Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Petty cash policy (Ohio)

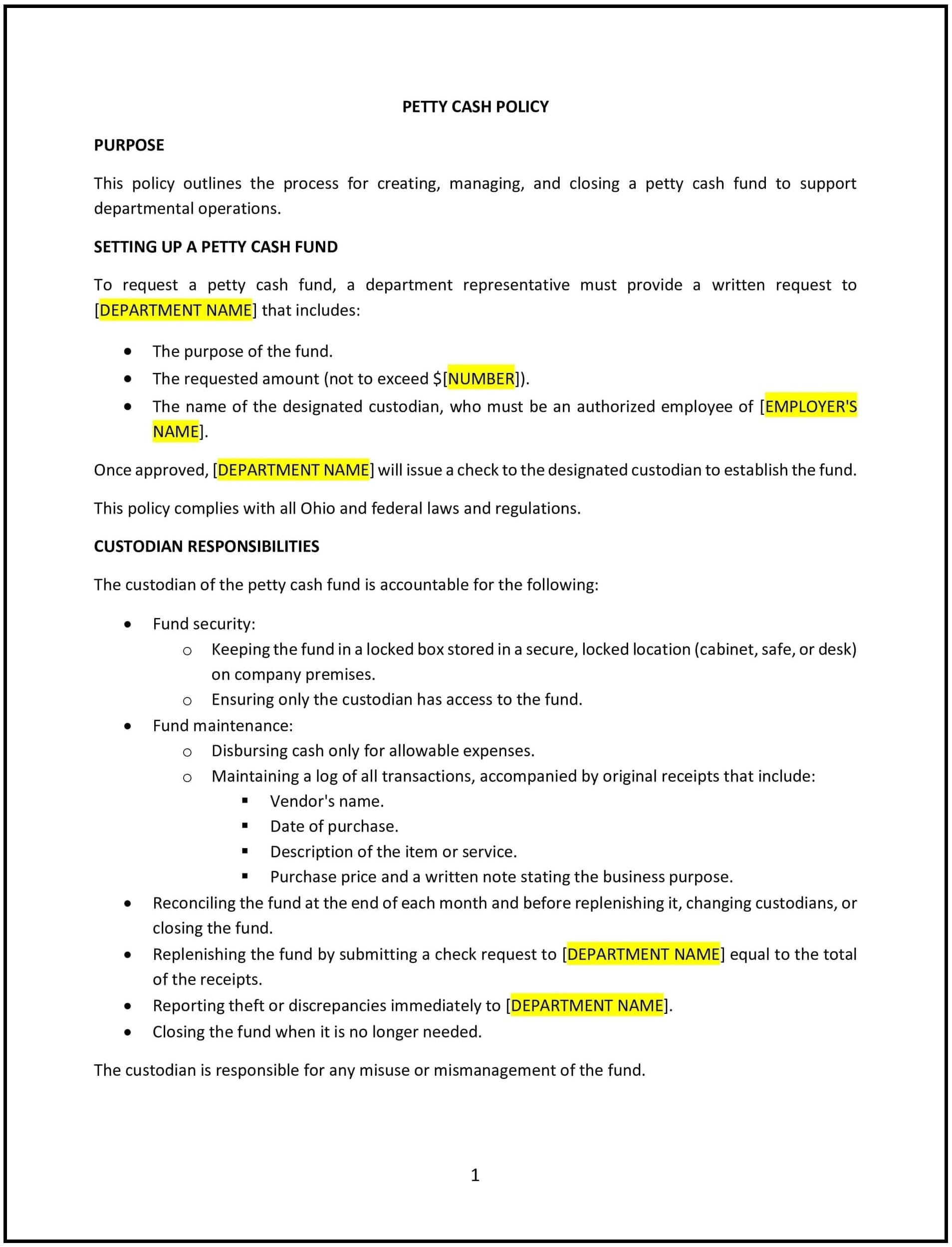

A petty cash policy provides Ohio businesses with guidelines for managing small cash transactions for minor business expenses that do not justify formal procurement processes. This policy outlines how petty cash is handled, who has access to it, how funds are replenished, and how transactions are documented. It also ensures that petty cash is used appropriately for legitimate business purposes, helping to maintain financial accountability and transparency.

By implementing this policy, Ohio businesses can effectively manage small expenses, reduce administrative overhead, and ensure that petty cash is handled with integrity and in compliance with business financial practices.

How to use this petty cash policy (Ohio)

- Define petty cash limits: The policy should specify the maximum amount of petty cash that can be kept on hand at any given time and the types of expenses that can be paid using petty cash. Common examples include office supplies, small repairs, or travel-related expenses for employees.

- Outline access control: The policy should specify who has access to the petty cash fund and the procedures for checking out and returning cash. Access should be limited to authorized personnel, and controls should be put in place to prevent misuse or theft.

- Set documentation requirements: The policy should outline how petty cash transactions must be documented, including the need for receipts or written records that show the date, amount, purpose, and the person making the transaction.

- Define replenishment procedures: The policy should specify how and when petty cash is replenished. This could include regular reconciliations of the petty cash fund to ensure that it is properly funded and accounts for all disbursements.

- Implement reconciliation processes: The policy should require periodic reconciliation of petty cash records to ensure accuracy and prevent discrepancies. The person responsible for managing petty cash should compare the records to the actual cash on hand and document any discrepancies.

- Address non-reimbursable expenses: The policy should clearly define what types of expenses are not eligible for payment from the petty cash fund, such as personal expenses or any expenditure that is not directly related to business operations.

- Review and update regularly: The policy should be reviewed periodically to ensure it remains aligned with Ohio state laws, federal regulations, and the business’s evolving financial practices.

Benefits of using this petty cash policy (Ohio)

This policy provides several key benefits for Ohio businesses:

- Streamlines small expense management: The petty cash policy simplifies the process for handling small business expenses, reducing the need for cumbersome formal procurement procedures for minor purchases.

- Increases financial transparency: Clear documentation and reconciliation procedures ensure that petty cash is handled transparently, with accurate records of all transactions.

- Reduces the risk of fraud: By limiting access to petty cash and requiring proper documentation for every transaction, the policy helps prevent misuse or fraudulent activities.

- Promotes accountability: Assigning responsibility for managing petty cash ensures that someone is accountable for the fund, helping to maintain financial discipline.

- Improves cash flow management: The policy ensures that petty cash funds are replenished regularly and are available when needed, contributing to smoother day-to-day operations.

- Enhances business controls: By clearly defining how petty cash should be used and documented, the policy establishes strong internal controls, reducing the risk of financial errors or irregularities.

- Maintains compliance: The policy ensures that petty cash practices comply with Ohio state laws, federal regulations, and the business’s internal financial policies.

Tips for using this petty cash policy (Ohio)

- Communicate the policy clearly: Ensure that all employees are aware of the petty cash policy by including it in the employee handbook, reviewing it during onboarding, and providing periodic reminders about proper cash handling procedures.

- Regularly reconcile petty cash: Perform regular reconciliations of the petty cash fund to ensure that it matches the recorded transactions and balances. This will help catch any discrepancies early and keep financial records accurate.

- Limit petty cash access: Restrict access to petty cash to designated employees only, ensuring that it is not mishandled or used for personal purposes.

- Train employees on proper use: Ensure that all employees who may need to use petty cash understand the policy, including what is eligible for petty cash usage, how to request cash, and the documentation required.

- Maintain secure storage: Store petty cash in a secure location, such as a locked drawer or safe, to prevent unauthorized access.

- Review the policy periodically: Regularly review the policy to ensure it remains aligned with Ohio state laws, federal regulations, and the evolving needs of the business.