Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

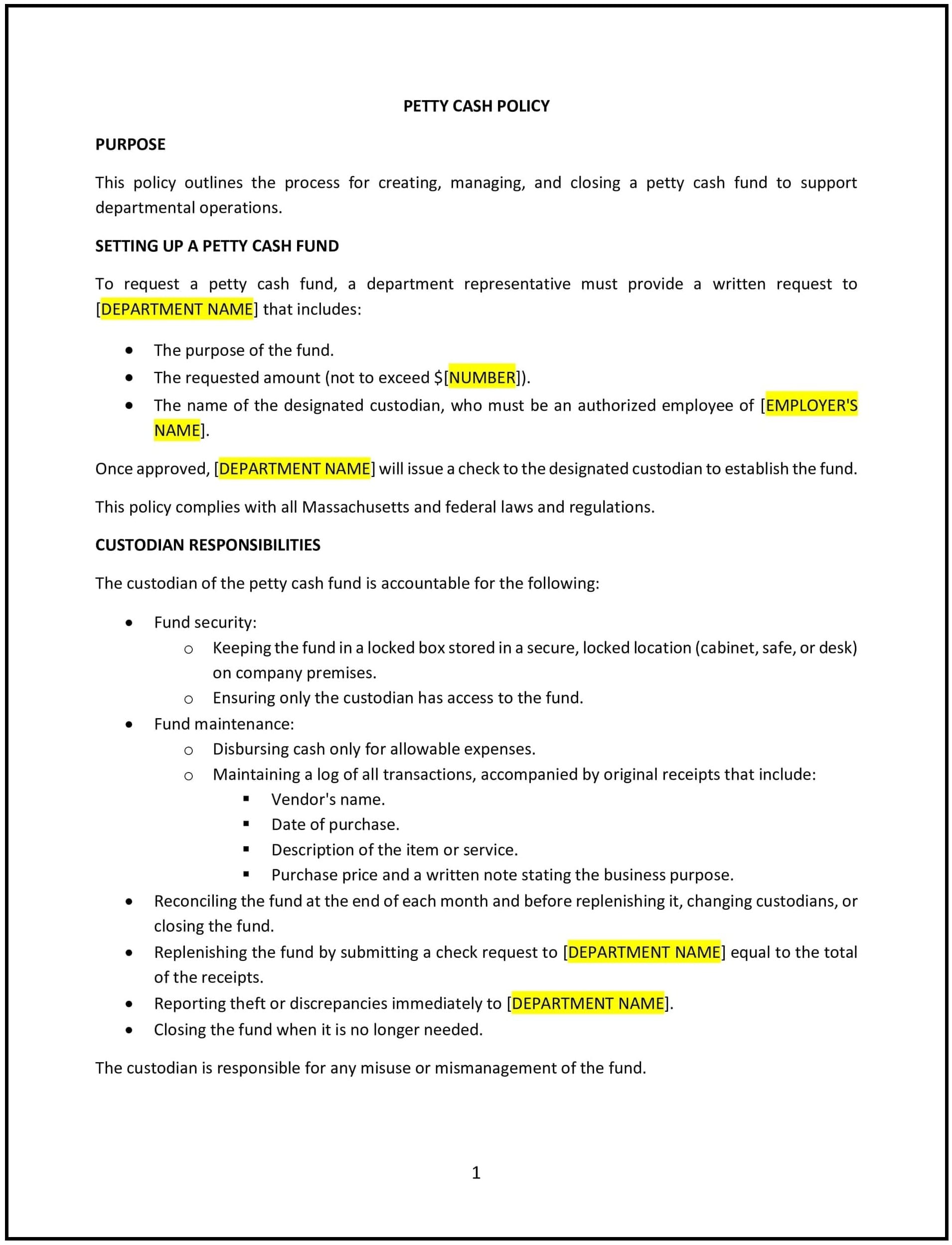

This petty cash policy is designed to help Massachusetts businesses manage the use of petty cash for small, routine business expenses. The policy outlines the procedures for requesting, dispensing, and replenishing petty cash, as well as the types of expenses that are eligible for payment from petty cash. It promotes compliance with Massachusetts state laws and federal regulations while ensuring that petty cash funds are used responsibly, accurately recorded, and consistently managed.

