Petty cash policy (Virginia): Free template

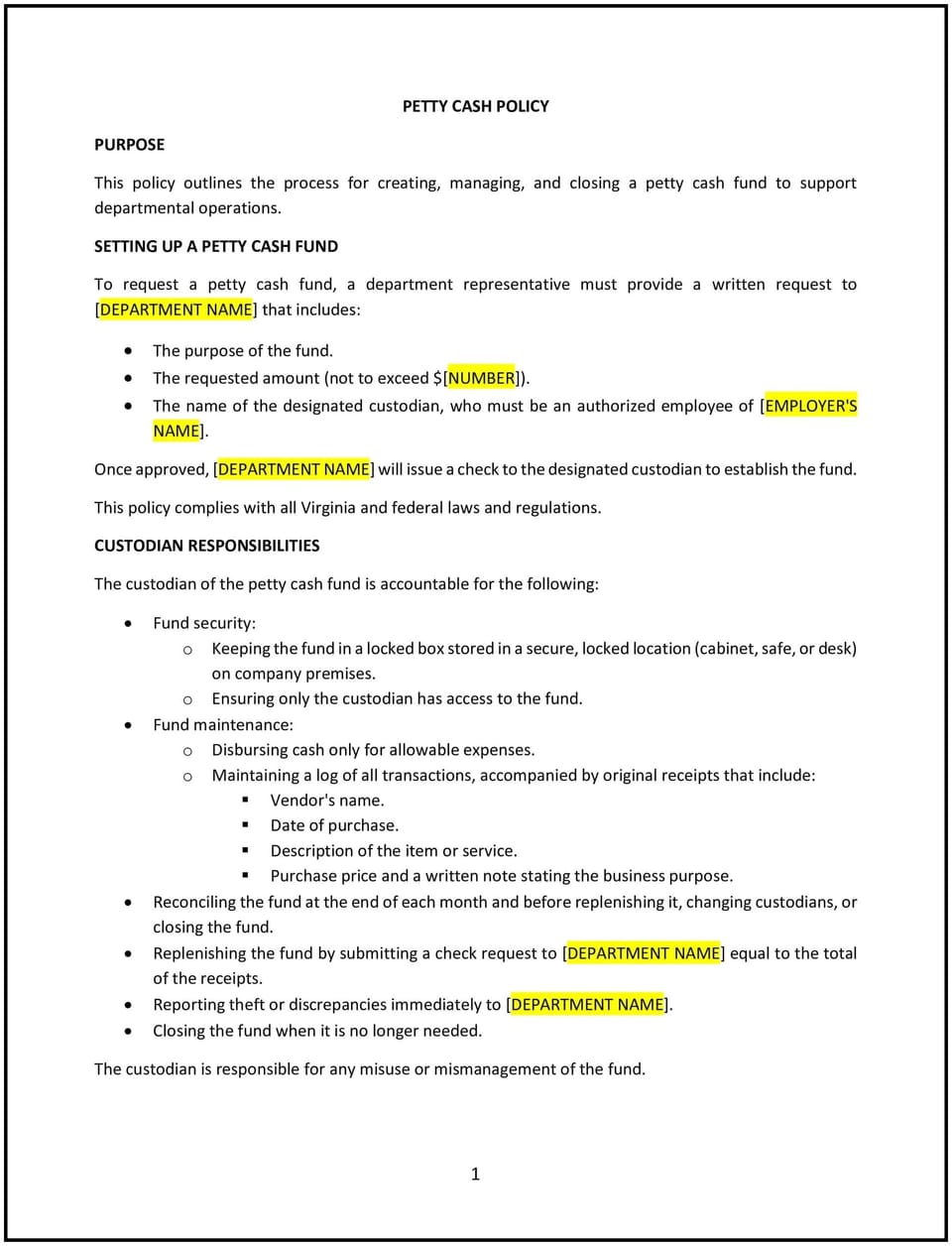

This petty cash policy is designed to help Virginia businesses manage and control petty cash funds used for minor, everyday business expenses. The policy outlines the procedures for handling, documenting, and replenishing petty cash to ensure that funds are used responsibly and transparently. The policy also sets limits on the types of expenditures that can be covered by petty cash and defines the process for tracking, reporting, and auditing these expenses.

By adopting this policy, businesses can ensure efficient handling of small expenses while maintaining accountability and preventing misuse of company funds.

