Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

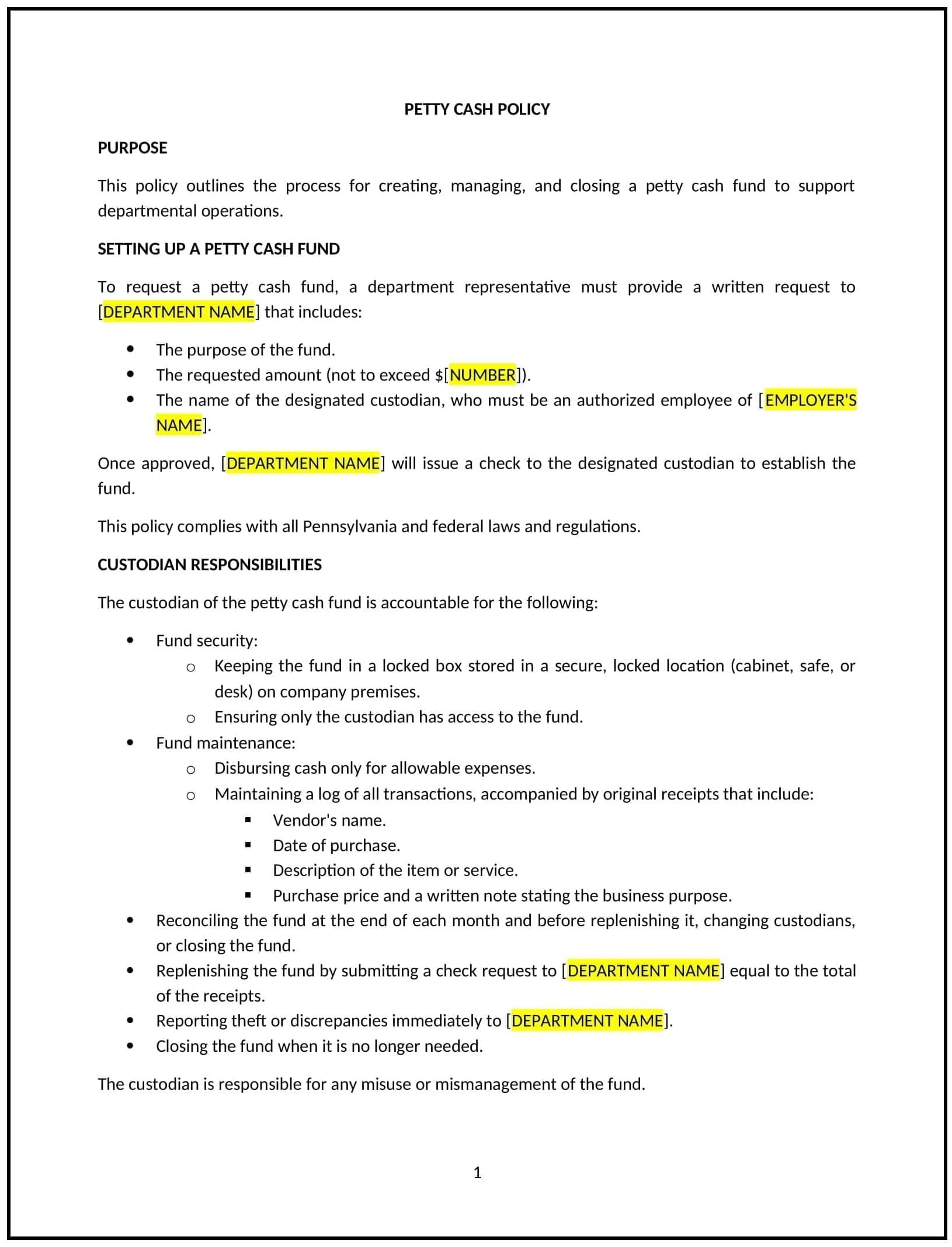

Petty cash policy (Pennsylvania)

This petty cash policy is designed to help businesses in Pennsylvania manage small cash transactions effectively and securely. By providing clear guidelines for the use, replenishment, and documentation of petty cash, this template ensures accountability and reduces the risk of misuse or errors.

By using this template, businesses can streamline cash handling practices, maintain accurate records, and align with Pennsylvania-specific financial regulations.

How to use this petty cash policy (Pennsylvania)

- Define petty cash use: Specify the types of expenses petty cash can be used for, such as office supplies, travel expenses, or minor repairs.

- Set spending limits: Clearly state the maximum amount that can be spent per transaction and the total amount maintained in the petty cash fund.

- Establish approval procedures: Detail the steps employees must follow to access petty cash, including obtaining approval from authorized personnel.

- Require documentation: Specify the need for receipts or vouchers to record petty cash transactions and maintain transparency.

- Reflect Pennsylvania-specific considerations: Tailor the policy to address local business practices or industry requirements, such as specific documentation for tax purposes.

Benefits of using a petty cash policy (Pennsylvania)

A well-structured petty cash policy supports financial accuracy and operational efficiency. Here's how it helps:

- Promotes accountability: Ensures all petty cash transactions are authorized and documented, reducing the risk of misuse.

- Improves transparency: Provides clear guidelines for accessing and using petty cash, minimizing disputes or confusion.

- Enhances record-keeping: Simplifies financial tracking and auditing by maintaining detailed petty cash records.

- Reduces errors: Establishes consistent procedures for handling petty cash, minimizing mistakes or discrepancies.

- Reflects local needs: Addresses Pennsylvania-specific financial practices or regulatory requirements for managing cash transactions.

Tips for using a petty cash policy (Pennsylvania)

- Communicate the policy: Share the policy with employees who may need access to petty cash and ensure they understand the procedures.

- Monitor usage: Regularly review petty cash transactions and reconcile the fund to ensure accuracy and compliance with the policy.

- Limit access: Restrict petty cash access to authorized personnel to reduce the risk of misuse or errors.

- Maintain documentation: Require receipts or vouchers for all petty cash transactions to ensure transparency and accountability.

- Review periodically: Update the policy to reflect changes in Pennsylvania business practices, tax laws, or operational needs.