Petty cash policy (Vermont): Free template

Petty cash policy (Vermont)

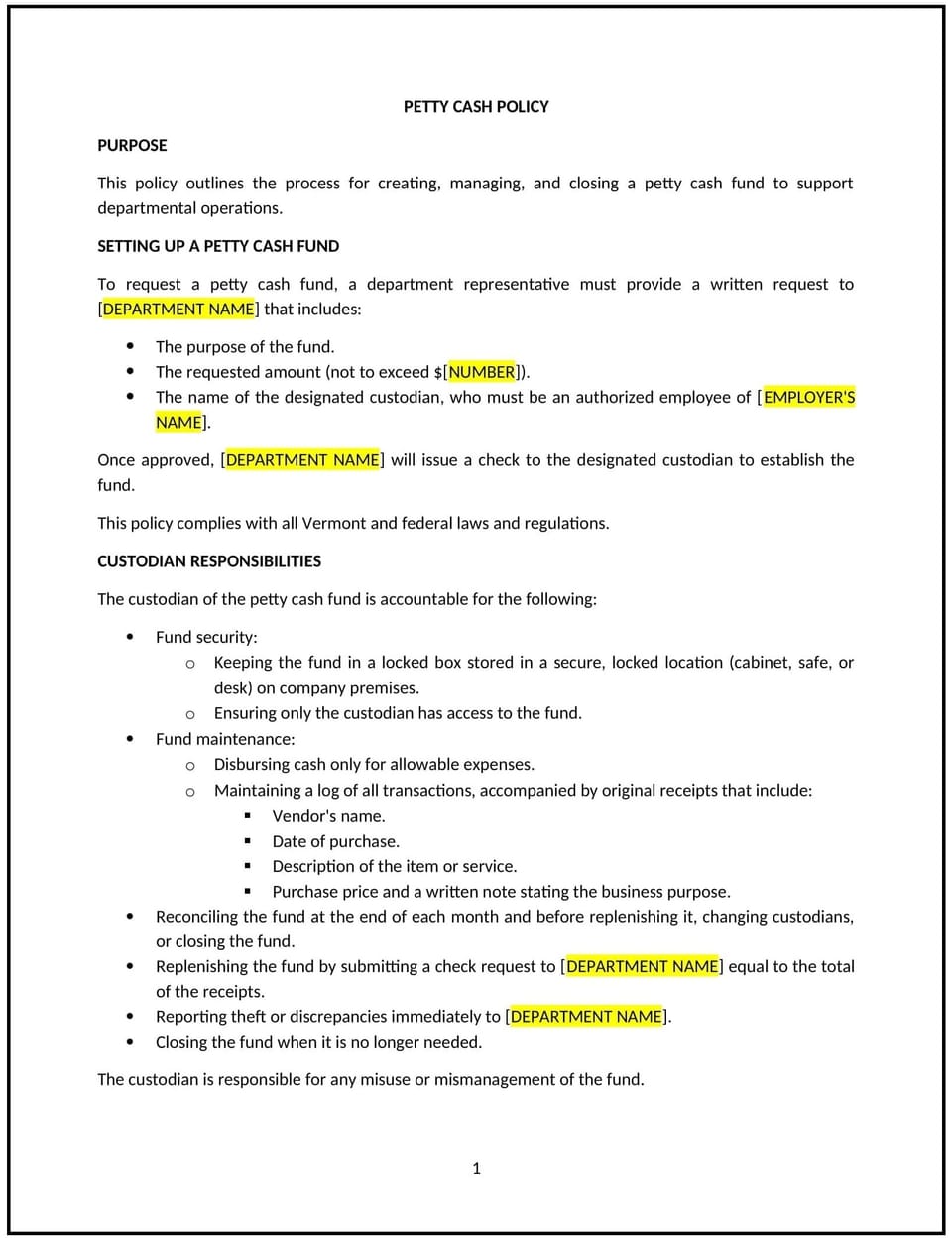

This petty cash policy is designed to help Vermont businesses manage small, day-to-day expenses through a controlled petty cash system. It outlines guidelines for the establishment, use, and reconciliation of petty cash funds, ensuring transparency, accountability, and compliance with Vermont laws and workplace practices.

By adopting this policy, businesses can simplify minor expense management while maintaining proper financial controls.

How to use this petty cash policy (Vermont)

- Define petty cash usage: Specify the types of expenses that can be paid through petty cash, such as office supplies, postage, or small repairs.

- Establish fund limits: Set a maximum amount for the petty cash fund and individual transactions to maintain control and accountability.

- Include disbursement procedures: Detail steps for requesting petty cash, including approval requirements and documentation of expenses.

- Outline reconciliation processes: Provide guidelines for reconciling the petty cash fund regularly, including reviewing receipts and replenishing funds as needed.

- Emphasize security: Require secure storage of petty cash, such as a locked box or safe, with limited access to authorized personnel.

- Assign accountability: Designate specific employees or roles responsible for managing, disbursing, and reconciling petty cash.

- Monitor compliance: Conduct periodic audits to ensure petty cash practices align with Vermont laws and company policies.

Benefits of using this petty cash policy (Vermont)

This policy provides several benefits for Vermont businesses:

- Simplifies expense management: Streamlines the handling of small, routine business expenses.

- Enhances accountability: Establishes clear procedures and responsibilities for petty cash usage.

- Promotes compliance: Aligns with Vermont financial regulations and workplace standards.

- Reduces risk: Minimizes misuse or mismanagement of petty cash funds through proper controls.

- Improves efficiency: Ensures small expenses are addressed promptly without requiring extensive approval processes.

Tips for using this petty cash policy (Vermont)

- Communicate the policy: Share the policy with employees involved in petty cash management and include it in the employee handbook or internal systems.

- Provide training: Educate employees on proper documentation, approval, and reconciliation procedures for petty cash.

- Maintain accurate records: Require detailed receipts and documentation for all petty cash transactions.

- Limit access: Restrict petty cash handling to a small number of trusted employees to ensure accountability.

- Update regularly: Revise the policy to reflect changes in Vermont laws, workplace practices, or financial requirements.

Q: What expenses are eligible for petty cash use?

A: Petty cash is typically used for small, immediate expenses such as office supplies, postage, or minor repairs, as specified in this policy.

Q: What is the maximum amount allowed for petty cash transactions?

A: The maximum transaction amount should be defined in the policy, often ranging between $25 and $100, depending on the business’s needs.

Q: How should petty cash disbursements be documented?

A: All petty cash disbursements must be accompanied by receipts, a description of the expense, and the approval of an authorized employee.

Q: Who is responsible for managing the petty cash fund?

A: A designated custodian, such as a finance or administrative employee, is responsible for managing, disbursing, and reconciling the petty cash fund.

Q: How often should petty cash funds be reconciled?

A: Petty cash should be reconciled regularly, such as weekly or monthly, to ensure accuracy and accountability.

Q: What security measures should be in place for petty cash?

A: Petty cash should be stored in a locked box or safe, with access limited to authorized personnel only.

Q: How often should this policy be reviewed?

A: This policy should be reviewed annually or whenever significant changes occur in Vermont laws or financial practices.

Q: Can petty cash be used for personal expenses?

A: No, petty cash is strictly for business-related expenses and any misuse may result in disciplinary action.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.