Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

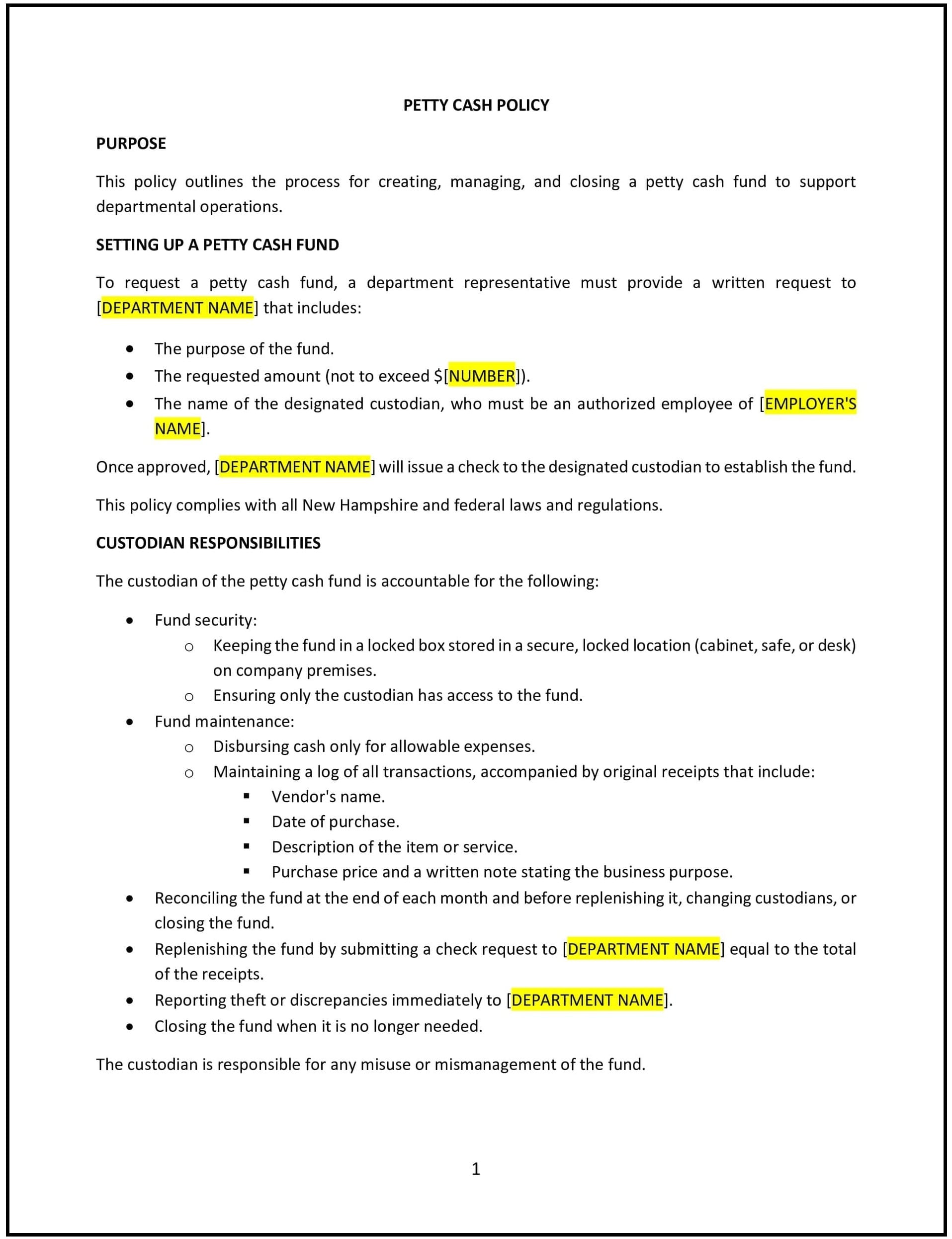

Petty cash policy (New Hampshire)

A petty cash policy helps New Hampshire businesses manage small, day-to-day cash expenses that are not appropriate for more formal payment methods like checks or credit cards. This policy defines the procedures for handling, tracking, and replenishing petty cash, ensuring that the funds are used appropriately and that accurate records are maintained.

By adopting this policy, businesses can streamline small financial transactions, improve cash flow management, and prevent misuse of company funds.

How to use this petty cash policy (New Hampshire)

- Define the purpose of petty cash: Specify the types of expenses that are appropriate for payment with petty cash, such as office supplies, minor repairs, or employee reimbursements for small purchases.

- Set a maximum limit: Establish a maximum dollar amount that can be maintained in the petty cash fund at any given time, as well as a limit for individual transactions. This helps control expenses and reduces the risk of fraud.

- Designate custodians: Appoint one or more employees as petty cash custodians responsible for managing and disbursing the funds, keeping records, and ensuring that petty cash is used appropriately.

- Outline request procedures: Define how employees can request petty cash, including the required documentation (e.g., receipts or forms), the process for approval, and the amount they can request.

- Establish record-keeping requirements: Require employees to record all transactions involving petty cash, including the amount disbursed, the purpose of the expenditure, and the recipient. Maintain these records for auditing purposes.

- Set replenishment procedures: Define the process for replenishing the petty cash fund when it runs low, including the documentation required and the frequency of replenishment.

- Address security: Establish measures to secure petty cash, such as locking the fund in a safe or drawer, limiting access to authorized personnel, and periodically auditing the fund.

- Review and update: Regularly review the petty cash policy to ensure it remains effective and in line with company practices, and update it as needed.

Benefits of using this petty cash policy (New Hampshire)

This policy offers several benefits for New Hampshire businesses:

- Streamlines small transactions: A petty cash policy simplifies minor financial transactions that would be cumbersome to process through formal payment methods like checks or wire transfers.

- Controls spending: Setting maximum amounts and requiring documentation for each expenditure helps businesses control petty cash use and ensures funds are spent responsibly.

- Reduces administrative burden: By clearly outlining the process for requesting and approving petty cash, the policy reduces the time spent on small financial transactions and ensures a smooth, efficient process.

- Enhances accountability: Designating custodians and tracking transactions ensures that petty cash is used appropriately and that there is accountability for the funds.

- Improves cash flow management: Properly managing petty cash ensures that the business has sufficient funds on hand for day-to-day operations while preventing overspending.

Tips for using this petty cash policy (New Hampshire)

- Communicate the policy clearly: Make sure all employees know how to request petty cash, the types of expenses that are allowed, and the documentation required for each transaction.

- Set clear guidelines for disbursement: Ensure employees understand the approval process for petty cash requests, including who is authorized to approve funds and how they can access the money.

- Regularly audit the petty cash fund: Periodically audit the petty cash fund to ensure that the records match the amount of cash available and that no discrepancies exist.

- Ensure adequate security: Keep petty cash locked in a secure location and limit access to authorized personnel to prevent misuse or theft.

- Maintain accurate records: Ensure that all petty cash transactions are documented accurately, with receipts or other proof of expenditure, for auditing and financial record-keeping.