Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

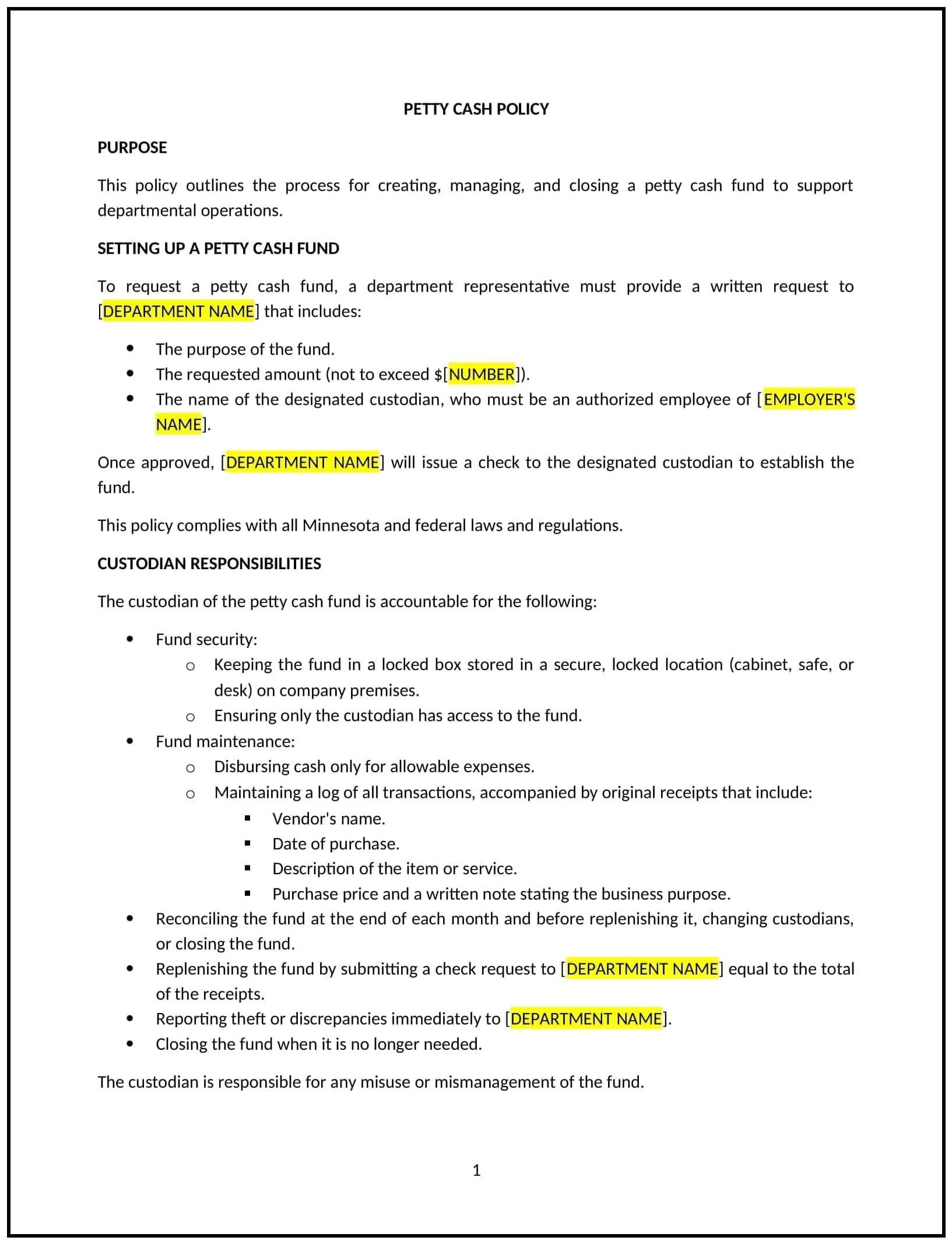

Petty cash policy (Minnesota)

This petty cash policy is designed to help Minnesota businesses manage small, day-to-day expenditures that cannot be processed through regular accounting procedures. The policy outlines how petty cash funds will be maintained, controlled, and used for minor business expenses, such as office supplies or small purchases that arise during daily operations.

By implementing this policy, businesses can maintain control over petty cash use, ensure transparency in financial management, and reduce the risk of misuse or fraud.

How to use this petty cash policy (Minnesota)

- Define petty cash usage: Clearly outline the types of expenses that petty cash can be used for, such as minor office supplies, postage, or employee reimbursements for small expenses. Specify any exclusions or restrictions, such as not allowing petty cash to be used for large purchases or personal expenses.

- Set the petty cash fund amount: Specify the maximum amount of petty cash that will be maintained by the business and the process for replenishing the fund once it reaches a predetermined threshold.

- Assign responsibility: Designate a petty cash custodian, who will be responsible for managing the fund, keeping accurate records, and ensuring that petty cash is used appropriately.

- Implement documentation and approval procedures: Require employees to provide receipts or documentation for each petty cash transaction and ensure that all requests for petty cash withdrawals are approved by a supervisor or manager.

- Outline reimbursement procedures: Specify how employees can be reimbursed for expenses paid out of pocket. Set clear guidelines for submitting reimbursement requests and the documentation required.

- Regularly reconcile the fund: Establish a procedure for reconciling the petty cash fund on a regular basis, such as monthly or quarterly, to ensure that all withdrawals are accounted for and that the fund balance matches the records.

- Provide for audits: Conduct periodic audits of the petty cash fund to ensure that funds are being used appropriately and that there are no discrepancies or unauthorized withdrawals.

Benefits of using a petty cash policy (Minnesota)

Implementing this policy provides several advantages for Minnesota businesses:

- Improves financial control: A clear petty cash policy helps businesses maintain control over minor expenses and ensures that funds are used appropriately and in accordance with company policies.

- Enhances transparency: By requiring documentation and approval for petty cash transactions, businesses can reduce the risk of fraud and ensure that all expenditures are legitimate.

- Increases operational efficiency: Petty cash allows businesses to address minor expenses quickly without going through the formal accounting process, saving time for both employees and managers.

- Promotes accountability: Designating a petty cash custodian and requiring regular reconciliation ensures that the fund is managed responsibly, preventing misuse or mismanagement of funds.

- Reflects Minnesota-specific considerations: Tailors the policy to Minnesota’s specific business environment and regulatory requirements, ensuring that it aligns with local expectations and best practices.

Tips for using this petty cash policy (Minnesota)

- Communicate clearly: Ensure all employees are aware of the petty cash policy and understand the rules regarding how petty cash can be used, as well as the documentation and approval process required.

- Maintain accurate records: Keep detailed records of all petty cash transactions, including receipts, amounts withdrawn, and the purpose of each expense.

- Be transparent: Review petty cash transactions regularly to ensure transparency and consistency in how the fund is used, and address any discrepancies immediately.

- Set clear limits: Ensure that petty cash is used only for small, day-to-day expenses and is not used for larger purchases or personal expenses.

- Review regularly: Periodically review the petty cash policy to ensure it remains aligned with the company’s evolving financial management practices and that the amount of petty cash maintained is sufficient for operational needs.