Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

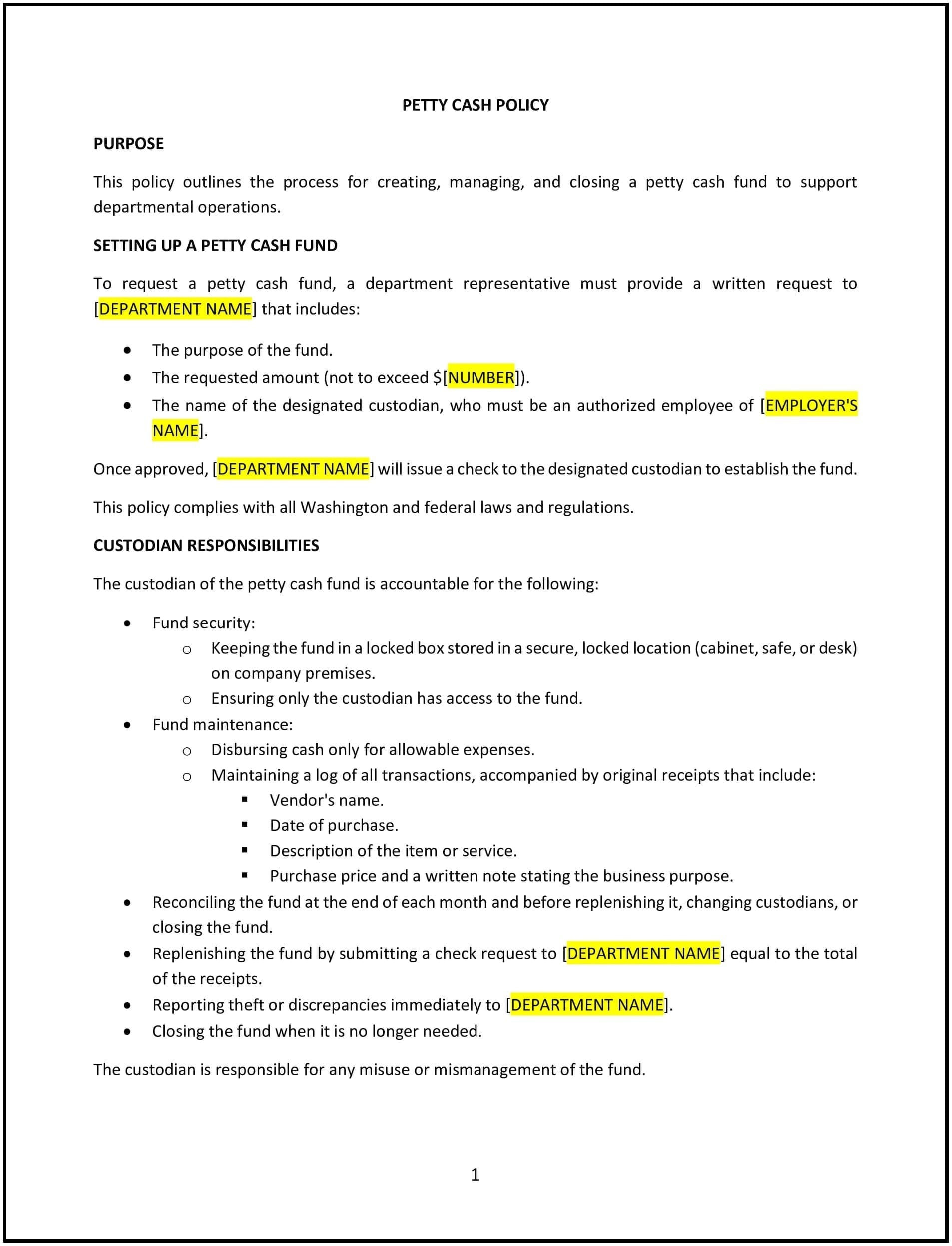

This petty cash policy is designed to help Washington businesses manage petty cash funds in a secure, transparent, and compliant manner. The policy outlines the procedures for requesting, using, and tracking petty cash, as well as how to replenish the fund. It ensures that petty cash is used appropriately and in line with company policies, reducing the risk of misuse or errors.

