Payroll and compensation policy (Washington): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

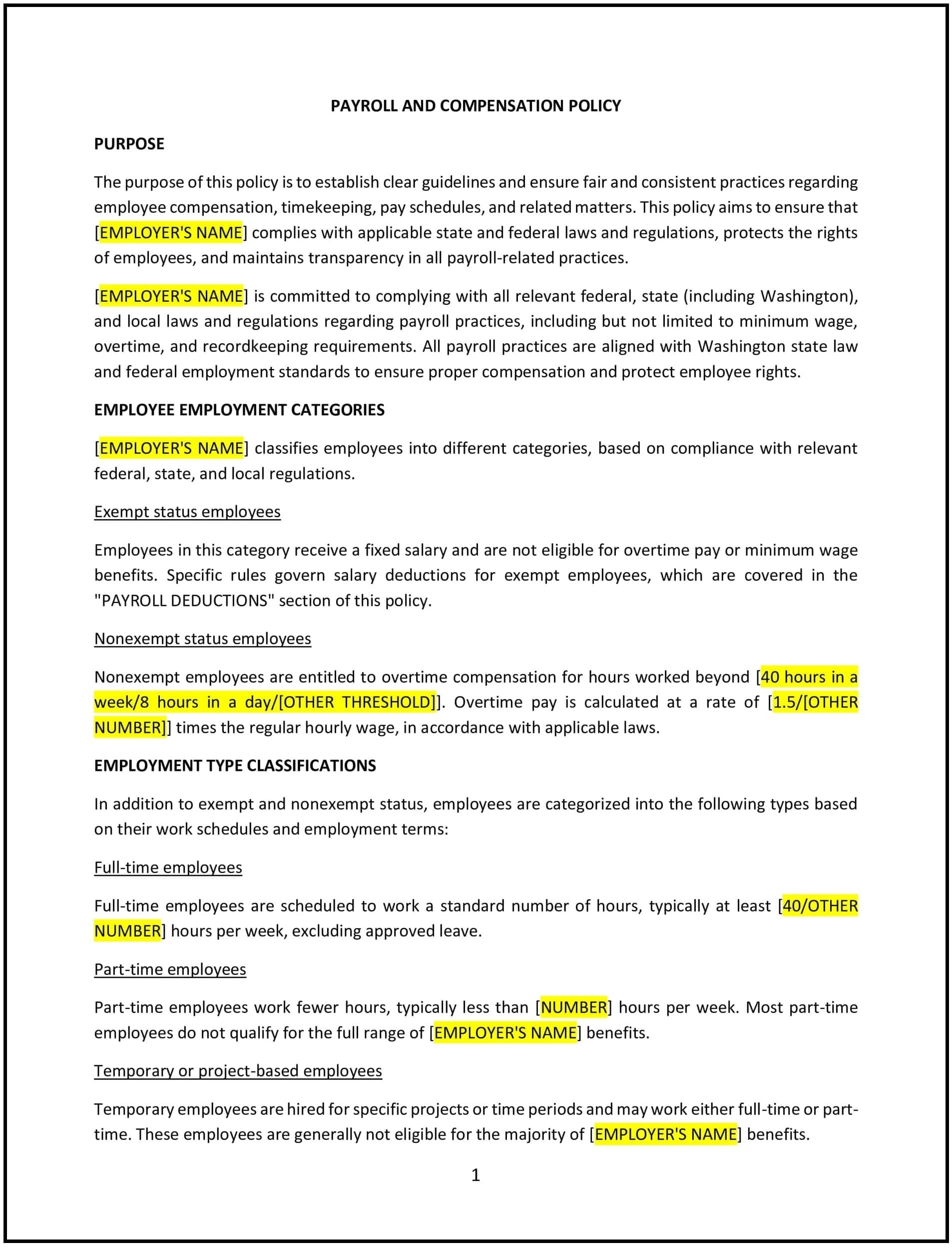

This payroll and compensation policy is designed to help Washington businesses establish clear guidelines for employee compensation and payroll practices. The policy outlines how employees will be compensated for their work, including wage rates, pay frequency, overtime pay, and deductions. It helps the business comply with Washington state laws and federal regulations related to compensation, including minimum wage laws, overtime laws, and other labor protections.

