Payroll compensation policy (Wisconsin): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

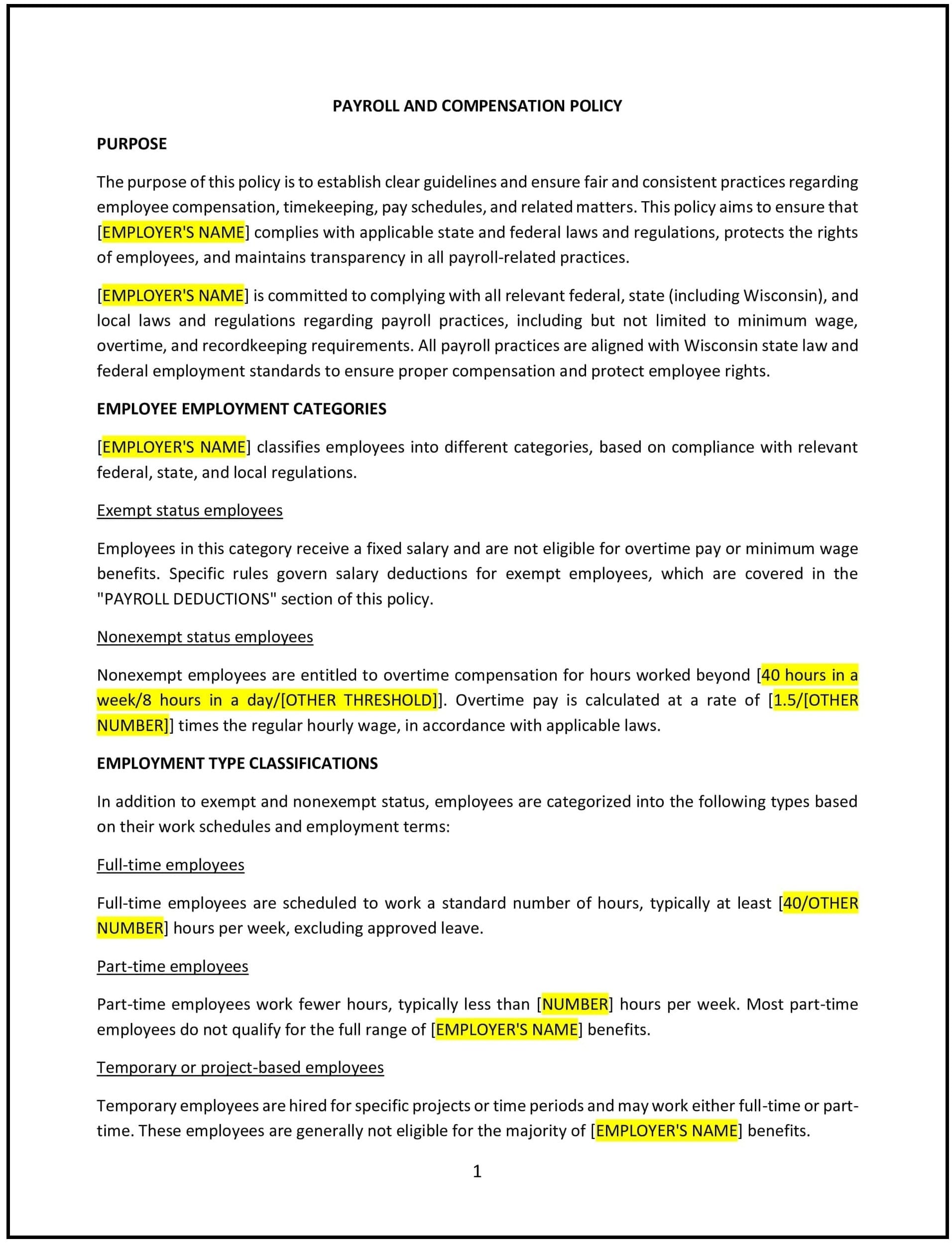

Payroll compensation policy (Wisconsin)

A payroll compensation policy helps Wisconsin businesses establish clear and consistent guidelines for employee compensation, including salary, wages, bonuses, and benefits. This policy outlines how employees will be paid, the frequency of payments, deductions, and how compensation is structured in accordance with state and federal laws.

By implementing this policy, businesses can improve compliance with labor laws, provide transparency to employees, and promote fairness in compensation practices.

How to use this payroll compensation policy (Wisconsin)

- Define compensation components: Clearly outline the different components of employee compensation, including base salary, hourly wages, overtime, bonuses, commissions, and benefits.

- Specify pay periods: State the frequency of pay periods (e.g., weekly, bi-weekly, monthly) and ensure timely and accurate payment according to the company’s payroll schedule.

- Outline deductions: Detail the types of deductions that may be taken from an employee's compensation, such as taxes, retirement contributions, health insurance premiums, and other voluntary deductions.

- Address overtime pay: Specify how overtime is calculated and paid, ensuring compliance with Wisconsin state laws and the Fair Labor Standards Act (FLSA).

- Ensure compliance with state and federal laws: Ensure that compensation practices comply with Wisconsin labor laws, including minimum wage, overtime, and paid leave requirements, as well as federal regulations such as the FLSA.

- Establish benefits and bonuses: Provide details on employee benefits, including health insurance, retirement plans, paid time off, and performance-based bonuses or incentives.

- Monitor and review: Regularly review the compensation structure to ensure it remains competitive and compliant with industry standards and legal requirements.

Benefits of using this payroll compensation policy (Wisconsin)

This policy offers several benefits for Wisconsin businesses:

- Supports legal compliance: Helps businesses comply with state and federal wage and hour laws, including minimum wage, overtime, and tax regulations.

- Promotes transparency: Provides employees with clear expectations regarding their compensation, including salary, deductions, and benefits.

- Supports fairness: Establishes equitable compensation practices that promote fairness across all employee levels, reducing potential conflicts or misunderstandings.

- Enhances employee satisfaction: Clear and competitive compensation structures contribute to employee retention, motivation, and satisfaction.

- Reduces legal risks: By adhering to legal requirements and maintaining accurate payroll practices, businesses can minimize the risk of wage disputes and legal challenges.

Tips for using this payroll compensation policy (Wisconsin)

- Communicate the policy clearly: Ensure that all employees are informed about the compensation structure, payroll schedules, and any benefits or bonuses available.

- Maintain accurate records: Keep detailed records of employee pay, deductions, and benefits to ensure compliance with tax and employment regulations.

- Conduct regular audits: Regularly review payroll practices and compensation structures to ensure compliance with applicable laws and industry standards.

- Update the policy as needed: Revise the policy whenever there are changes to Wisconsin labor laws, federal regulations, or company compensation practices.

- Provide resources for employees: Offer employees access to resources or support for understanding their compensation, including pay stubs, benefits summaries, and tax information.