Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

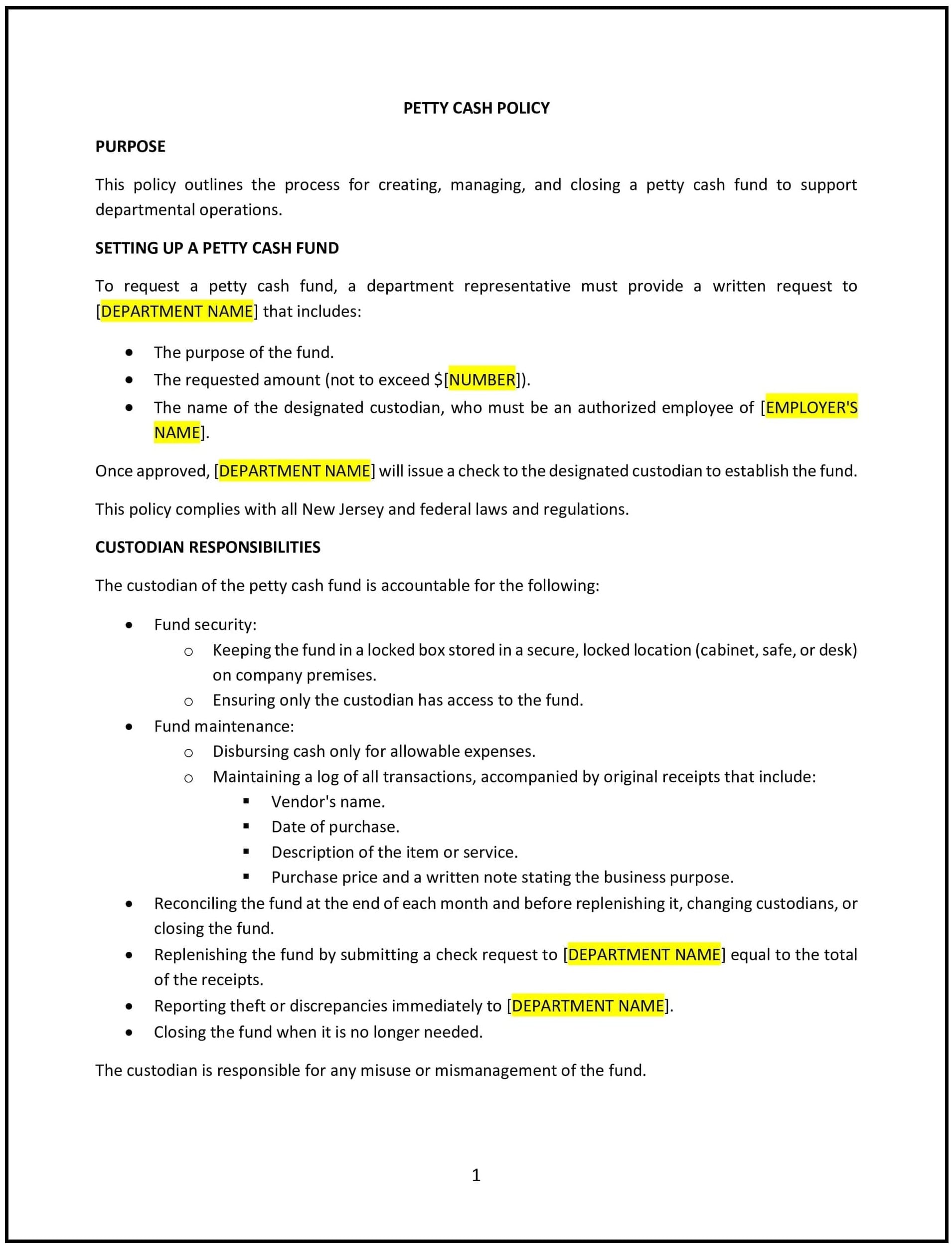

Petty cash policy (New Jersey)

A petty cash policy helps New Jersey businesses manage small, everyday expenditures that don’t require formal purchase orders or reimbursement procedures. This policy defines the process for handling petty cash, including how funds are requested, disbursed, and replenished, as well as how records are kept. It also sets guidelines for maintaining accountability and transparency in the use of petty cash.

By adopting this policy, businesses in New Jersey can ensure the proper handling of small cash transactions, improve financial control, and reduce the risk of misuse or fraud.

How to use this petty cash policy (New Jersey)

- Define the purpose of petty cash: Specify the types of small expenses that can be paid using petty cash, such as office supplies, postage, or minor operational costs.

- Set a petty cash fund limit: Establish a maximum amount of petty cash available at any given time and determine when the fund should be replenished.

- Outline access and control: Identify who is responsible for managing the petty cash fund and set limits on who can authorize withdrawals.

- Implement a record-keeping system: Require all petty cash disbursements to be documented with receipts and a brief description of the expense.

- Define replenishment procedures: Set guidelines for requesting and authorizing fund replenishment when the petty cash balance falls below a predetermined threshold.

- Establish regular audits: Conduct periodic audits of petty cash to ensure that funds are being used appropriately and in accordance with company policies.

- Address misuse or fraud: Set consequences for employees who misuse petty cash, including disciplinary actions or termination if warranted.

- Review and update: Regularly assess the policy to ensure it remains effective, aligns with business practices, and complies with New Jersey regulations.

Benefits of using this petty cash policy (New Jersey)

This policy provides several benefits for New Jersey businesses:

- Ensures financial accountability: Helps track small cash transactions and minimizes the risk of misuse.

- Streamlines small expense management: Reduces administrative burden for minor purchases and ensures they are handled efficiently.

- Improves transparency: Provides a clear structure for using and replenishing petty cash, reducing potential confusion.

- Reduces fraud risks: Limits access and requires documentation to ensure petty cash is used for authorized purposes only.

- Promotes financial control: Allows businesses to manage small expenditures without complicated reimbursement processes.

Tips for using this petty cash policy (New Jersey)

- Communicate the policy clearly: Ensure all employees understand when and how petty cash can be used and what expenses are eligible.

- Keep detailed records: Ensure that all petty cash transactions are documented with receipts and signed approval forms.

- Regularly audit petty cash: Perform routine checks to ensure funds are being used appropriately and that records are accurate.

- Limit access: Designate specific employees to manage the petty cash fund and ensure that no one individual has exclusive control.

- Review the policy regularly: Update the policy to reflect any changes in New Jersey regulations or business procedures.