Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

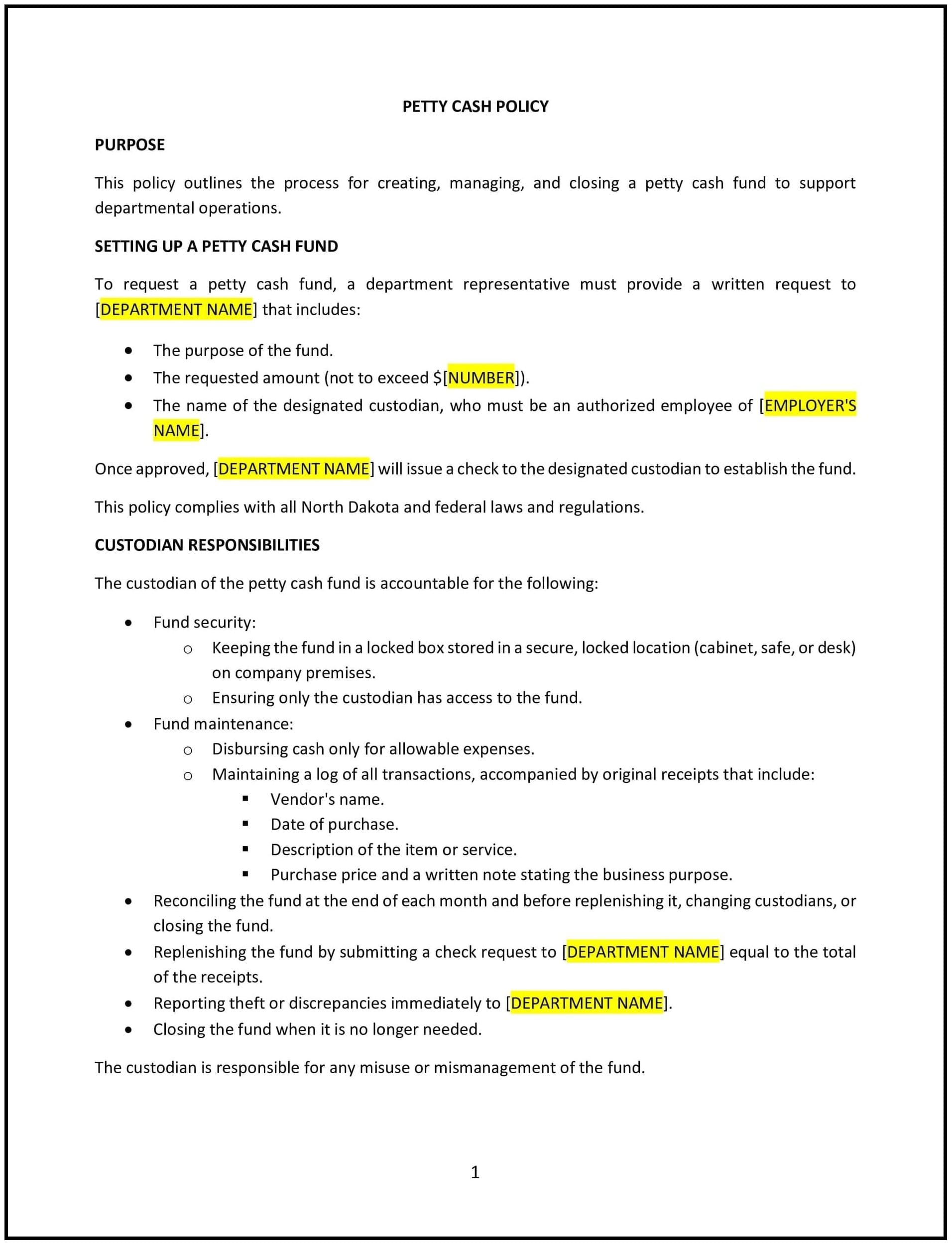

Petty cash policy (North Dakota)

This petty cash policy is designed to help North Dakota businesses establish guidelines for managing small, routine expenses using a petty cash fund. It outlines procedures for disbursing, replenishing, and reconciling petty cash while ensuring accountability and transparency.

By adopting this policy, businesses can streamline small expense management, reduce administrative burdens, and maintain financial control.

How to use this petty cash policy (North Dakota)

- Define petty cash: Clearly explain what petty cash is and its purpose, such as covering small office supplies, postage, or minor reimbursements.

- Establish fund limits: Specify the maximum amount of the petty cash fund and the maximum amount that can be disbursed per transaction.

- Outline disbursement procedures: Provide steps for requesting and approving petty cash disbursements, including required documentation.

- Address replenishment: Describe how the petty cash fund will be replenished, including submission of receipts and approval processes.

- Set reconciliation guidelines: Explain how the petty cash fund will be reconciled regularly to ensure accuracy and prevent misuse.

- Train employees: Educate staff on the policy and their responsibilities when using petty cash.

- Review and update: Assess the policy annually to ensure it aligns with evolving business needs and financial practices.

Benefits of using this petty cash policy (North Dakota)

This policy offers several advantages for North Dakota businesses:

- Streamlines expenses: Simplifies the process of managing small, routine expenses, reducing administrative burdens.

- Enhances accountability: Ensures proper documentation and approval for all petty cash transactions, preventing misuse.

- Improves transparency: Provides clear guidelines for employees on using petty cash, fostering trust and fairness.

- Reduces risks: Minimizes the likelihood of errors, fraud, or financial mismanagement.

- Builds trust: Demonstrates a commitment to responsible financial practices and accountability.

Tips for using this petty cash policy (North Dakota)

- Communicate clearly: Ensure all employees understand the policy and their responsibilities when using petty cash.

- Provide training: Educate employees on the procedures for requesting, documenting, and reconciling petty cash.

- Monitor usage: Regularly review petty cash transactions to ensure compliance with the policy and identify potential issues.

- Encourage documentation: Foster a culture where employees consistently provide receipts and documentation for petty cash disbursements.

- Update regularly: Review the policy annually to ensure it remains effective and aligned with business needs.