Payroll and compensation policy (Utah): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

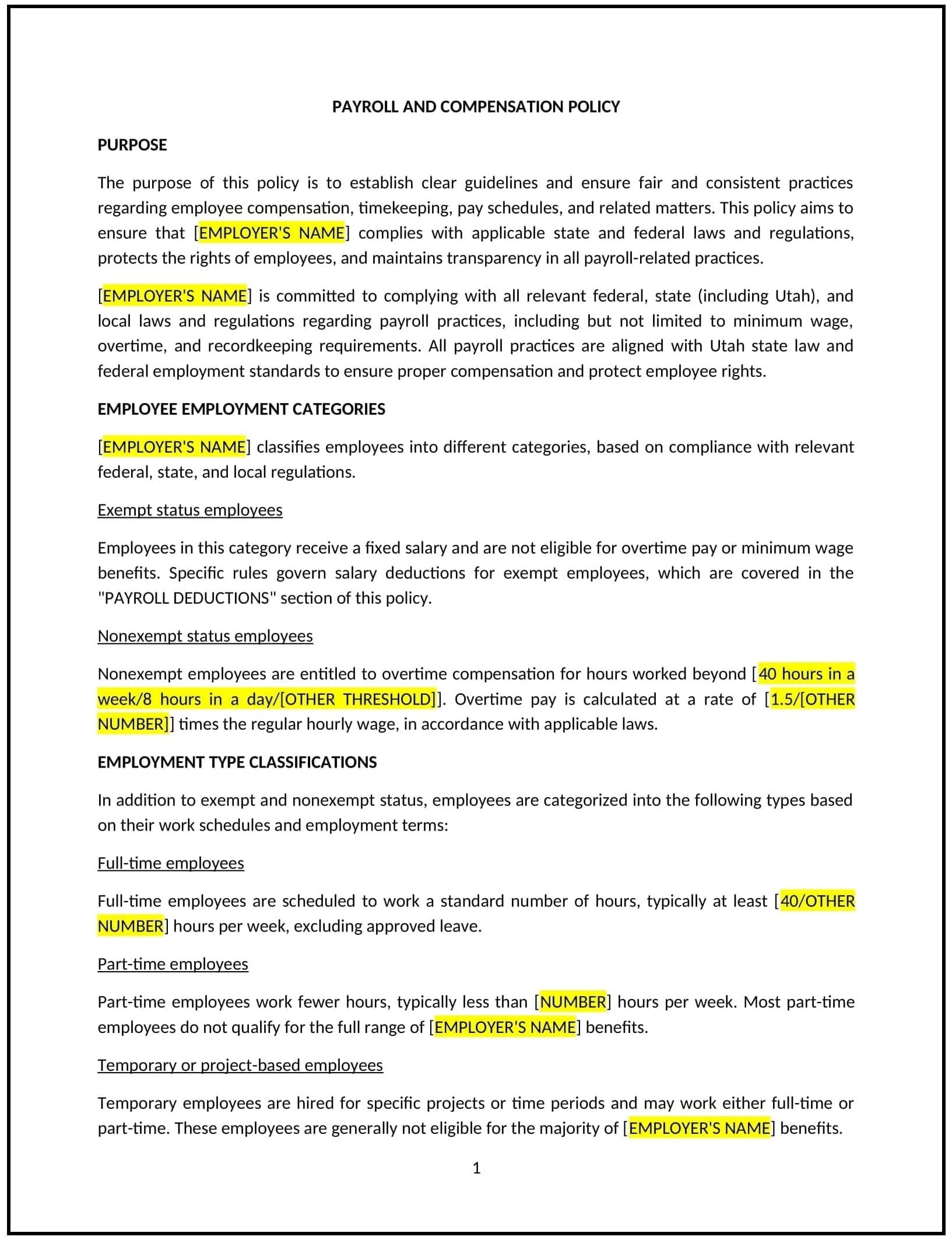

Payroll and compensation policy (Utah)

This payroll and compensation policy is designed to help Utah businesses establish guidelines for managing employee pay, benefits, and deductions. It outlines procedures for payroll processing, wage calculations, and compliance with federal and state labor laws.

By adopting this policy, businesses can ensure accurate and timely payroll, maintain compliance, and align with general best practices for compensation management.

How to use this payroll and compensation policy (Utah)

- Define pay periods: Specify the frequency of payroll processing, such as weekly, biweekly, or monthly.

- Outline wage calculations: Provide guidelines for calculating wages, including overtime, bonuses, and commissions.

- Address deductions: Specify allowable payroll deductions, such as taxes, benefits, or garnishments.

- Ensure compliance: Align payroll practices with federal and state labor laws, such as the Fair Labor Standards Act (FLSA) and Utah labor regulations.

- Provide pay statements: Ensure employees receive detailed pay statements with each paycheck.

- Train payroll staff: Educate payroll personnel on wage calculations, deductions, and compliance requirements.

- Review and update: Assess the policy annually to ensure it aligns with evolving labor laws and business needs.

Benefits of using this payroll and compensation policy (Utah)

This policy offers several advantages for Utah businesses:

- Ensures accuracy: Provides clear guidelines for calculating wages and processing payroll.

- Maintains compliance: Helps businesses comply with federal and state labor laws, reducing legal risks.

- Enhances transparency: Ensures employees understand their pay, deductions, and benefits.

- Aligns with best practices: Offers a structured approach to managing payroll and compensation.

- Builds trust: Demonstrates a commitment to fair and timely payment of employees.

Tips for using this payroll and compensation policy (Utah)

- Communicate the policy: Share the policy with employees and include it in the employee handbook.

- Provide training: Educate payroll staff on wage calculations, deductions, and compliance requirements.

- Monitor compliance: Regularly review payroll practices to ensure adherence to the policy.

- Address issues promptly: Take corrective action if payroll errors or discrepancies occur.

- Update regularly: Assess the policy annually to ensure it aligns with evolving labor laws and business needs.