Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

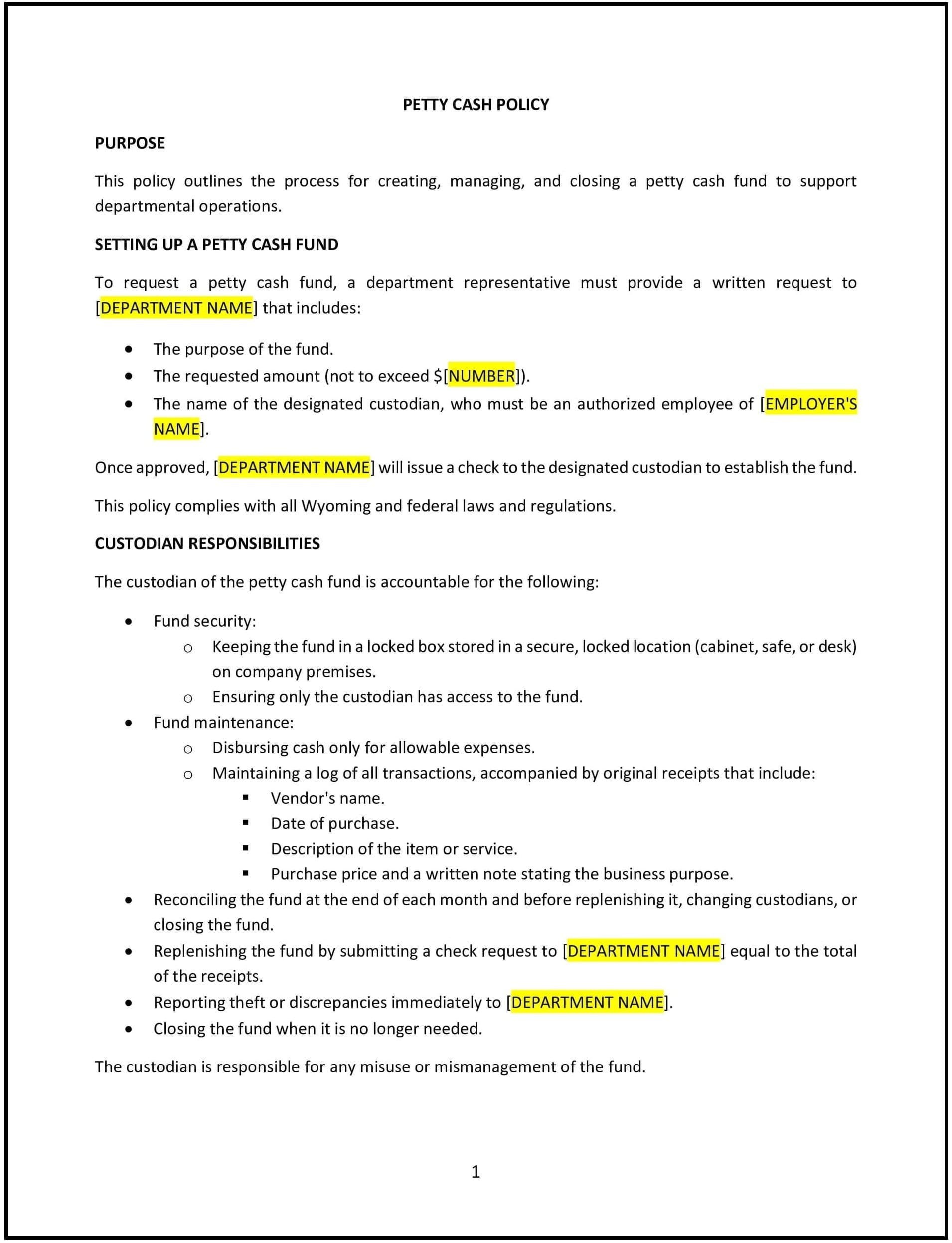

Petty cash policy (Wyoming)

In Wyoming, a petty cash policy provides guidelines for managing small cash funds used for minor business expenses. This policy ensures proper oversight, accountability, and promotes compliance with financial regulations while streamlining reimbursement for small expenditures.

This policy outlines procedures for establishing, maintaining, and reconciling petty cash funds, promoting transparency and efficiency in financial management.

How to use this petty cash policy (Wyoming)

- Define petty cash usage: Clearly specify acceptable uses for petty cash, such as purchasing office supplies or covering minor travel expenses.

- Set fund limits: Establish a maximum limit for petty cash funds and individual transactions to prevent misuse.

- Designate custodians: Assign responsibility for managing petty cash to a designated employee or team, such as an office manager or finance staff.

- Outline documentation requirements: Require receipts or detailed records for all petty cash transactions, ensuring accountability.

- Establish reconciliation procedures: Include steps for regularly reconciling petty cash funds, such as reviewing receipts, verifying balances, and replenishing funds.

Benefits of using a petty cash policy (Wyoming)

A petty cash policy provides several advantages for Wyoming businesses:

- Promotes accountability: Ensures all petty cash transactions are documented and authorized, reducing the risk of misuse.

- Improves efficiency: Streamlines reimbursement for minor expenses, reducing administrative burdens.

- Supports compliance: Aligns with financial regulations and auditing standards, minimizing the risk of errors or disputes.

- Enhances transparency: Provides clear guidelines for managing petty cash, fostering trust among employees and stakeholders.

- Adapts to local needs: Reflects Wyoming’s unique business environment and operational requirements.

Tips for using a petty cash policy (Wyoming)

- Train custodians: Provide training on proper petty cash management practices, including recordkeeping and reconciliation.

- Monitor usage: Conduct periodic audits to ensure petty cash is being used appropriately and funds are accounted for.

- Limit access: Restrict access to petty cash to authorized personnel to enhance security.

- Communicate expectations: Share the policy with employees and provide examples of acceptable and unacceptable uses of petty cash.

- Review periodically: Update the policy to reflect changes in financial practices, regulations, or organizational needs.