How to use this petty cash policy (Virginia)

- Define the purpose of petty cash: The policy should clearly define the purpose of petty cash, which is generally used for small, routine business expenses that cannot be easily processed through regular accounts payable channels. These can include office supplies, postage, or small employee reimbursements.

- Set a limit for petty cash funds: The policy should specify the maximum amount of petty cash that can be held at any given time. This amount should be sufficient to cover small expenses but not excessive. Establishing a limit helps control the fund and prevent misuse.

- Designate responsible individuals: The policy should designate one or more employees responsible for managing the petty cash fund. These employees should be responsible for issuing funds, keeping records, and reconciling the fund regularly.

- Establish procedures for fund replenishment: The policy should outline the process for replenishing petty cash, including how employees can request funds and what documentation is required (e.g., receipts, expense forms). The replenishment process should be clearly defined and monitored.

- Track petty cash transactions: The policy should require that all petty cash transactions are documented and tracked. This may include maintaining a log of expenses, keeping receipts, and submitting expense reports to ensure transparency and accountability.

- Address acceptable expenses: The policy should clearly define the types of expenses that are eligible to be paid from petty cash, such as office supplies, parking fees, or small reimbursements for work-related expenses. It should specify any prohibited expenses.

- Establish auditing and reconciliation procedures: The policy should specify how often petty cash should be audited and reconciled to ensure that the amount on hand matches the recorded transactions. Regular audits can help identify discrepancies or potential misuse of funds.

- Promote compliance with Virginia state and federal laws: The policy should ensure that it complies with relevant Virginia state and federal regulations, including tax reporting requirements for business expenses and employee reimbursements.

- Review and update regularly: Periodically review and update the policy to ensure it is compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this petty cash policy (Virginia)

This policy offers several benefits for Virginia businesses:

- Promotes financial accountability: By documenting and tracking petty cash transactions, businesses can ensure that funds are used for legitimate business expenses, reducing the risk of misuse or fraud.

- Simplifies expense management: The policy makes it easy to handle small, routine expenses without having to go through a lengthy accounts payable process, increasing operational efficiency.

- Improves transparency: By requiring documentation and audits of petty cash funds, the policy ensures that all transactions are transparent and properly accounted for, making it easier to identify any discrepancies.

- Reduces legal and financial risks: A clear and well-implemented petty cash policy helps businesses stay compliant with tax and financial regulations, reducing the risk of penalties or legal issues.

- Enhances employee trust: When employees know there are clear rules for managing petty cash, they can trust that the funds are being used responsibly, contributing to a positive work environment.

- Increases operational efficiency: With a structured petty cash system, businesses can address small, urgent expenses quickly without disrupting regular accounting processes.

Tips for using this petty cash policy (Virginia)

- Communicate the policy clearly: Ensure that all employees who handle petty cash understand the policy, including how to request funds, document expenses, and follow the proper procedures. Include the policy in the employee handbook and provide training as needed.

- Maintain accurate records: Ensure that all petty cash transactions are recorded accurately, including receipts and expense forms. Regularly audit and reconcile the petty cash fund to ensure the amounts match the documented expenses.

- Monitor spending: Keep track of petty cash usage to ensure that the fund is not being depleted too quickly and that it is only being used for authorized expenses.

- Implement security measures: Store petty cash in a secure location, such as a locked drawer or safe, to prevent unauthorized access. Limit access to the fund to only those employees who are authorized to manage or request petty cash.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

Q: Who is responsible for managing the petty cash fund?

A: The policy designates one or more employees to manage the petty cash fund. These individuals are responsible for issuing funds, maintaining records, and reconciling the fund regularly.

Q: What types of expenses can be paid from petty cash?

A: Petty cash can be used for small, routine business expenses such as office supplies, postage, parking fees, or minor employee reimbursements. The policy outlines acceptable and prohibited expenses.

Q: How do employees request petty cash?

A: Employees must submit a request for petty cash using the process outlined in the policy, which may include submitting a request form or providing receipts for expenses that have already been incurred.

Q: How often should the petty cash fund be reconciled?

A: The policy specifies how often the petty cash fund should be reconciled, typically on a monthly or quarterly basis, to ensure that the amount on hand matches the documented expenses and receipts.

Q: What happens if there is a discrepancy in the petty cash fund?

A: If a discrepancy is identified during the reconciliation process, the policy requires an investigation to determine the cause. Employees responsible for the fund may be required to provide additional documentation or correct any errors.

Q: How often should this policy be reviewed?

A: The policy should be reviewed periodically, at least annually, to ensure it is compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.