Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Petty cash policy (Montana)

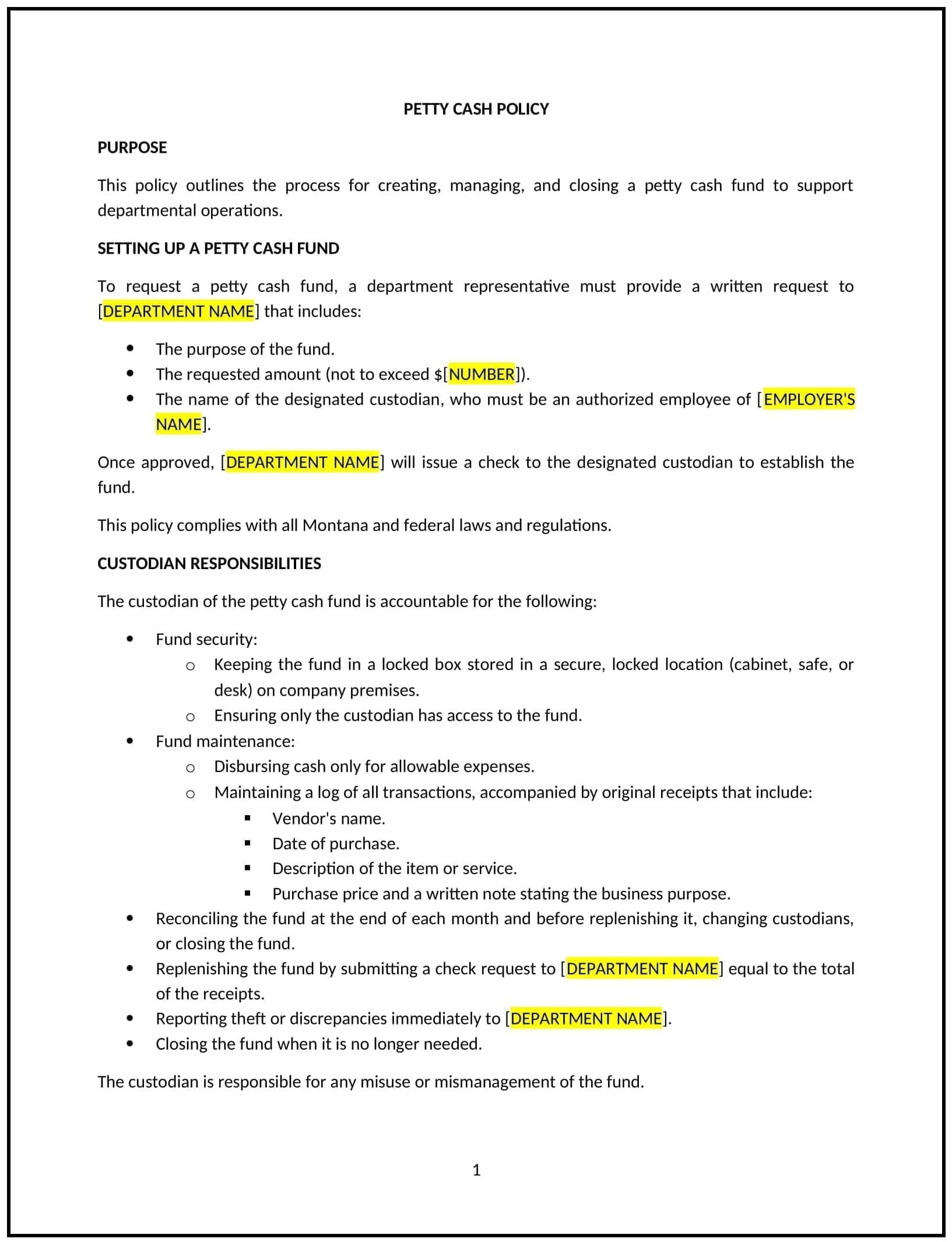

A petty cash policy helps Montana businesses manage small, day-to-day expenses that are typically paid in cash, such as office supplies or transportation costs. This policy outlines how petty cash is handled, including procedures for requesting, using, and replenishing petty cash, as well as safeguards to prevent misuse or errors.

By implementing this policy, businesses can maintain transparency and control over small expenditures, reduce the risk of fraud or mismanagement, and ensure that petty cash is used appropriately.

How to use this petty cash policy (Montana)

- Define petty cash limits: The policy should specify the maximum amount of petty cash that can be maintained at any given time. It should also define the maximum amount that can be used for individual transactions to prevent excessive or unauthorized use.

- Set guidelines for petty cash requests: The policy should outline the process employees must follow to request petty cash, including what information is required (e.g., purpose of the expense, amount requested) and who must approve the request.

- Track petty cash usage: The policy should include a requirement to document all petty cash transactions, including the date, amount, purpose, and the individual receiving the funds. This documentation should be signed and kept for accounting purposes.

- Replenishment procedures: The policy should outline the process for replenishing petty cash when the fund runs low, specifying who is responsible for requesting replenishment and how the amount needed is determined.

- Set safeguards against misuse: The policy should specify who is responsible for managing petty cash, and how access to the cash is controlled. This can include limiting access to designated employees and requiring regular audits of petty cash usage.

- Establish accountability: The policy should include a clear process for tracking and reconciling petty cash at the end of each period, and establish the consequences for misuse or failure to follow procedures.

- Review and update regularly: The policy should be reviewed periodically to ensure it remains aligned with the business’s financial practices and legal requirements.

Benefits of using this petty cash policy (Montana)

This policy provides several key benefits for Montana businesses:

- Maintains control over small expenditures: A petty cash policy helps businesses track and control small, everyday expenses, preventing unnecessary or unauthorized spending.

- Improves financial transparency: By requiring documentation and approval for petty cash transactions, the policy increases transparency, making it easier to monitor and audit these expenses.

- Reduces the risk of fraud: Safeguards such as limiting access to petty cash and requiring documentation help reduce the risk of fraud or misuse of company funds.

- Increases operational efficiency: Having clear procedures in place for managing petty cash requests and replenishments streamlines operations and minimizes confusion over how petty cash should be handled.

- Supports accountability: Clear guidelines and regular tracking ensure that employees are held accountable for their use of petty cash, promoting responsible spending practices.

- Simplifies auditing: A well-organized petty cash system, with documented transactions and regular reconciliations, makes it easier for businesses to conduct audits and maintain accurate financial records.

Tips for using this petty cash policy (Montana)

- Communicate the policy clearly: Ensure that all employees understand the petty cash policy, including how to request cash, what the limits are, and how transactions should be documented and approved.

- Designate responsible employees: Limit access to petty cash to a small group of trusted employees and designate a manager or finance officer to oversee and reconcile the fund regularly.

- Monitor petty cash usage: Track petty cash usage on a regular basis to ensure that the fund is not being misused and that all expenses are properly documented and justified.

- Use accounting software for tracking: Consider using accounting software or spreadsheets to track petty cash transactions, making it easier to reconcile the fund and review expenditures.

- Replenish the fund promptly: Ensure that the petty cash fund is replenished as soon as it runs low to avoid delays in processing employee requests for small expenses.

- Conduct regular audits: Schedule regular audits of the petty cash fund to ensure that all funds are accounted for and that the system is being used appropriately.