Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

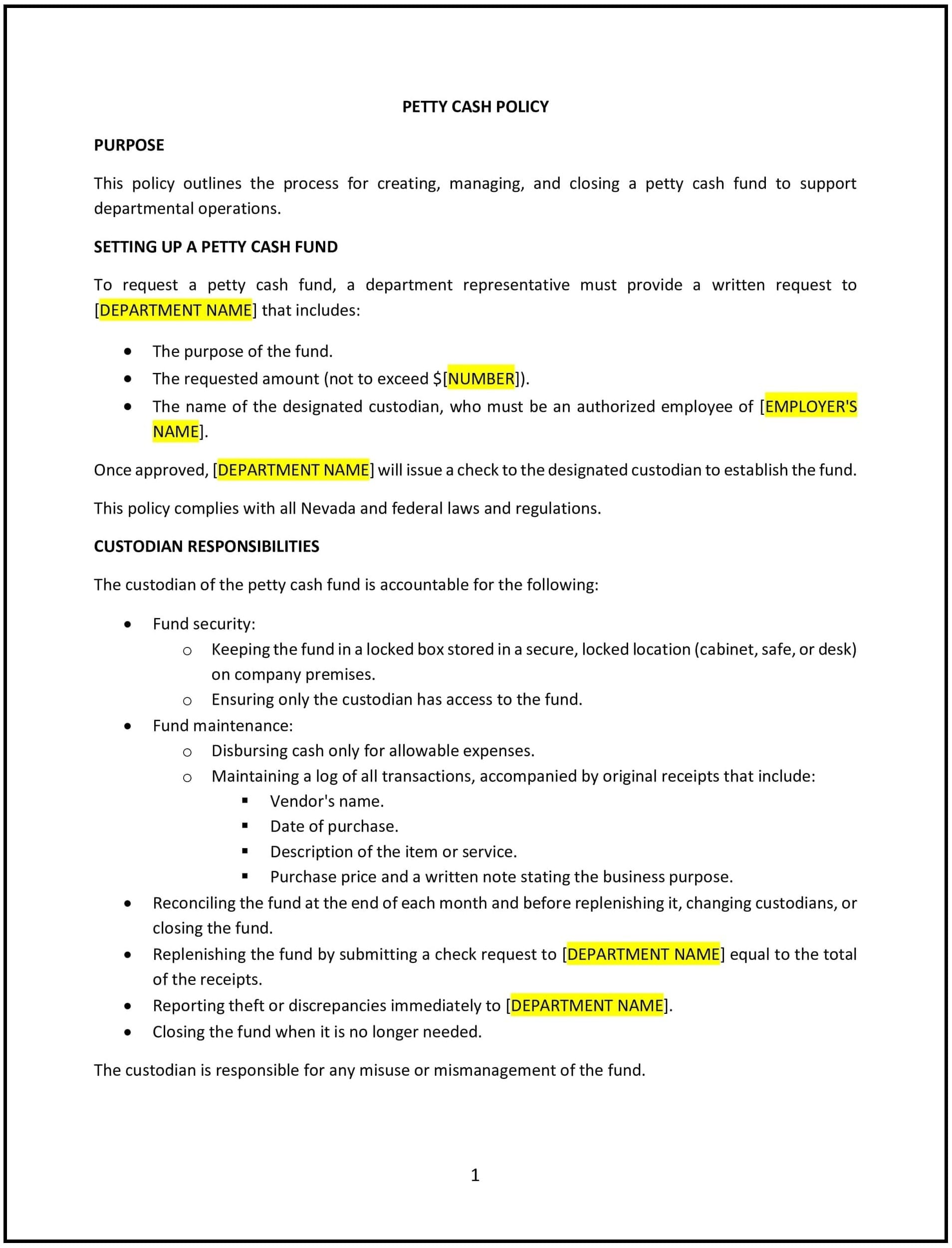

Petty cash policy (Nevada)

This petty cash policy is designed to help Nevada businesses establish clear guidelines for managing and using petty cash funds. It outlines procedures for disbursing, tracking, and replenishing petty cash to ensure proper usage, accountability, and compliance with financial regulations.

By adopting this policy, businesses can streamline petty cash management, prevent misuse, and maintain accurate financial records.

How to use this petty cash policy (Nevada)

- Define petty cash usage: Specify acceptable uses of petty cash, such as minor office expenses, emergency purchases, or small reimbursements, and outline prohibited uses.

- Set a cash limit: Establish a maximum amount of petty cash to be maintained in the fund and the maximum amount that can be disbursed per transaction.

- Assign custodians: Designate a responsible individual or team to oversee petty cash management, including distribution, record-keeping, and reconciliation.

- Require documentation: Mandate that all petty cash transactions be supported by receipts or other proof of purchase and recorded in a logbook.

- Reconcile regularly: Conduct regular reconciliations of the petty cash fund to ensure the recorded balance matches the actual cash on hand.

- Outline replenishment procedures: Specify how and when the petty cash fund should be replenished, including approval requirements and documentation.

- Enforce security measures: Include measures to secure petty cash, such as locking the cash box in a designated location and restricting access to authorized personnel.

- Address misuse and noncompliance: Establish consequences for misuse of petty cash funds, such as disciplinary action or repayment requirements.

Benefits of using this petty cash policy (Nevada)

This policy provides several benefits for Nevada businesses:

- Promotes accountability: Ensures that petty cash is used responsibly and transactions are properly documented.

- Prevents misuse: Establishes clear guidelines to minimize the risk of unauthorized or inappropriate spending.

- Improves financial tracking: Provides a structured approach to recording and reconciling petty cash transactions, enhancing accuracy.

- Simplifies operations: Streamlines the process for managing minor expenses and maintaining operational efficiency.

- Supports legal compliance: Aligns with Nevada financial regulations and best practices for cash management.

Tips for using this petty cash policy (Nevada)

- Communicate the policy: Share the policy with employees who may use or oversee petty cash, ensuring they understand its guidelines and restrictions.

- Train custodians: Provide training for designated petty cash custodians to ensure accurate management and reconciliation.

- Perform spot checks: Conduct unannounced spot checks of the petty cash fund to verify compliance with the policy.

- Limit fund access: Restrict access to petty cash to minimize the risk of theft or misuse.

- Update regularly: Review and revise the policy as needed to reflect changes in company practices or financial regulations.