By adopting this policy, businesses can maintain clear guidelines for handling minor business expenses, promote accountability, and minimize the risk of financial mismanagement.

How to use this petty cash policy (Massachusetts)

- Define petty cash fund: Clearly specify the total amount of petty cash the business will maintain. This amount should be sufficient to cover small business expenses but should not exceed what is necessary for day-to-day operations. The policy should define the maximum amount that can be requested for each expense.

- Outline procedures for requesting petty cash: Specify the steps employees need to take to request petty cash. This may include submitting a written request with a description of the expense, the amount needed, and the approval from a designated manager or department head. Employees should follow the established approval process for all requests.

- Approve specific expenses: Clearly state what types of expenses are eligible for petty cash use. These may include minor office supplies, emergency repairs, postage, or employee reimbursements. Petty cash should not be used for large purchases or non-business-related expenses.

- Recordkeeping and documentation: Require employees to provide receipts for all petty cash transactions. Employees should submit receipts along with their request for reimbursement, and the company should maintain accurate records of all petty cash expenditures, including the amount spent, the purpose of the expense, and the person who requested the funds.

- Replenishment and oversight: Define the process for replenishing the petty cash fund when it gets low. The policy should outline the steps for requesting replenishment, who is responsible for approving it, and the frequency of review. Regular audits should be conducted to ensure that all petty cash expenditures are accounted for and there are no discrepancies.

- Limit access to petty cash: Specify who is authorized to handle and disburse petty cash. Access should be limited to designated individuals, such as finance or accounting staff, to reduce the risk of misuse or fraud.

- Ensure compliance with Massachusetts and federal laws: The policy should comply with Massachusetts state laws and federal regulations, including the proper accounting practices and financial reporting standards for small business expenditures.

- Review and update regularly: Periodically review and update the policy to ensure it is compliant with changes in state and federal laws and any changes in the company’s financial practices or petty cash needs.

Benefits of using this petty cash policy (Massachusetts)

This policy offers several benefits for Massachusetts businesses:

- Promotes financial accountability: The policy ensures that petty cash is used only for legitimate business purposes and requires accurate documentation of all expenses, helping to maintain financial control and prevent misuse.

- Reduces the risk of fraud: By limiting access to petty cash and requiring approval for all expenses, the policy helps minimize the risk of theft or fraudulent activities related to petty cash funds.

- Streamlines financial management: The policy simplifies the process for handling small business expenses, allowing employees to quickly access petty cash for routine purchases without delays, while maintaining financial oversight.

- Improves recordkeeping and transparency: The policy requires employees to provide receipts and submit accurate records, promoting transparency and improving the company’s financial reporting.

- Enhances business compliance: By following established procedures and complying with state and federal regulations, businesses reduce the risk of non-compliance and legal issues related to financial mismanagement.

- Improves financial audits: With clear documentation and regular reviews, businesses can easily track petty cash expenditures, making audits more efficient and helping ensure that all funds are properly accounted for.

Tips for using this petty cash policy (Massachusetts)

- Communicate the policy clearly: Make sure all employees are aware of the petty cash policy and the procedure for requesting funds. Provide the policy in the employee handbook and review it during onboarding or regular meetings.

- Provide training for managers and finance staff: Ensure that managers and finance staff understand the petty cash policy and how to properly request, approve, and track petty cash expenses.

- Regularly audit petty cash: Perform regular audits of petty cash funds to ensure that all expenses are properly documented and that there are no discrepancies in the records.

- Maintain a secure storage system: Store petty cash in a secure location, such as a locked cash box or safe, to prevent unauthorized access.

- Track expenditures accurately: Keep detailed records of all petty cash transactions, including receipts and written approvals, to help maintain financial transparency and accuracy.

- Review and update regularly: Periodically review the policy to ensure it is compliant with Massachusetts state laws, federal regulations, and any changes in the business’s financial practices or petty cash needs.