Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

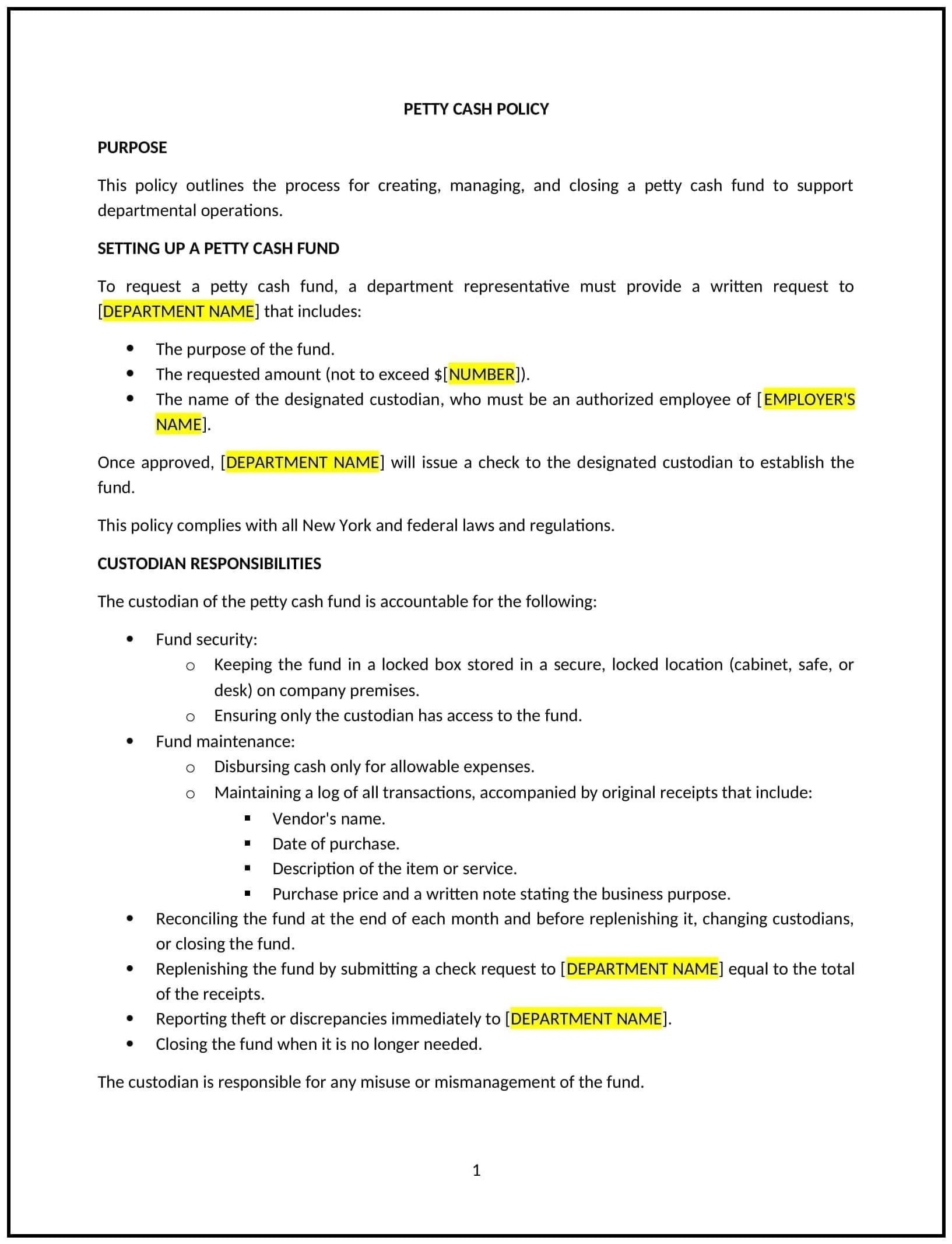

Petty cash policy (New York)

This petty cash policy is designed to help New York businesses establish clear guidelines for the use, management, and tracking of petty cash. Whether businesses are managing small, incidental expenses or handling cash disbursements, this template provides a structured approach to ensure proper control and transparency in petty cash transactions.

By adopting this template, businesses can minimize financial risks, maintain accurate records, and ensure responsible use of petty cash funds.

How to use this petty cash policy (New York)

- Define petty cash purpose: Clearly explain the purpose of petty cash, such as covering small, incidental expenses like office supplies, postage, or employee reimbursements.

- Set funding limits: Establish a maximum limit for petty cash funds to ensure they are used only for minor, everyday business expenses.

- Specify authorization procedures: Outline the approval process for accessing petty cash, including who can approve requests and how disbursements are authorized.

- Include record-keeping requirements: Detail the documentation needed for each petty cash transaction, such as receipts and transaction logs, to track expenses accurately.

- Define reimbursement process: Provide instructions on how petty cash is replenished and how employees should submit reimbursement requests for expenses that exceed petty cash limits.

Benefits of using a petty cash policy (New York)

This policy offers several benefits for New York businesses:

- Promotes accountability: Clear guidelines ensure that petty cash is used for its intended purpose and that all transactions are properly documented and tracked.

- Reduces fraud risks: By setting limits and requiring approval for cash disbursements, businesses can minimize the risk of misuse or theft.

- Improves financial control: A structured process for managing petty cash helps businesses keep track of small expenses without impacting larger financial systems.

- Enhances transparency: Maintaining accurate records of petty cash transactions promotes transparency and reduces the potential for misunderstandings or disputes.

- Streamlines processes: Having a clear policy in place reduces confusion and makes it easier to manage petty cash disbursements across the organization.

Tips for using this petty cash policy (New York)

- Communicate the policy: Ensure that all employees understand the rules regarding petty cash use, including the limits and approval processes.

- Assign responsibility: Designate a staff member or department responsible for managing petty cash funds, maintaining records, and ensuring compliance with the policy.

- Monitor usage: Regularly review petty cash transactions to ensure that funds are being used appropriately and in line with business needs.

- Use secure storage: Store petty cash in a secure, locked location to prevent unauthorized access and reduce the risk of theft.

- Review regularly: Update the policy as necessary to reflect changes in business operations, expenses, or New York state regulations.