Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Petty cash policy (Nebraska)

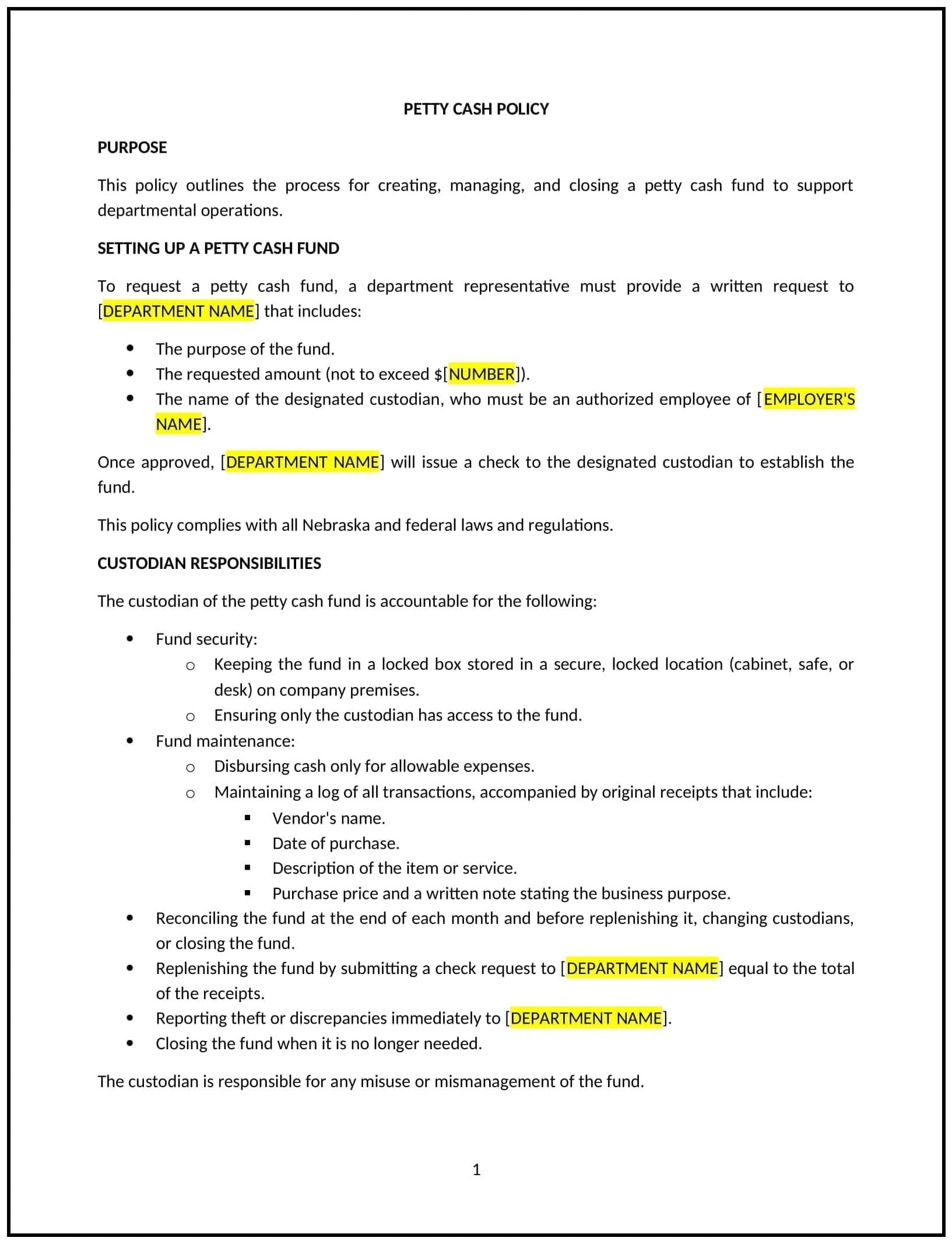

A petty cash policy helps Nebraska businesses manage small, day-to-day expenses that are too minor to process through regular accounting procedures. This policy outlines how petty cash should be handled, who is authorized to access it, and the procedures for replenishing and tracking expenses. It is designed to ensure that petty cash is used responsibly and that all disbursements are accurately recorded, minimizing the risk of misuse or mismanagement.

