Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

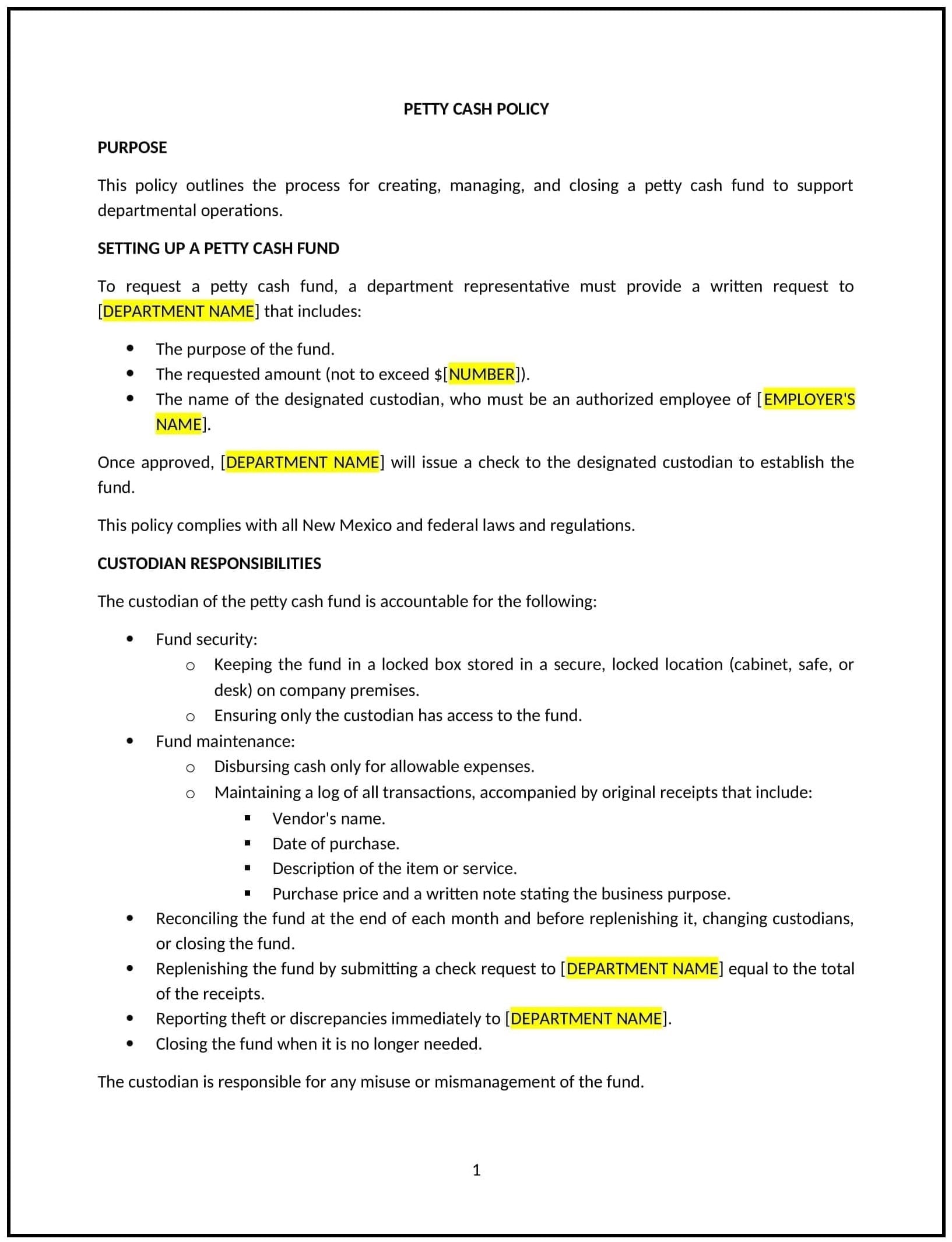

Petty cash policy (New Mexico)

This petty cash policy is designed to help New Mexico businesses manage small, incidental expenses that cannot be processed through the usual accounts payable procedures. The policy outlines how petty cash funds will be allocated, used, tracked, and replenished, ensuring that small cash transactions are handled efficiently and transparently.

By adopting this policy, New Mexico businesses can streamline the management of minor expenses, reduce the risk of fraud, and ensure that petty cash usage remains within the established guidelines.

How to use this petty cash policy (New Mexico)

- Define petty cash: Clearly outline what qualifies as petty cash expenses, including small office supplies, postage, or minor repairs that are necessary for day-to-day business operations.

- Set limits: Specify the maximum amount of petty cash that can be disbursed for any single transaction or within a given time period. This prevents misuse and ensures that petty cash is only used for appropriate expenses.

- Assign responsibility: Designate a person or team responsible for managing petty cash, keeping accurate records of transactions, and ensuring that all expenses are justified and within the scope of the policy.

- Track and document expenses: Establish a system for tracking petty cash expenses, such as requiring receipts or written explanations for every transaction. This ensures transparency and accountability.

- Reflect New Mexico-specific considerations: Address any state-specific rules related to cash handling, taxes, or reporting that might impact the management of petty cash in New Mexico.

Benefits of using this petty cash policy (New Mexico)

Implementing this policy provides New Mexico businesses with several advantages:

- Increases efficiency: Having a clearly defined petty cash process enables employees to quickly obtain funds for small expenses without waiting for formal approval, improving operational efficiency.

- Prevents misuse: Clear guidelines on how petty cash should be used help prevent fraudulent or inappropriate use of funds, protecting the company’s financial resources.

- Enhances accountability: By requiring documentation and tracking of petty cash transactions, businesses can ensure transparency and hold responsible parties accountable for managing funds properly.

- Supports employee satisfaction: By providing a convenient way for employees to pay for minor business expenses, businesses can improve employee satisfaction and reduce frustration when making small purchases.

- Simplifies financial reporting: A clear and consistent petty cash policy helps streamline financial reporting, making it easier to reconcile petty cash balances and ensure accurate bookkeeping.

Tips for using this petty cash policy (New Mexico)

- Communicate the policy clearly: Ensure that all employees understand the petty cash policy and how they can access funds for minor expenses. The policy should be included in the employee handbook and discussed during onboarding.

- Maintain detailed records: Ensure that all petty cash transactions are documented with receipts, a description of the expense, and the signature of the person requesting or approving the expenditure.

- Monitor petty cash usage: Regularly review petty cash expenses to ensure that funds are being used appropriately. Implement spot checks or audits to verify that all transactions align with the policy.

- Set up a replenishment system: Establish clear guidelines for when and how petty cash should be replenished, ensuring that the balance remains sufficient for day-to-day operations without exceeding the business’s financial limits.

- Review the policy regularly: Periodically review the petty cash policy to ensure that it remains aligned with business needs, New Mexico regulations, and best practices in cash management.