Payroll and compensation policy (Texas): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Payroll and compensation policy (Texas)

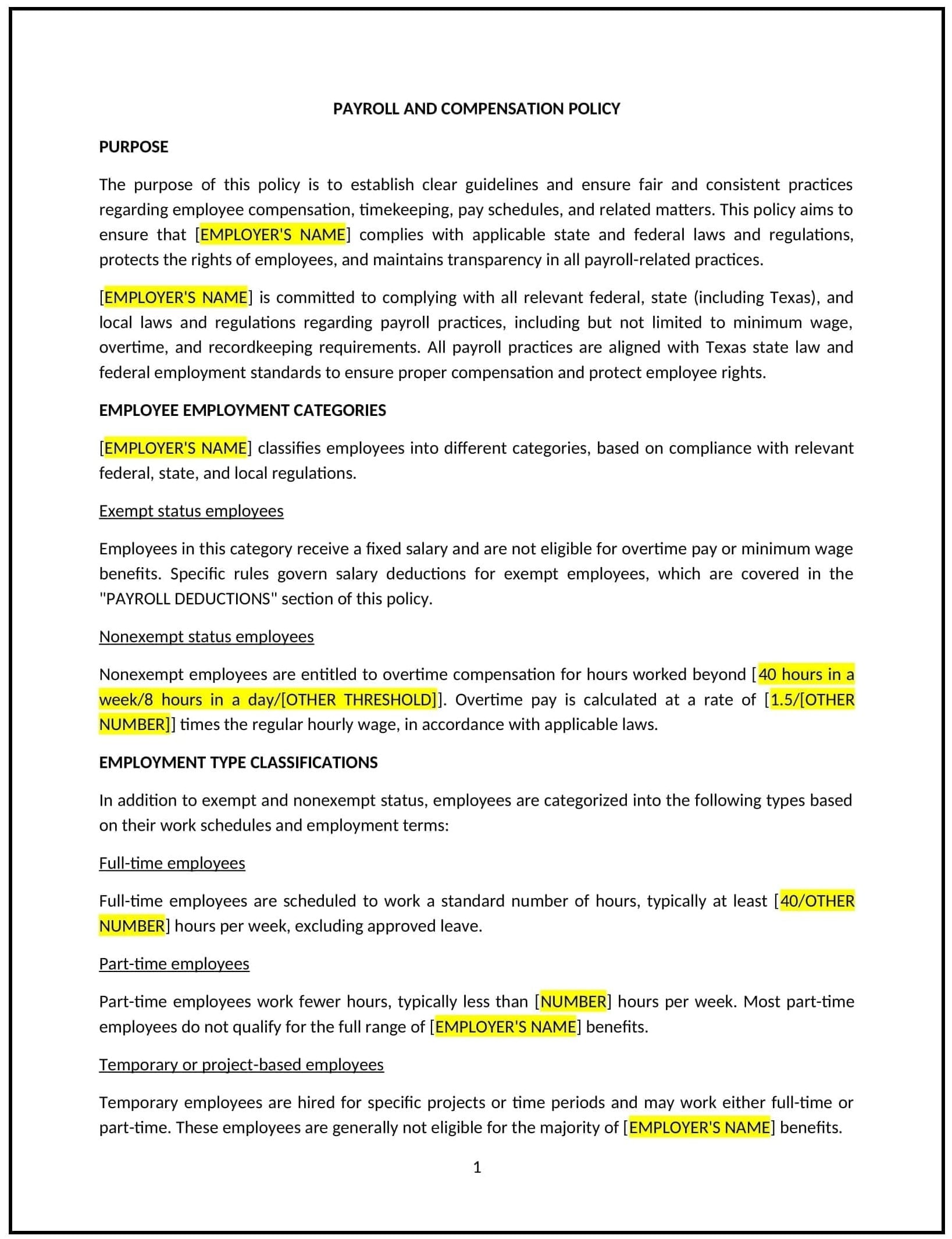

This payroll and compensation policy is designed to help Texas businesses establish clear guidelines for employee compensation, including salary, wages, bonuses, and other forms of remuneration. The policy outlines the company’s approach to payroll processing, ensuring that all employees are compensated fairly and in compliance with Texas state laws, federal regulations, and industry standards.

By adopting this policy, businesses can promote transparency, fairness, and consistency in their compensation practices, while minimizing legal risks and promoting employee satisfaction.

How to use this payroll and compensation policy (Texas)

- Define compensation components: Specify the different forms of compensation offered to employees, including base salary, hourly wages, commissions, bonuses, and other benefits such as retirement contributions, healthcare, and paid time off.

- Set pay periods and pay schedules: Outline the company’s pay periods (e.g., weekly, bi-weekly, monthly) and when employees can expect to receive their wages. Ensure that the policy is clear on pay dates and any adjustments for holidays or other factors.

- Address overtime pay: Clearly explain how overtime pay is calculated for non-exempt employees, as defined by the Fair Labor Standards Act (FLSA). Specify the overtime rate (typically 1.5 times the regular hourly rate) and how overtime hours should be tracked and reported.

- Outline payroll deductions: Specify any mandatory and voluntary payroll deductions, such as federal and state taxes, Social Security, Medicare, health insurance premiums, retirement contributions, and garnishments.

- Address performance-based compensation: Detail how performance-based compensation (e.g., bonuses, commissions, profit sharing) is determined and how employees are evaluated for these bonuses.

- Explain payroll adjustments: Provide guidelines for payroll adjustments, such as corrections to pay, deductions for missed work, or adjustments for overpayment.

- Promote pay transparency: Encourage open communication about pay structures and ensure that employees understand how their compensation is determined. This promotes fairness and can help prevent misunderstandings or disputes.

- Address compliance with state and federal laws: Ensure that the compensation practices are compliant with Texas state laws and federal regulations, including minimum wage laws, overtime regulations, and tax reporting requirements.

Benefits of using this payroll and compensation policy (Texas)

This policy offers several benefits for Texas businesses:

- Promotes fairness and transparency: By clearly defining compensation components and pay structures, businesses can foster a more transparent work environment, which helps build trust and reduces confusion among employees.

- Reduces legal risks: A well-structured policy ensures that businesses comply with Texas state laws and federal regulations, reducing the risk of legal challenges related to wage and hour issues, discrimination, or non-compliance.

- Enhances employee satisfaction: A fair and transparent compensation system contributes to higher employee satisfaction, engagement, and retention. When employees feel they are compensated fairly, they are more likely to remain committed to the company.

- Supports business operations: A clear payroll and compensation policy allows for smoother payroll processing, reducing administrative errors and ensuring that employees are paid accurately and on time.

- Encourages performance: By linking compensation to performance, businesses can motivate employees to achieve their targets, improve productivity, and contribute to the company’s overall success.

Tips for using this payroll and compensation policy (Texas)

- Communicate the policy clearly: Ensure that all employees understand the payroll and compensation policy, including how their pay is calculated, when they will be paid, and any payroll deductions.

- Regularly review compensation: Periodically review employee compensation to ensure it aligns with industry standards, legal requirements, and business goals. Adjust salaries and benefits as necessary to remain competitive.

- Monitor overtime pay: Carefully track employee hours to ensure that overtime pay is calculated correctly and that non-exempt employees are compensated fairly for additional hours worked.

- Ensure timely payroll processing: Establish clear procedures for processing payroll on time and addressing any errors or discrepancies quickly to avoid employee dissatisfaction or potential legal issues.

- Stay compliant with tax laws: Ensure that payroll taxes are accurately calculated, withheld, and remitted to the appropriate authorities, in accordance with both federal and Texas state tax laws.