Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

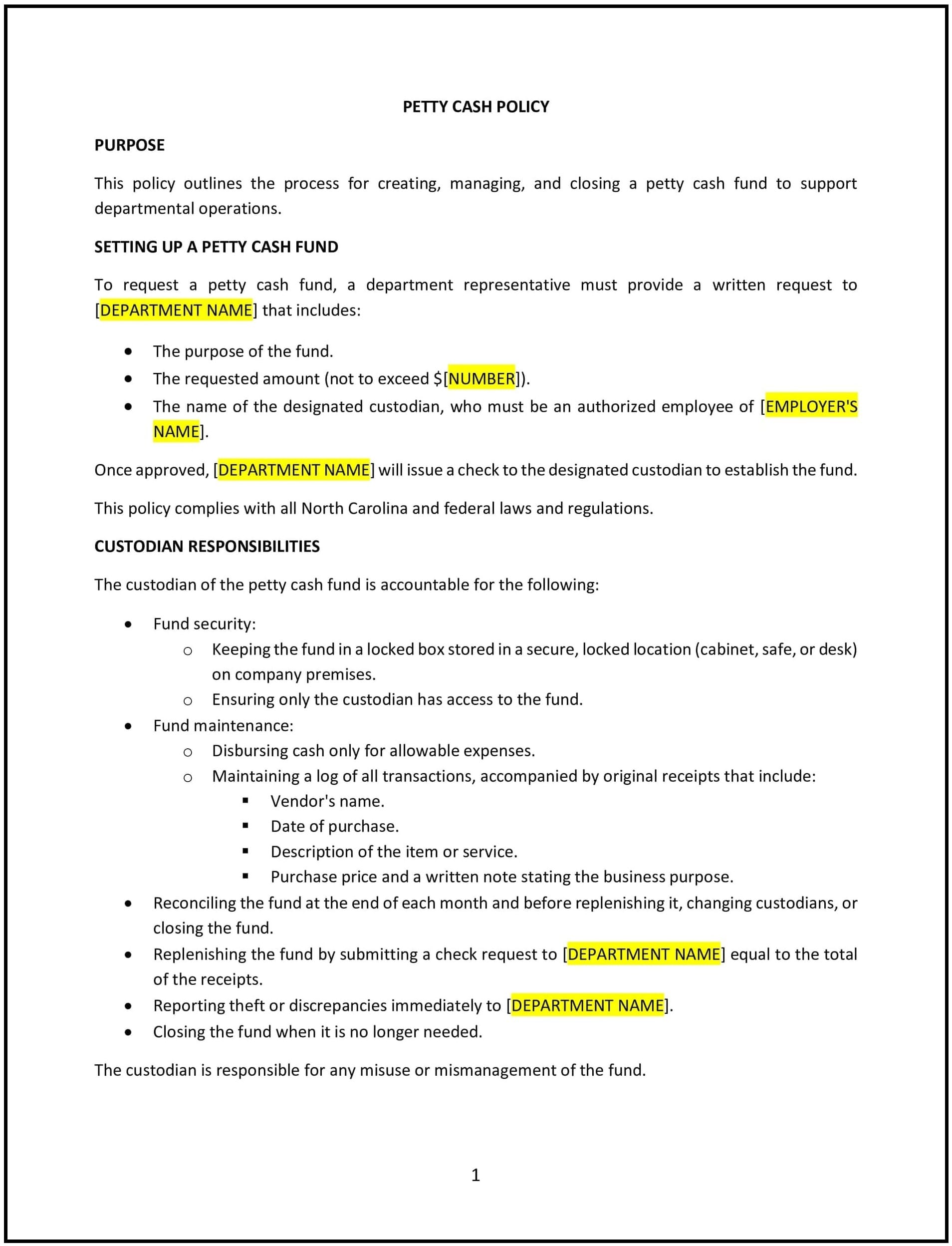

Petty cash policy (North Carolina)

A petty cash policy helps North Carolina businesses manage small, day-to-day expenses that do not require formal purchasing processes. This policy outlines the procedures for requesting, disbursing, and accounting for petty cash, ensuring that funds are used appropriately and that records are kept for transparency. It also addresses how petty cash funds are replenished and tracked.

By adopting this policy, businesses can streamline minor expense processes while maintaining control and accountability over company funds.

How to use this petty cash policy (North Carolina)

- Define petty cash usage: Clearly outline the types of expenses that can be paid from petty cash, such as office supplies, small reimbursements, or other minor operational costs.

- Set cash limits: Specify the maximum amount of petty cash that can be disbursed at any given time or that can be kept in the petty cash fund.

- Establish disbursement procedures: Define the steps employees must follow to request petty cash, including how to submit receipts and obtain approval for cash disbursements.

- Track petty cash usage: Require that employees keep detailed records of petty cash expenditures, including receipts and explanations for each transaction.

- Reflect North Carolina-specific considerations: Ensure the policy complies with North Carolina’s tax and accounting regulations for handling small-scale transactions.

Benefits of using this petty cash policy (North Carolina)

This policy provides several benefits for North Carolina businesses:

- Increases efficiency: By allowing for small purchases without the need for formal approval, businesses can expedite operational needs and reduce delays in procurement.

- Enhances accountability: Clear procedures for tracking petty cash expenditures help businesses maintain control over company funds and reduce the risk of misuse.

- Supports transparency: Keeping records of petty cash disbursements ensures transparency and accountability, making it easier to review expenditures when needed.

- Reduces administrative burden: Petty cash allows employees to handle small purchases directly, saving time on paperwork and formal procurement processes.

- Improves financial management: The policy helps businesses track minor expenditures and maintain accurate financial records.

Tips for using this petty cash policy (North Carolina)

- Communicate the policy clearly: Ensure employees understand how petty cash can be used, the request process, and the requirements for keeping receipts.

- Keep accurate records: Ensure that petty cash transactions are properly recorded and monitored to prevent misuse or accounting errors.

- Set up regular audits: Periodically audit petty cash funds to ensure that they are being used appropriately and that records are accurate.

- Review the policy regularly: The policy should be reviewed annually to ensure it aligns with North Carolina’s accounting regulations and business needs.