By adopting this policy, businesses can streamline the handling of small, routine expenses while ensuring accountability and maintaining compliance with Washington state laws.

How to use this petty cash policy (Washington)

- Define the purpose of petty cash: The policy should specify the purpose for which petty cash can be used, such as for minor office supplies, emergency repairs, or other small, incidental expenses. The policy should clarify that petty cash should not be used for larger or non-urgent expenses.

- Set the petty cash limit: The policy should establish a limit for the amount of petty cash that can be maintained and issued. This limit should be reasonable and based on the company’s operational needs. The policy should also outline the process for requesting additional funds if the limit is reached.

- Establish procedures for accessing petty cash: The policy should explain how employees can request petty cash, including the approval process and any documentation required (such as receipts or expense forms). The policy should also outline who is authorized to access and disburse petty cash.

- Implement tracking and documentation: The policy should require that all petty cash transactions be documented with receipts or invoices. A log should be maintained to track each withdrawal, including the date, amount, purpose of the expense, and the employee requesting the funds.

- Set procedures for replenishing the fund: The policy should outline how the petty cash fund will be replenished when the balance is low. It should specify how often petty cash should be reconciled, who is responsible for the reconciliation, and the process for requesting and processing replenishments.

- Address the security of the fund: The policy should specify how the petty cash fund will be secured, such as by keeping it locked in a safe or cash box. The policy should also designate one or more employees responsible for managing and safeguarding the fund.

- Ensure compliance with Washington and federal laws: The policy should ensure that the management of petty cash complies with Washington state laws and any applicable federal regulations related to financial recordkeeping, tax reporting, and accountability.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this petty cash policy (Washington)

This policy offers several benefits for Washington businesses:

- Ensures transparency and accountability: The policy ensures that all petty cash transactions are documented, tracked, and approved, reducing the risk of misuse or unauthorized spending.

- Streamlines expense management: By providing clear guidelines for accessing and using petty cash, the policy simplifies the process for employees and reduces confusion or delays in handling small expenses.

- Promotes financial control: The policy helps businesses maintain control over small, routine expenses by setting limits and requiring proper documentation, making it easier to track company spending.

- Reduces the risk of fraud: The policy’s emphasis on documentation and secure storage of petty cash reduces the opportunity for fraud or theft, helping to protect the company’s financial assets.

- Complies with legal requirements: The policy helps achieve compliance with Washington state laws and federal regulations regarding financial recordkeeping, minimizing the risk of legal issues or penalties related to petty cash management.

- Enhances trust and clarity: A well-defined petty cash policy promotes fairness and consistency in how funds are allocated, which enhances trust among employees and improves overall business operations.

Tips for using this petty cash policy (Washington)

- Communicate the policy clearly: Ensure that all employees are aware of the petty cash policy and understand the process for requesting and using petty cash. Include the policy in the employee handbook, review it during onboarding, and provide periodic reminders.

- Keep accurate records: Ensure that all petty cash transactions are properly documented with receipts and logged into a centralized tracking system. Regularly check the logs to ensure that all expenses are accounted for.

- Monitor petty cash use: Periodically review petty cash transactions to ensure that the funds are being used for legitimate business expenses and that the fund is properly reconciled. Take corrective action if any discrepancies are found.

- Implement strong security practices: Ensure that the petty cash fund is stored securely and that only authorized personnel have access to it. Use lockable cash boxes or safes to safeguard the funds.

- Reconcile regularly: Reconcile the petty cash fund at regular intervals (e.g., monthly) to ensure that the amount on hand matches the documented expenses. The reconciliation process should be conducted by an employee who is not responsible for disbursing petty cash.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s operations. Regular updates will help keep the policy relevant and effective.