Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

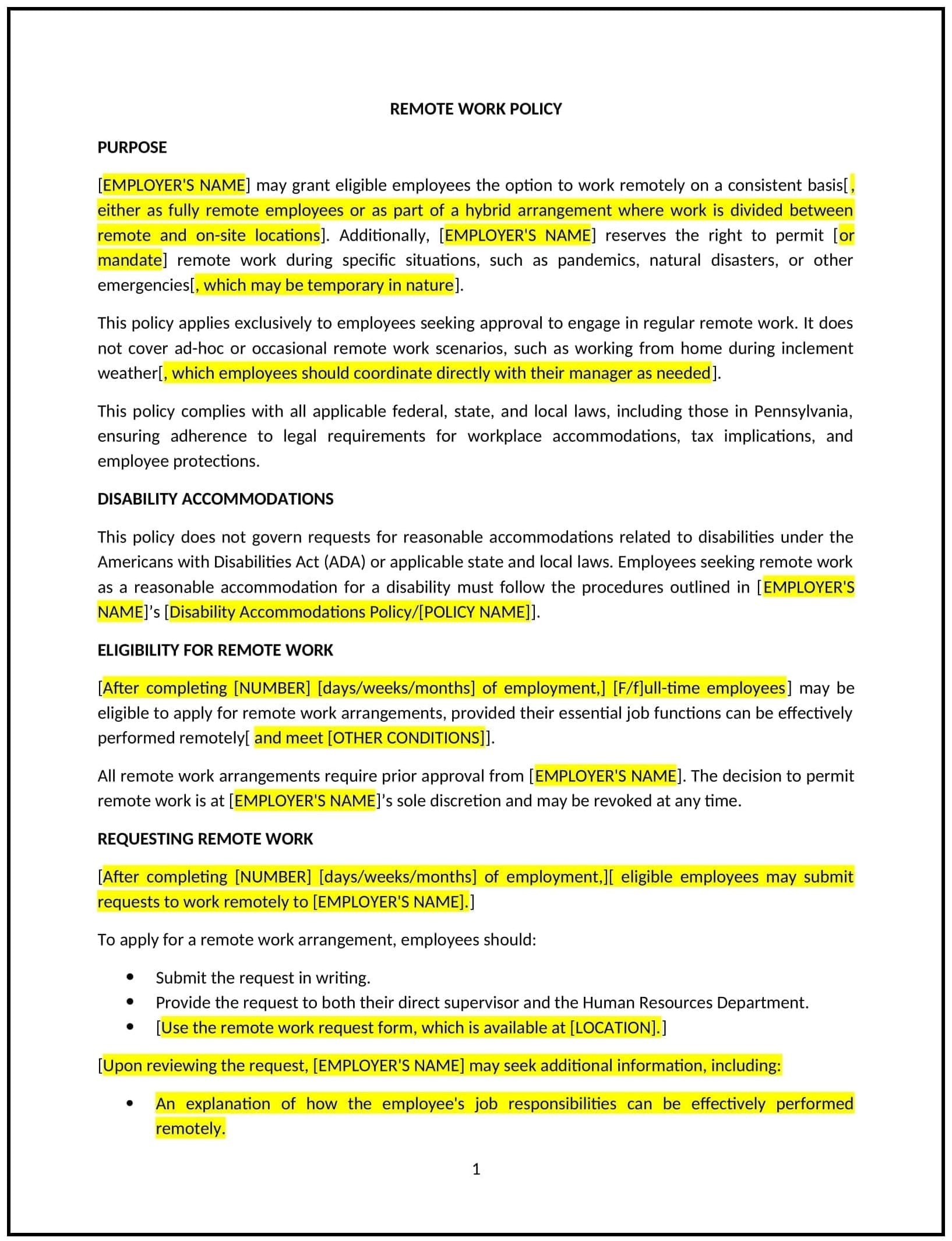

Remote work policy (Pennsylvania)

This remote work policy is designed to help businesses in Pennsylvania establish clear guidelines for employees working from home or other remote locations. By addressing eligibility, expectations, and technology requirements, this template ensures productivity and accountability while supporting employee flexibility.

By using this template, businesses can enhance operational efficiency, reduce overhead costs, and adapt to Pennsylvania's evolving workforce needs.

How to use this remote work policy (Pennsylvania)

- Define eligibility: Clearly specify which roles or employees are eligible for remote work, considering job responsibilities and business needs.

- Outline expectations: Provide guidelines for work hours, availability, communication, and productivity standards for remote employees.

- Address technology requirements: Include details about the equipment and software employees must use, such as laptops, VPNs, or collaboration tools.

- Set security measures: Specify protocols for safeguarding company data, such as password protection, secure Wi-Fi usage, and regular updates.

- Reflect Pennsylvania-specific considerations: Tailor the policy to address local tax laws, such as municipal taxes, or other regional regulations affecting remote work.

Benefits of using a remote work policy (Pennsylvania)

A well-structured remote work policy supports flexibility and operational efficiency. Here's how it helps:

- Enhances flexibility: Allows employees to work from locations that best suit their needs, improving work-life balance.

- Boosts productivity: Establishes clear expectations and standards to maintain employee performance and accountability.

- Supports compliance: Aligns with Pennsylvania labor laws and tax regulations, minimizing legal risks.

- Reduces overhead: Decreases costs associated with office space, utilities, and other onsite resources.

- Reflects local needs: Considers Pennsylvania-specific workforce trends and regulatory requirements for remote work arrangements.

Tips for using a remote work policy (Pennsylvania)

- Communicate the policy: Share the policy with employees and managers to ensure everyone understands the guidelines and expectations for remote work.

- Provide training: Equip employees with the tools and knowledge to work effectively and securely from remote locations.

- Monitor performance: Use regular check-ins and performance metrics to ensure remote employees meet their goals and stay connected with the team.

- Address tax considerations: Review Pennsylvania-specific tax implications for remote workers, such as local income tax requirements.

- Review periodically: Update the policy to reflect changes in Pennsylvania laws, workplace technology, or business needs.