By adopting this policy, businesses can provide fair and transparent compensation, reduce legal risks, and ensure employees understand their pay and benefits.

How to use this payroll and compensation policy (Washington)

- Define compensation structure: The policy should specify the company’s pay structure, including hourly rates, salaried positions, and any performance-based compensation such as bonuses or commissions. It should also outline any classifications, such as exempt and non-exempt employees, and how those classifications affect pay and benefits.

- Set pay frequency: The policy should clearly state the frequency with which employees are paid (e.g., bi-weekly, monthly, etc.). This ensures that employees understand when they can expect to receive their wages.

- Address overtime pay: The policy should outline how overtime pay is calculated for non-exempt employees in accordance with Washington state and federal wage and hour laws. It should specify the overtime rate (typically 1.5 times the regular hourly rate) and the circumstances under which overtime is applicable.

- Detail payroll deductions: The policy should outline any payroll deductions, such as taxes, employee benefits contributions (e.g., health insurance, retirement plans), wage garnishments, or other deductions required by law. It should specify whether employees will be notified of these deductions and how they are calculated.

- Provide guidance on bonuses and commissions: If the company offers performance-based bonuses or commissions, the policy should specify the criteria for earning these incentives, how they are calculated, and when they are paid.

- Ensure compliance with Washington and federal laws: The policy should comply with Washington state’s minimum wage law, overtime regulations, and other applicable wage and hour laws. It should also reflect federal regulations, such as the Fair Labor Standards Act (FLSA), and ensure that all compensation practices are lawful.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s compensation practices. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this payroll and compensation policy (Washington)

This policy offers several benefits for Washington businesses:

- Ensures fair and transparent compensation: The policy provides clear guidelines on how employees will be compensated for their work, ensuring fairness and transparency in pay practices.

- Reduces legal risks: By ensuring compliance with Washington state and federal wage and hour laws, the policy helps businesses avoid legal disputes and penalties related to pay practices, including minimum wage and overtime violations.

- Improves employee satisfaction: When employees understand their compensation structure and can rely on timely, accurate pay, it improves job satisfaction and fosters trust in the business.

- Promotes equal pay: The policy helps ensure that employees are compensated equitably for their work, promoting fairness and preventing discrimination based on gender, race, or other factors.

- Supports business operations: By providing a clear framework for managing payroll and compensation, the policy helps streamline payroll processes and ensures that employees are paid accurately and on time.

- Enhances company reputation: A business with a clear, fair payroll and compensation policy demonstrates its commitment to supporting employees, which can improve the company’s reputation as a responsible and ethical employer.

Tips for using this payroll and compensation policy (Washington)

- Communicate the policy clearly: Ensure that all employees understand the payroll and compensation policy, including how their pay is calculated, when they will be paid, and what deductions may be taken from their wages. Include the policy in the employee handbook, review it during onboarding, and provide periodic reminders.

- Monitor compliance with pay regulations: Regularly monitor payroll practices to ensure that the company is complying with Washington state laws and federal regulations regarding minimum wage, overtime, and other compensation-related issues.

- Train payroll staff: Ensure that payroll staff are trained on how to properly calculate wages, manage overtime, and apply payroll deductions in compliance with state and federal laws.

- Provide clear pay stubs: Employees should receive clear, itemized pay stubs that outline their gross pay, deductions, and net pay. This helps ensure transparency and allows employees to understand how their pay is calculated.

- Address employee concerns promptly: Employees may have questions about their pay, overtime, or deductions. Ensure that there is a clear process for employees to ask questions and resolve concerns related to payroll and compensation.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s compensation practices. Regular updates will help keep the policy relevant and effective.