Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

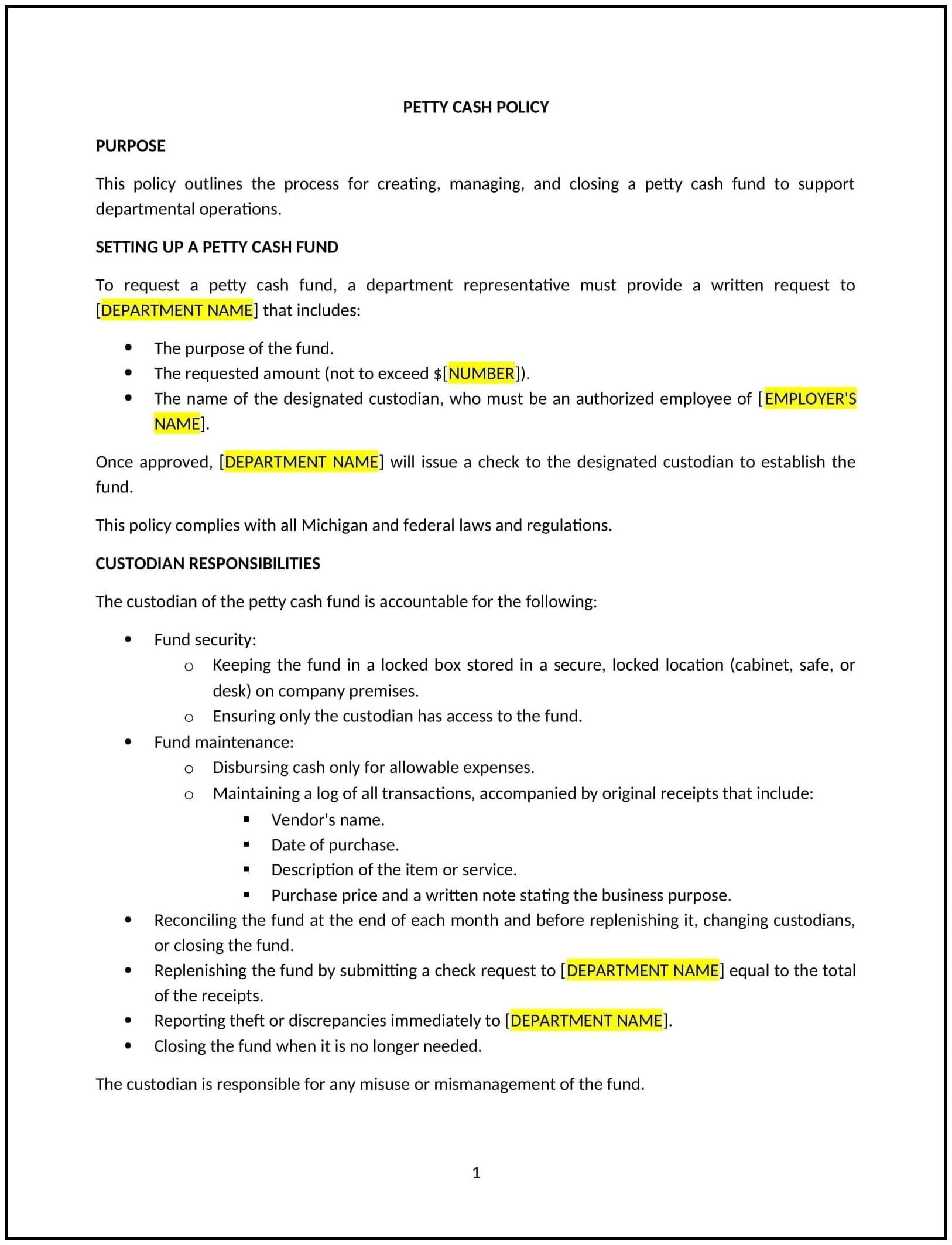

Petty cash policy (Michigan)

A petty cash policy provides Michigan businesses with guidelines for the management, usage, and monitoring of petty cash funds. This policy establishes how petty cash should be handled, who is responsible for it, and the procedures for requesting, using, and replenishing the fund. It also includes rules on documentation, tracking, and reporting to ensure that petty cash is used appropriately and in compliance with business standards and regulations.

By implementing this policy, businesses can streamline their expense management processes, reduce the risk of misuse, and maintain transparency in handling small cash disbursements.

How to use this petty cash policy (Michigan)

- Define the purpose of petty cash: Clearly outline what petty cash can be used for, such as covering small, incidental expenses like office supplies, postage, or travel expenses. The policy should specify which types of purchases are appropriate and which are not.

- Set limits on petty cash: Establish a maximum amount for the petty cash fund, as well as a cap on individual disbursements. This ensures that petty cash is only used for small, necessary expenses.

- Designate responsible personnel: Specify who is responsible for managing the petty cash fund, including the custodian or person in charge of disbursing funds. The policy should also outline who is authorized to approve petty cash withdrawals.

- Implement request procedures: Outline the process for requesting petty cash, including the required documentation (e.g., receipts, invoices), the approval process, and any necessary forms to be filled out before funds are disbursed.

- Track and document expenses: Require employees to submit receipts for all petty cash transactions and maintain a detailed log of all disbursements, including the date, purpose, amount, and recipient.

- Replenish petty cash: Specify the procedure for replenishing the petty cash fund when it runs low, including who can authorize the replenishment and the process for submitting requests.

- Conduct audits: Implement regular audits of the petty cash fund to ensure that it is being used properly and that records are accurate. This helps prevent misuse or errors and ensures accountability.

- Ensure compliance with Michigan laws: Ensure that the petty cash policy aligns with any relevant Michigan state laws, including tax and reporting requirements, and follows sound financial management practices.

- Review and update regularly: Periodically review the policy to ensure that it remains effective, compliant with relevant laws, and aligned with the business’s financial procedures.

Benefits of using this petty cash policy (Michigan)

This policy provides several key benefits for Michigan businesses:

- Improves financial control: By establishing clear guidelines for managing petty cash, businesses can prevent misuse and maintain better control over small expenditures.

- Promotes transparency: The policy encourages documentation and tracking of petty cash transactions, ensuring transparency and accountability in financial practices.

- Simplifies expense management: The policy provides a streamlined process for handling small expenses, reducing the need for complex approval workflows for minor disbursements.

- Reduces the risk of fraud: Regular audits and clear approval processes reduce the potential for fraud or misuse of petty cash funds.

- Enhances compliance: The policy helps businesses comply with financial reporting requirements and tax laws related to petty cash transactions.

- Boosts employee confidence: A well-managed petty cash system fosters trust among employees by ensuring that funds are used appropriately and that all transactions are documented.

Tips for using this petty cash policy (Michigan)

- Communicate the policy clearly: Ensure all employees are aware of the petty cash policy by including it in the employee handbook, during onboarding, and in financial management training.

- Designate a custodian: Appoint a trusted individual to be responsible for managing petty cash and ensure they are trained on the proper procedures for handling and tracking funds.

- Monitor and audit regularly: Conduct regular checks of the petty cash fund to verify that the balance is correct and that all disbursements are properly documented and justified.

- Use digital records: Consider using digital tools or software to track petty cash transactions, which can streamline record-keeping and reduce the risk of errors.

- Limit access to petty cash: Only authorized personnel should be allowed to access the petty cash fund. Clearly define who can approve petty cash requests and set limits on how much can be withdrawn at one time.

- Review the policy regularly: Periodically assess the petty cash policy to ensure it remains effective and aligned with the business’s evolving financial management needs.