Payroll and compensation policy (South Dakota): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

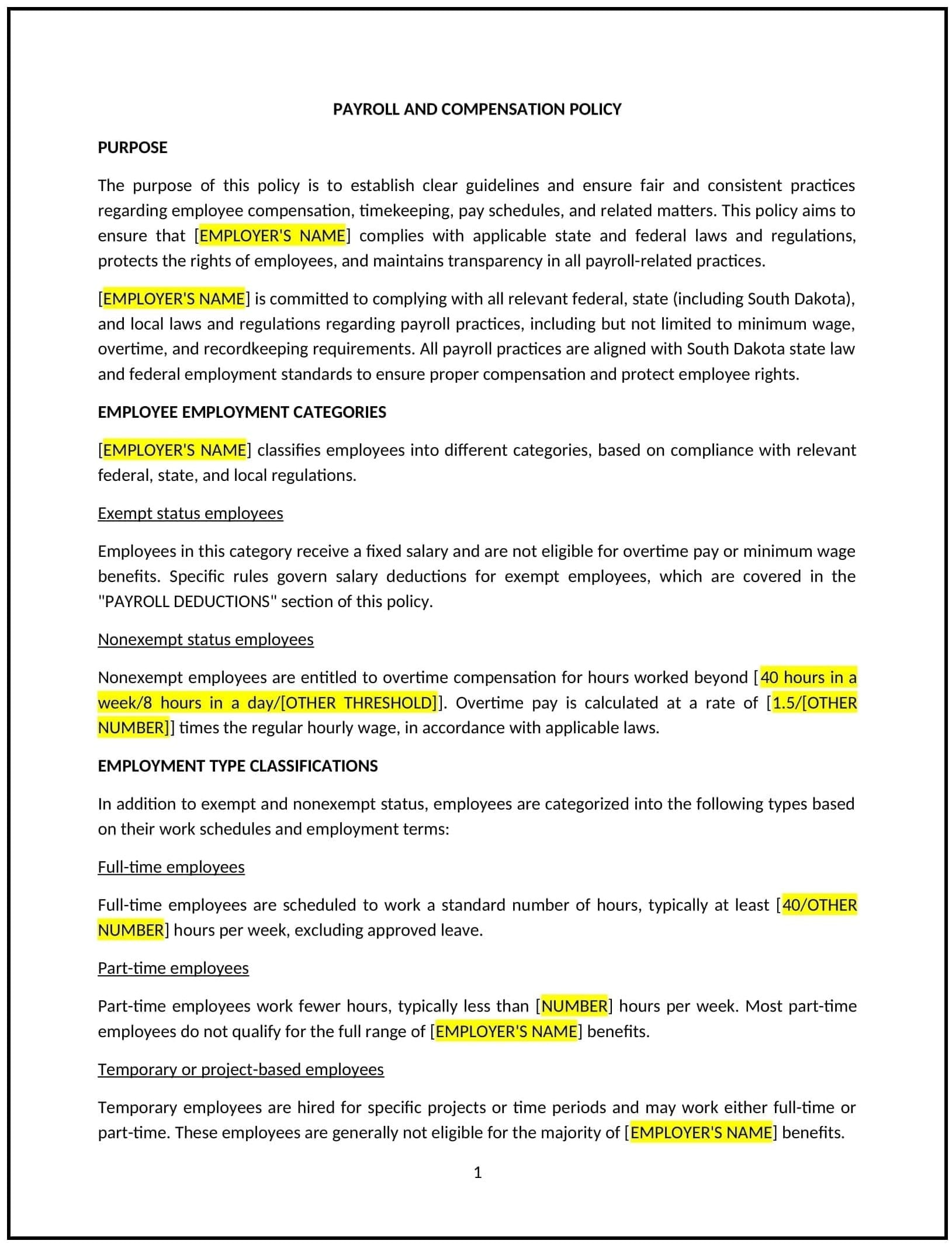

Payroll and compensation policy (South Dakota)

This payroll and compensation policy is designed to help South Dakota businesses establish guidelines for managing employee pay, benefits, and compensation-related processes. It outlines procedures for payroll processing, wage calculations, and benefit administration.

By adopting this policy, businesses can promote transparency, ensure timely and accurate payments, and align with general best practices for payroll management.

How to use this payroll and compensation policy (South Dakota)

- Define payroll and compensation: Explain what constitutes payroll, including wages, salaries, bonuses, and deductions.

- Establish pay periods: Specify the frequency of payroll processing, such as bi-weekly or monthly.

- Outline wage calculations: Provide guidelines for calculating wages, including overtime, commissions, and reimbursements.

- Address benefits administration: Specify how employee benefits, such as health insurance or retirement plans, will be managed.

- Train payroll staff: Educate payroll administrators on processing payments accurately and efficiently.

- Monitor implementation: Regularly review payroll processes to ensure adherence to the policy.

- Review and update: Assess the policy annually to ensure it aligns with evolving business needs and payroll practices.

Benefits of using this payroll and compensation policy (South Dakota)

This policy offers several advantages for South Dakota businesses:

- Promotes transparency: Demonstrates a commitment to clear and consistent payroll practices.

- Ensures accuracy: Helps prevent errors in wage calculations and benefit administration.

- Enhances employee satisfaction: Provides timely and accurate payments, boosting morale and retention.

- Builds trust: Shows employees that the business values their contributions and financial well-being.

- Supports best practices: Aligns with industry standards for payroll and compensation management.

Tips for using this payroll and compensation policy (South Dakota)

- Communicate the policy: Share the policy with employees and include it in the employee handbook.

- Provide training: Educate payroll administrators on processing payments accurately and efficiently.

- Monitor implementation: Regularly review payroll processes to ensure adherence to the policy.

- Address issues promptly: Take corrective action if payroll errors or delays occur.

- Update regularly: Assess the policy annually to ensure it aligns with evolving business needs.