Payroll and compensation policy (West Virginia): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

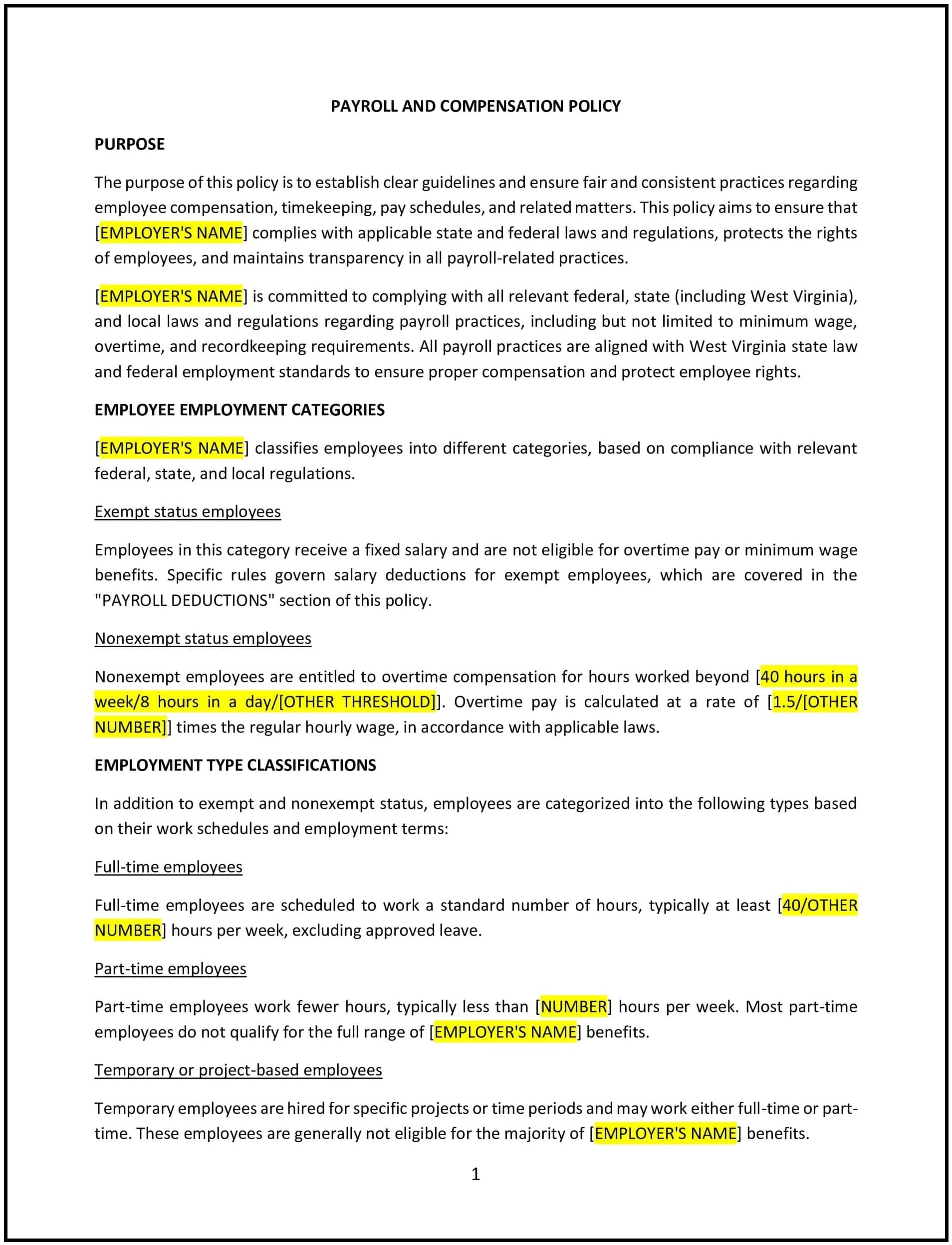

Payroll and compensation policy (West Virginia)

In West Virginia, a payroll and compensation policy provides clear guidelines for managing employee wages, salaries, and benefits in compliance with state and federal laws. This policy ensures transparency, consistency, and fairness in payroll administration while addressing issues like payment schedules, overtime, and deductions.

The policy outlines employee rights, employer responsibilities, and procedures for handling payroll-related matters.

How to use this payroll and compensation policy (West Virginia)

- Define pay schedules: Specify how often employees will be paid (e.g., weekly, bi-weekly, or monthly) and the method of payment (e.g., direct deposit, check).

- Clarify wage classifications: Distinguish between exempt and non-exempt employees and their eligibility for overtime under the Fair Labor Standards Act (FLSA) and West Virginia laws.

- Address overtime: Outline rules for calculating and compensating overtime for eligible employees in compliance with federal and state requirements.

- Explain deductions: Provide details on mandatory deductions (e.g., taxes, Social Security) and any voluntary deductions (e.g., health insurance, retirement contributions).

- Support compliance: Ensure the policy aligns with West Virginia labor laws and federal wage and hour regulations to avoid legal risks.

Benefits of using a payroll and compensation policy (West Virginia)

- Promotes transparency: Ensures employees understand how their wages and benefits are calculated and managed.

- Supports compliance: Aligns with West Virginia labor laws and federal regulations to avoid legal disputes or penalties.

- Enhances employee trust: Demonstrates a commitment to fair and consistent payroll practices.

- Reduces errors: Provides clear processes for managing payroll and addressing discrepancies promptly.

- Improves efficiency: Streamlines payroll administration, reducing confusion and operational inefficiencies.

Tips for using a payroll and compensation policy (West Virginia)

- Communicate the policy: Share the policy with employees during onboarding and ensure it is easily accessible for reference.

- Train payroll staff: Provide training on West Virginia wage laws, tax regulations, and the organization’s payroll software to ensure accuracy.

- Handle discrepancies promptly: Establish a process for employees to report payroll errors or concerns and resolve them quickly.

- Monitor compliance: Regularly review payroll practices to ensure alignment with state and federal laws and make adjustments as needed.

- Update regularly: Revise the policy to reflect changes in West Virginia laws, tax rates, or company practices.