Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

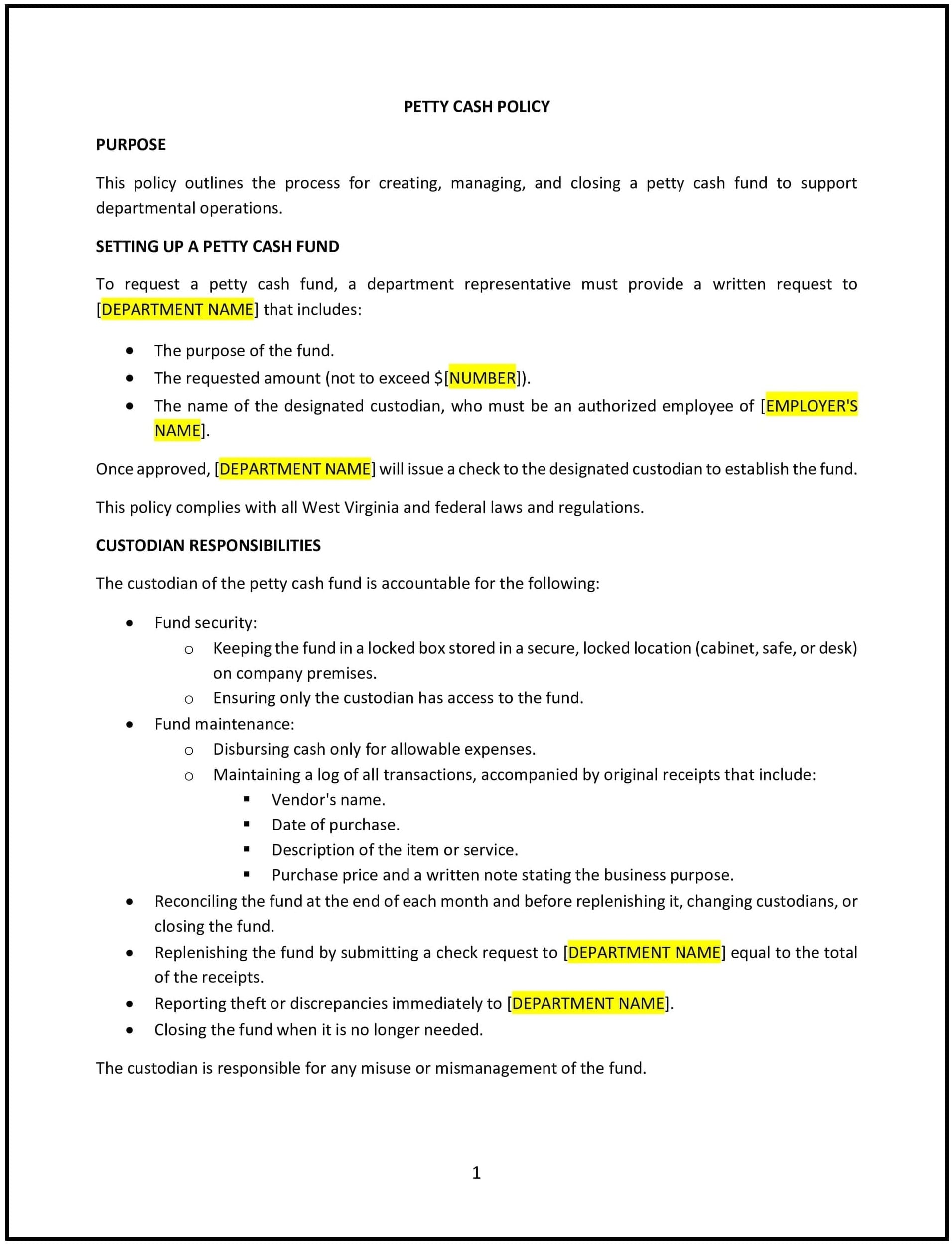

Petty cash policy (West Virginia)

In West Virginia, a petty cash policy outlines guidelines for managing small cash transactions within an organization. This policy ensures accountability, proper recordkeeping, and compliance with financial management standards. It establishes procedures for disbursing, replenishing, and monitoring petty cash funds while preventing misuse or errors.

The policy defines allowable expenses, approval processes, and responsibilities for employees handling petty cash.

How to use this petty cash policy (West Virginia)

- Define allowable expenses: Clearly specify the types of expenses that can be paid from petty cash, such as minor office supplies, small reimbursements, or incidental expenses.

- Set cash limits: Establish a maximum amount for individual transactions and the total petty cash fund to ensure proper control over expenditures.

- Outline disbursement procedures: Detail the steps for requesting petty cash, including approval requirements and documentation, such as receipts or vouchers.

- Establish replenishment protocols: Provide guidelines for replenishing the petty cash fund, including frequency and required records for reconciliation.

- Support compliance: Align the policy with West Virginia laws and financial regulations to ensure lawful and transparent cash management.

Benefits of using a petty cash policy (West Virginia)

- Enhances accountability: Ensures employees handling petty cash follow clear guidelines and maintain accurate records.

- Reduces misuse: Establishes controls to prevent unauthorized or inappropriate use of petty cash funds.

- Promotes transparency: Provides a clear framework for managing small cash transactions, reducing misunderstandings or disputes.

- Improves efficiency: Streamlines the process for handling minor expenses, reducing administrative burdens.

- Supports compliance: Aligns with West Virginia financial regulations and accounting standards to maintain proper oversight.

Tips for using a petty cash policy (West Virginia)

- Train employees: Provide training on petty cash procedures, including allowable expenses, documentation, and approval requirements.

- Maintain records: Keep detailed records of all petty cash transactions, including receipts, vouchers, and reconciliation reports.

- Conduct regular audits: Periodically review petty cash usage and records to ensure compliance with the policy and identify any discrepancies.

- Limit access: Designate specific employees to manage and access the petty cash fund to enhance control and accountability.

- Review periodically: Update the policy to reflect changes in West Virginia laws, financial practices, or organizational needs.