Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

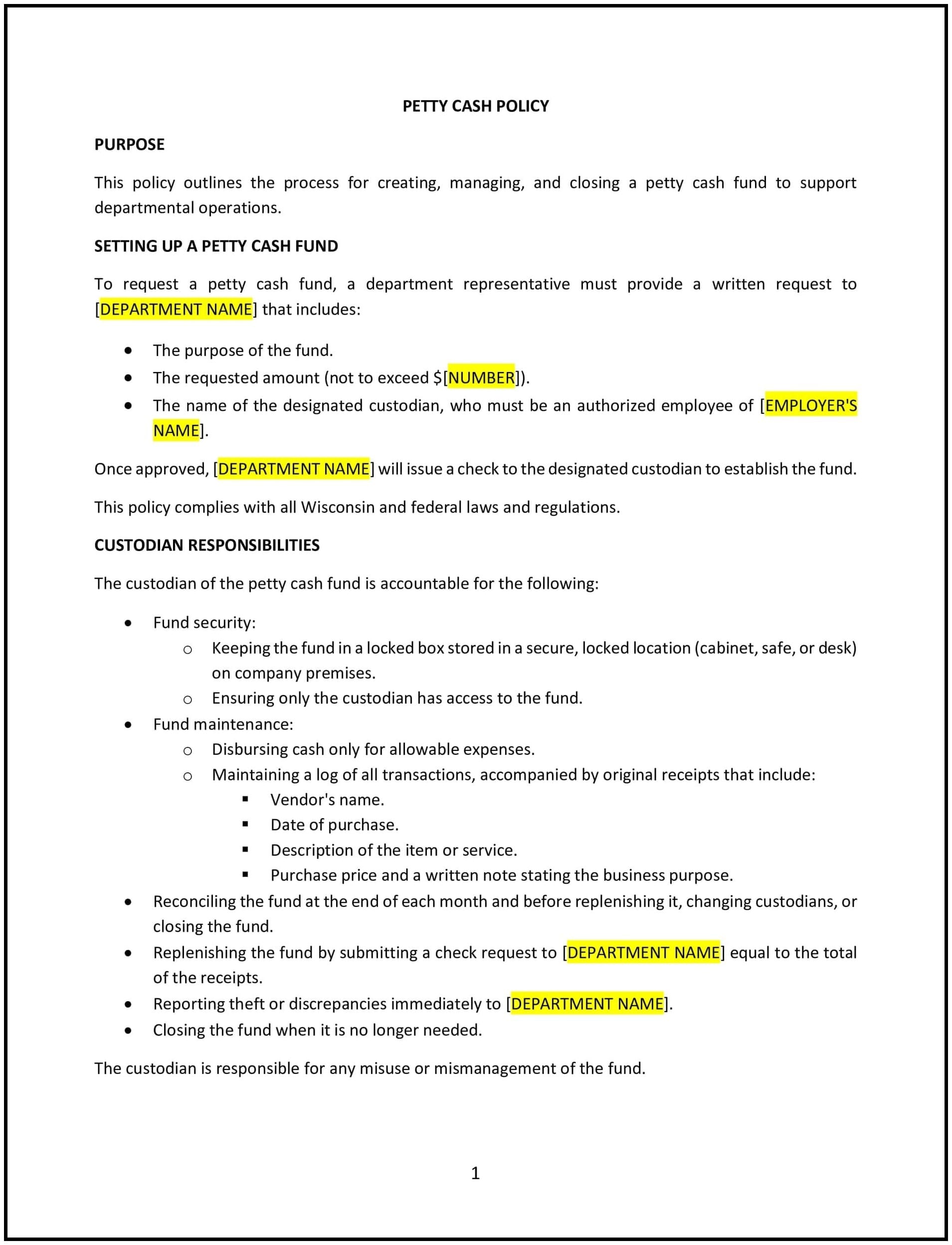

Petty cash policy (Wisconsin)

A petty cash policy helps Wisconsin businesses manage small, day-to-day expenses by establishing guidelines for the use, replenishment, and oversight of petty cash funds. This policy ensures that petty cash is used appropriately for business-related expenses and is properly accounted for to prevent misuse or fraud.

By implementing this policy, businesses can maintain financial control, streamline minor expense management, and ensure compliance with company accounting standards.

How to use this petty cash policy (Wisconsin)

- Define petty cash: Clearly specify what constitutes petty cash and the types of expenses it is meant to cover, such as small office supplies, transportation costs, or employee reimbursements.

- Set cash limits: Establish a maximum amount for the petty cash fund to prevent excessive funds from being kept on hand and to maintain financial control.

- Assign fund custodians: Designate an individual or team responsible for managing the petty cash fund, including overseeing disbursements, maintaining records, and ensuring security.

- Outline disbursement procedures: Provide guidelines for how petty cash requests are made, how funds are disbursed, and any necessary documentation (e.g., receipts, invoices) required for transactions.

- Require replenishment: Set a procedure for replenishing the petty cash fund once it reaches a specified minimum level, ensuring that records are kept up-to-date and that the fund is always sufficient for anticipated needs.

- Monitor usage: Regularly audit and reconcile the petty cash fund to ensure that all disbursements are legitimate, documented, and within the defined guidelines.

- Address unauthorized use: Outline consequences for unauthorized use of petty cash, such as disciplinary action or reimbursement for improper expenses.

Benefits of using this petty cash policy (Wisconsin)

This policy offers several benefits for Wisconsin businesses:

- Enhances financial control: By setting clear limits and procedures for using petty cash, the business can better manage minor expenses and avoid misuse of funds.

- Ensures accountability: Designating a custodian and requiring documentation for all transactions ensures transparency and accountability in managing petty cash.

- Reduces fraud risk: Establishing strict controls and monitoring mechanisms minimizes the risk of fraudulent use of petty cash.

- Improves efficiency: A clearly defined process for petty cash transactions streamlines the handling of small expenses, ensuring timely and efficient reimbursement.

- Supports compliance: Helps businesses adhere to accounting standards and legal requirements for managing company funds and expenses.

Tips for using this petty cash policy (Wisconsin)

- Communicate the policy clearly: Ensure that all employees understand the guidelines for requesting and using petty cash, as well as the importance of maintaining accurate records.

- Keep accurate records: Require documentation for every petty cash disbursement, including receipts, invoices, and the purpose of the expense.

- Conduct regular audits: Perform periodic reconciliations and audits of the petty cash fund to ensure that all disbursements are legitimate and properly documented.

- Train employees and fund custodians: Educate employees responsible for managing petty cash on the policy's procedures and how to handle transactions appropriately.

- Update the policy as needed: Revise the policy periodically to reflect changes in business needs, financial practices, or compliance requirements.