By adopting this policy, businesses in Nebraska can maintain control over small expenditures, streamline expense processes, and reduce the risk of fraud or errors.

How to use this petty cash policy (Nebraska)

- Define petty cash usage: Specify the types of expenses that can be paid with petty cash, such as office supplies, postage, or small emergency purchases. The policy should outline that petty cash should not be used for large or routine expenses, which should be handled through the company’s regular accounting systems.

- Assign responsibility for petty cash: Identify who is responsible for managing the petty cash fund, including the person who will hold the fund and track expenditures. This may be a designated employee or department such as the finance or accounting team.

- Set maximum petty cash limits: Establish a maximum amount that can be held in petty cash and set individual transaction limits. For example, the policy may specify that no single petty cash expenditure should exceed a certain dollar amount, such as $50.

- Replenishment procedures: Outline the procedures for replenishing the petty cash fund when it is running low. Specify how and when requests for replenishment should be made, and what documentation is required to verify expenditures.

- Record-keeping requirements: Specify how petty cash transactions should be documented, including keeping receipts for every transaction and logging the date, amount, purpose, and the person who received the funds. This ensures that all disbursements are tracked and accounted for.

- Establish reconciliation procedures: Implement regular reconciliation of the petty cash fund to ensure that the amount of cash on hand matches the recorded transactions. This can be done at set intervals, such as monthly or quarterly, and should include reviewing receipts and reconciling any discrepancies.

- Set guidelines for audits: Outline how audits will be conducted to verify the proper use of petty cash, including periodic checks of the petty cash fund by management or internal auditors. The policy should specify that the fund will be audited regularly to detect any irregularities.

- Provide clear consequences for misuse: Make it clear that any misuse or mishandling of petty cash, such as using the fund for unauthorized purposes or failing to document transactions properly, will result in disciplinary action.

Benefits of using this petty cash policy (Nebraska)

This policy provides several benefits for Nebraska businesses:

- Improves financial control: By establishing clear guidelines for handling petty cash, businesses can better track and control small expenditures, reducing the risk of fraud or mismanagement.

- Streamlines small transactions: Petty cash provides an efficient way to handle minor purchases quickly, without the need for a formal purchase order or invoice process, saving time for both employees and the accounting team.

- Enhances transparency and accountability: Proper documentation and regular reconciliation ensure that petty cash transactions are transparent and that employees are held accountable for their use of the funds.

- Minimizes financial risks: By setting limits on petty cash usage and implementing auditing procedures, businesses can reduce the likelihood of financial errors, theft, or misuse of company resources.

- Promotes fair and consistent usage: A clearly defined petty cash policy helps ensure that all employees are treated equally when requesting petty cash and that funds are used for legitimate business purposes.

Tips for using this petty cash policy (Nebraska)

- Communicate the policy clearly: Ensure that all employees involved in handling petty cash understand the policy and its requirements. The policy should be clearly communicated in employee handbooks or training materials.

- Designate a responsible person: Assign a specific individual or department to be in charge of the petty cash fund, ensuring that someone is accountable for managing and reconciling the fund regularly.

- Implement checks and balances: Periodically audit petty cash transactions to verify accuracy and prevent any misuse. Implement a second level of oversight for greater accountability, such as requiring another employee to verify the accuracy of receipts and logs.

- Encourage proper documentation: Remind employees that receipts are required for all petty cash transactions. Maintain a system to ensure receipts are collected and logged properly to support transparency.

- Review the fund regularly: Conduct regular reviews of the petty cash fund’s usage to ensure it is being managed according to the policy and that it aligns with company needs.