Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

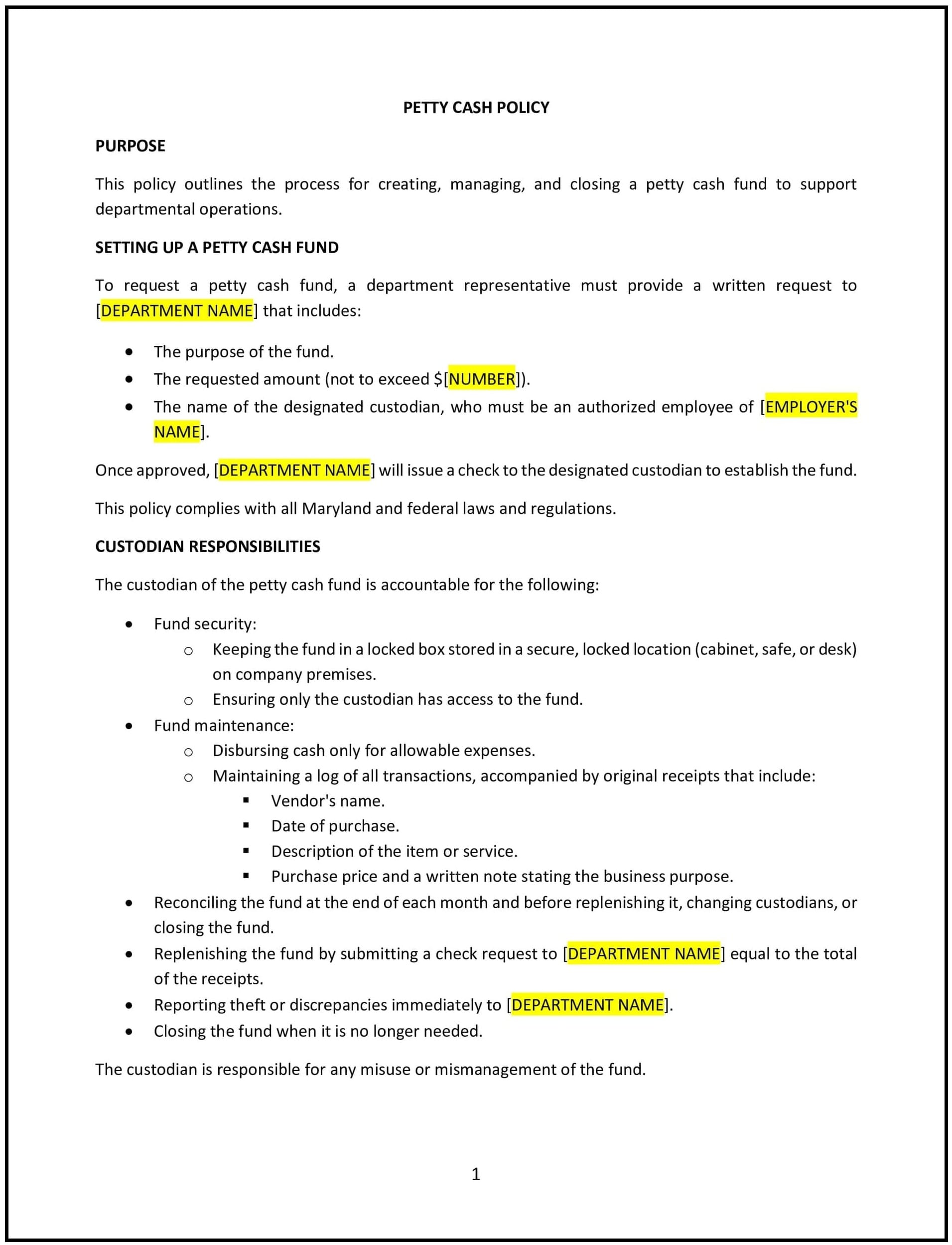

Petty cash policy (Maryland)

This petty cash policy is designed to help Maryland businesses manage small, day-to-day expenses that arise in the course of business operations. It outlines guidelines for maintaining and using petty cash funds, ensuring accurate record-keeping and accountability.

By adopting this policy, Maryland businesses can maintain efficient cash flow management while reducing the risk of misuse or discrepancies in petty cash handling.

How to use this petty cash policy (Maryland)

- Define petty cash: Specify what constitutes petty cash expenses, such as office supplies, postage, or minor emergency purchases.

- Set cash limits: Determine the maximum allowable amount for the petty cash fund and individual transactions.

- Establish approval procedures: Outline the process for requesting and approving petty cash disbursements, including required documentation such as receipts or forms.

- Assign responsibility: Designate an employee or department responsible for managing the petty cash fund, tracking expenses, and ensuring proper use.

- Include record-keeping requirements: Maintain accurate records of all transactions, including the date, amount, purpose, and individual responsible for the expense.

- Set replenishment procedures: Specify when and how the petty cash fund will be replenished, ensuring it remains adequately funded for business needs.

- Reflect Maryland-specific considerations: Address any local regulations or practices that may impact petty cash management, if applicable.

Benefits of using this petty cash policy (Maryland)

Implementing this policy provides Maryland businesses with several advantages:

- Promotes accountability: Clearly defines the process for accessing and using petty cash, reducing the risk of misuse.

- Enhances efficiency: Streamlines minor purchases and expenses, allowing employees to handle day-to-day needs without delays.

- Maintains accurate records: Provides a standardized approach to tracking petty cash expenditures, ensuring transparency.

- Reduces fraud risk: Establishes controls to prevent unauthorized access to or use of petty cash funds.

- Aligns with business practices: Supports business operations by maintaining a reliable petty cash system for minor purchases.

Tips for using this petty cash policy (Maryland)

- Train employees: Ensure all staff members involved in petty cash management are familiar with the policy and its procedures.

- Monitor usage: Regularly review petty cash transactions to identify trends, errors, or discrepancies.

- Keep records up-to-date: Maintain detailed records of each transaction and update the fund balance accordingly.

- Implement security measures: Store petty cash in a secure location, such as a locked drawer or safe, to minimize the risk of theft or loss.

- Review regularly: Update the policy periodically to reflect changes in Maryland regulations, business needs, or best practices.