate the policy clearly: Ensure that all employees understand the payroll and compensation policy by including it in the employee handbook, reviewing it during onboarding, and holding periodic training sessions or Q&A sessions to answer any questions.

- Review and update regularly: Regularly review the policy to ensure it remains up-to-date with Ohio state laws, federal wage laws, and best practices in compensation and payroll management.

- Handle payroll errors quickly: Establish a system for promptly addressing payroll errors, such as incorrect pay or deductions, and ensure that employees know how to report errors and the steps taken to correct them.

- Ensure payroll consistency: Maintain consistent payroll practices, ensuring that employees are paid on time and that all deductions are applied correctly. Inconsistencies in payroll can erode trust and affect employee morale.

- Monitor changes in compensation: Regularly monitor compensation levels to ensure that they remain competitive with industry standards and in line with employee expectations, making adjustments as necessary to maintain employee satisfaction and retention.

- Protect sensitive payroll data: Ensure that all payroll data is handled confidentially and securely, and that only authorized personnel have access to employee pay information.