Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

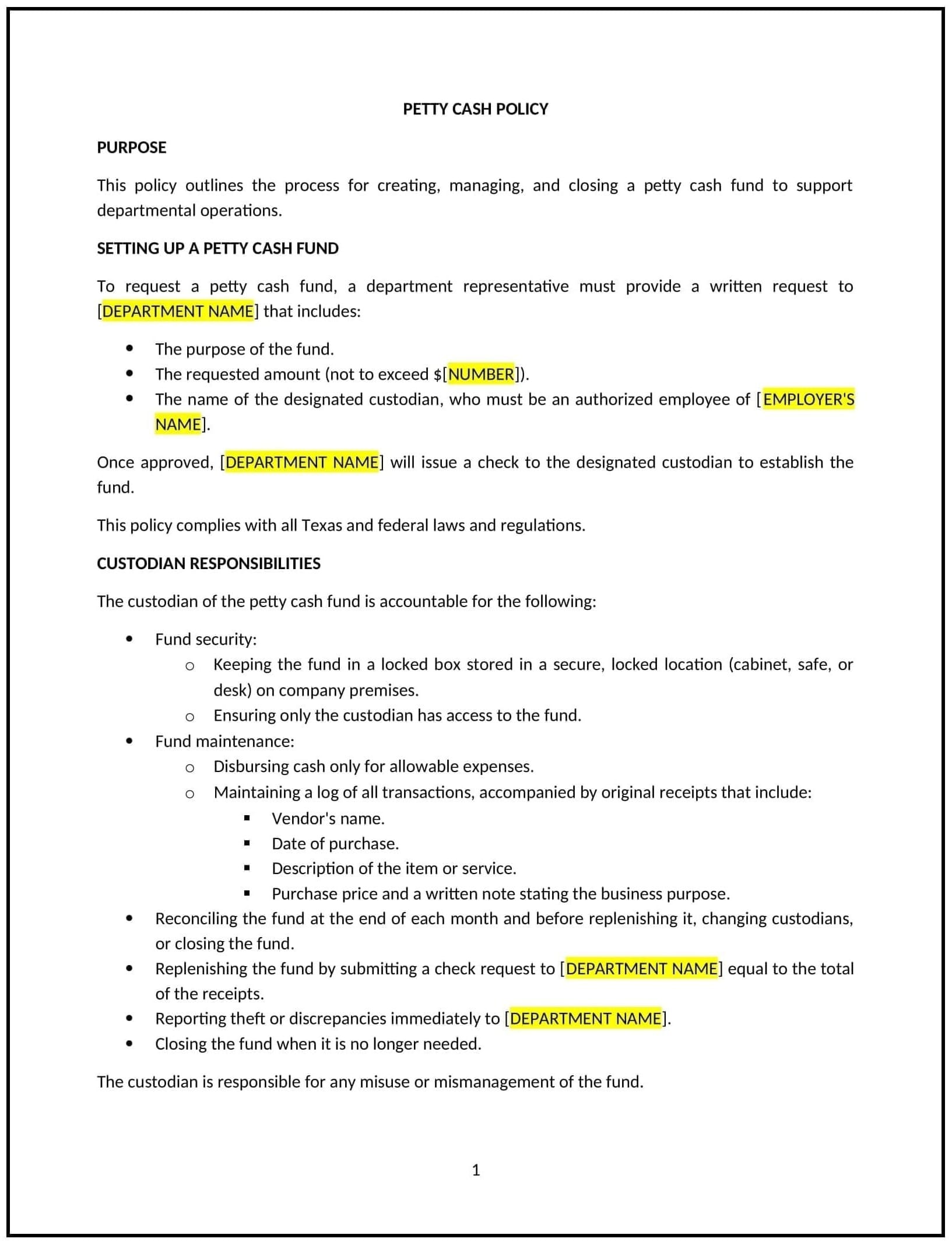

Petty cash policy (Texas)

This petty cash policy is designed to help Texas businesses manage and control the use of petty cash funds for small, incidental expenses that arise in the course of business operations. The policy outlines the procedures for requesting, disbursing, and accounting for petty cash, ensuring transparency, accountability, and compliance with company standards.

By adopting this policy, businesses can prevent misuse of petty cash, ensure accurate recordkeeping, and maintain control over small business expenditures.

How to use this petty cash policy (Texas)

- Define petty cash: Clearly define what constitutes petty cash expenses, including small purchases like office supplies, postage, or emergency purchases. Specify the types of expenses that can be covered using petty cash and any exclusions (e.g., large capital expenditures or employee reimbursements).

- Set petty cash limits: Establish the maximum amount of petty cash that can be held at any given time, and specify how much can be spent per transaction. This helps control spending and ensures that petty cash is used only for legitimate business needs.

- Establish approval procedures: Outline the approval process for petty cash disbursements, specifying who can approve requests for petty cash and the documentation required (e.g., receipts, written approval).

- Implement recordkeeping requirements: Specify how employees should document each petty cash transaction, including details like the date, amount, purpose of the expense, and who authorized it. The company should maintain a petty cash log to track all transactions.

- Set up reimbursement processes: Define the process for replenishing the petty cash fund, including the frequency of replenishment and the process for submitting reimbursement requests. Ensure that receipts and appropriate documentation are provided when requesting replenishment.

- Address accountability: Specify who is responsible for managing and overseeing the petty cash fund. This may include assigning a custodian to maintain the fund, count cash, and ensure that it is properly reconciled.

- Ensure security: Outline the steps taken to secure the petty cash fund, such as keeping it locked in a safe or a secure location. The policy should also address the consequences of mismanagement or misuse of the petty cash fund.

Benefits of using this petty cash policy (Texas)

This policy offers several benefits for Texas businesses:

- Promotes financial control: By setting clear guidelines and procedures for petty cash use, businesses can ensure that spending is controlled and monitored, preventing unauthorized or inappropriate expenses.

- Enhances accountability: Assigning responsibility for petty cash and requiring documentation of all transactions promotes accountability, ensuring that funds are used only for legitimate business purposes.

- Reduces the risk of fraud: A structured and transparent petty cash system helps minimize the risk of theft or fraud, as all transactions are recorded, approved, and tracked.

- Improves financial reporting: Proper documentation and recordkeeping provide a clear and accurate record of petty cash expenditures, which is helpful for accounting and financial reporting purposes.

- Streamlines small purchases: By maintaining a petty cash fund, businesses can quickly and efficiently handle small, day-to-day expenses without the need for formal purchase orders or complicated reimbursement processes.

Tips for using this petty cash policy (Texas)

- Communicate the policy clearly: Ensure that all employees who handle petty cash are aware of the policy and understand the procedures for using and accounting for the fund. This can be communicated through the employee handbook or during training sessions.

- Keep detailed records: Maintain a petty cash log that includes the date, amount, purpose of the expense, and receipts for all transactions. This helps track spending and provides transparency.

- Regularly reconcile the petty cash fund: Periodically count the petty cash on hand and reconcile it with the records to ensure that there are no discrepancies. This should be done by the designated custodian or an independent reviewer.

- Monitor petty cash usage: Regularly review the types of expenses covered by petty cash to ensure they are consistent with company policies. If necessary, adjust the petty cash limit or approval process to better align with business needs.

- Set a replenishment schedule: Establish a schedule for replenishing the petty cash fund, such as on a monthly basis, to ensure that the fund is always available for use when needed.