Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

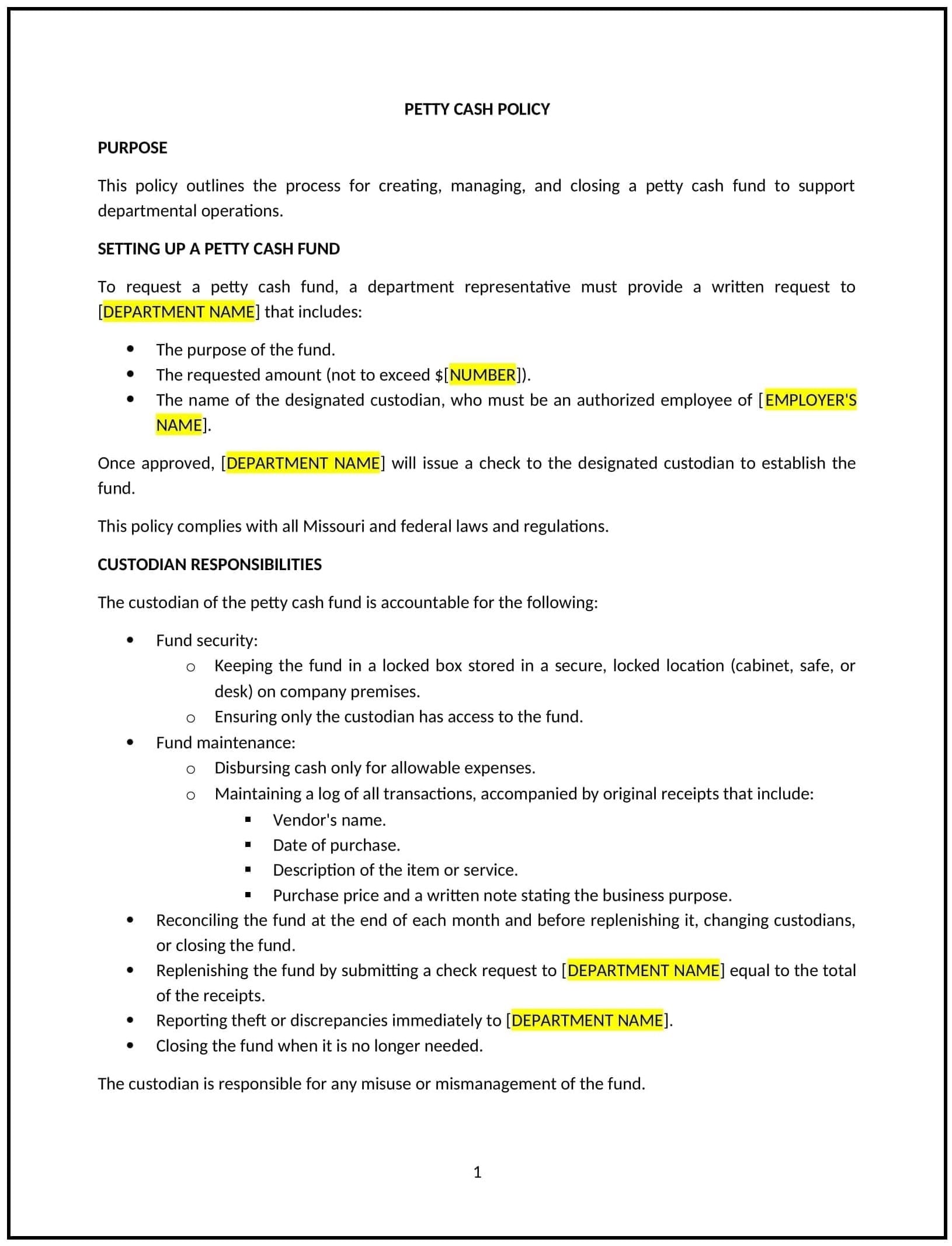

Petty cash policy (Missouri)

A petty cash policy helps businesses in Missouri manage small, incidental expenses that arise during daily operations. This policy outlines the procedures for handling petty cash, including how funds are allocated, who is authorized to use petty cash, and how transactions are recorded. It is designed to ensure proper control and accountability for minor expenditures, while maintaining transparency and reducing the risk of misuse or fraud.

By adopting this policy, businesses can efficiently manage small expenses without needing to go through a formal reimbursement process, while ensuring that petty cash is properly tracked and used only for appropriate purposes.

How to use this petty cash policy (Missouri)

- Define petty cash usage: Specify the types of expenses that can be paid using petty cash, such as office supplies, postage, or minor travel expenses, and clarify any restrictions on the types of purchases allowed.

- Set limits on petty cash amounts: Establish the maximum amount of petty cash that can be maintained in the fund, ensuring that it remains reasonable for the size and scope of the business’s daily operations.

- Appoint petty cash custodians: Identify who is responsible for managing the petty cash fund, including maintaining the cash, authorizing disbursements, and ensuring that proper records are kept.

- Outline documentation and receipts: Require employees to provide receipts for all petty cash transactions, and specify the process for submitting requests for reimbursement, ensuring that every disbursement is documented appropriately.

- Establish approval processes: Define who is authorized to approve petty cash disbursements and under what circumstances, ensuring that all payments are reviewed before funds are released.

- Track and reconcile the fund: Set up procedures for regularly reconciling the petty cash fund, ensuring that the amount of cash on hand matches the records and that any discrepancies are promptly addressed.

- Set a clear reimbursement policy: Explain how employees should request reimbursement for petty cash expenditures, ensuring that proper documentation and approvals are provided for each request.

- Review regularly: Periodically review and update the policy to ensure it remains aligned with company operations and financial practices, as well as with Missouri state laws.

Benefits of using this petty cash policy (Missouri)

This policy provides several benefits for businesses in Missouri:

- Promotes accountability: By setting clear guidelines and approval processes, businesses can reduce the risk of misuse or fraud and ensure that petty cash is used responsibly.

- Increases financial transparency: A structured petty cash process ensures that all small transactions are properly documented, providing transparency in the company’s financial management.

- Streamlines expense management: Petty cash enables businesses to handle small, urgent expenses quickly and efficiently, reducing the need for time-consuming reimbursement procedures.

- Prevents discrepancies: Regular reconciliation of petty cash ensures that any errors or discrepancies are detected early, preventing larger financial issues from arising.

- Improves financial control: By limiting the amount of petty cash in circulation and requiring proper documentation, businesses can maintain tighter control over their finances and minimize the risk of mismanagement.

Tips for using this petty cash policy (Missouri)

- Communicate the policy clearly: Ensure that all employees are aware of the petty cash policy, including who is authorized to use the funds, what types of expenses are covered, and how to document their transactions.

- Monitor usage regularly: Keep track of petty cash disbursements to ensure that they are consistent with company needs and that funds are being used appropriately.

- Require documentation: Ensure that employees submit receipts for all petty cash transactions and provide any necessary information to support the expense, such as a description of the purchase or the reason for the expenditure.

- Reconcile frequently: Set up regular intervals for reconciling petty cash, such as weekly or monthly, to ensure that the funds are being properly tracked and managed.

- Limit access: Limit access to the petty cash fund to authorized personnel, such as a designated custodian, to ensure that the cash is being handled responsibly.

- Review regularly: Periodically review the policy to ensure it remains relevant to the company’s operational needs and financial controls, and to reflect any changes in Missouri state laws.