Payroll and compensation policy (Wyoming): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

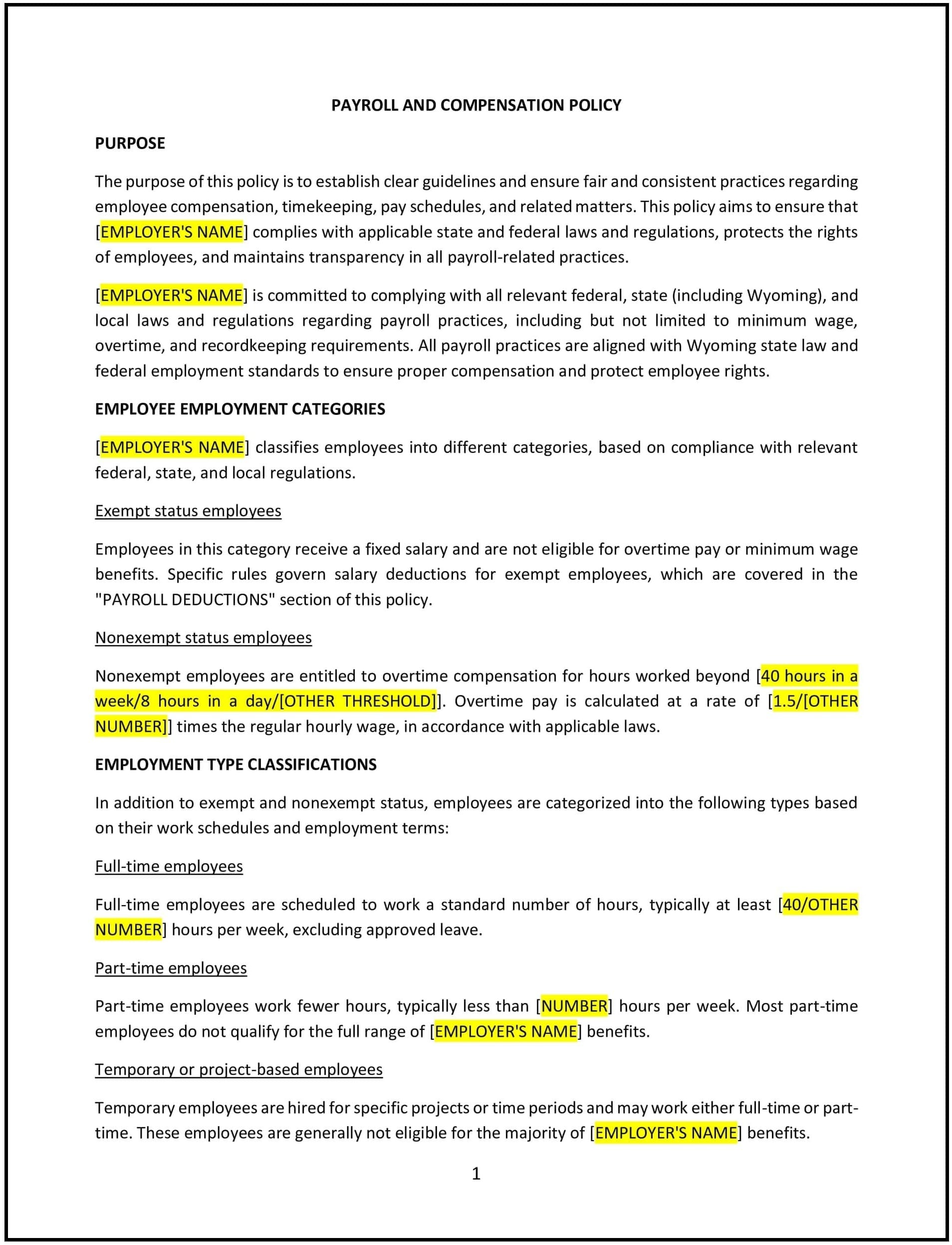

Payroll and compensation policy (Wyoming)

In Wyoming, a payroll and compensation policy ensures that employees are paid accurately and fairly while maintaining compliance with state and federal wage laws. This policy provides clear guidelines for payroll processing, payment schedules, and employee compensation practices.

This policy outlines procedures for managing wages, overtime, deductions, and payroll records, fostering transparency and trust in the workplace.

How to use this payroll and compensation policy (Wyoming)

- Define payment schedules: Clearly state the frequency of payments, such as weekly, biweekly, or monthly, and the specific payday.

- Outline wage components: Specify how wages are calculated, including hourly rates, salaries, commissions, and bonuses, and explain any overtime pay calculations.

- Detail deductions: Include information on permissible deductions, such as taxes, benefits contributions, or wage garnishments, in compliance with Wyoming laws.

- Establish reporting procedures: Provide instructions for employees to report payroll discrepancies or request corrections to ensure accuracy.

- Support compliance: Align the policy with Wyoming wage laws and federal regulations, such as the Fair Labor Standards Act (FLSA), to support adherence to legal standards.

Benefits of using a payroll and compensation policy (Wyoming)

A payroll and compensation policy provides several advantages for Wyoming businesses:

- Improves compliance: Aligns with state and federal wage laws, reducing the risk of penalties or legal disputes.

- Promotes transparency: Clearly communicates payroll and compensation practices, building trust among employees.

- Improves accuracy: Establishes structured procedures for payroll processing, minimizing errors and discrepancies.

- Supports employee satisfaction: Demonstrates a commitment to fair and timely compensation, fostering morale and loyalty.

- Adapts to local needs: Reflects Wyoming’s unique workforce dynamics and industry-specific requirements.

Tips for using a payroll and compensation policy (Wyoming)

- Communicate effectively: Share the policy with employees during onboarding and provide access to it through the employee handbook or intranet.

- Monitor compliance: Regularly review payroll practices to ensure adherence to legal requirements and company policies.

- Educate employees: Offer resources or training to help employees understand their pay stubs, deductions, and compensation structure.

- Leverage technology: Use payroll software or services to streamline processes and improve accuracy.

- Review periodically: Update the policy to reflect changes in laws, organizational practices, or workforce needs.