Third-party agents policy (Michigan): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Third-party agents policy (Michigan)

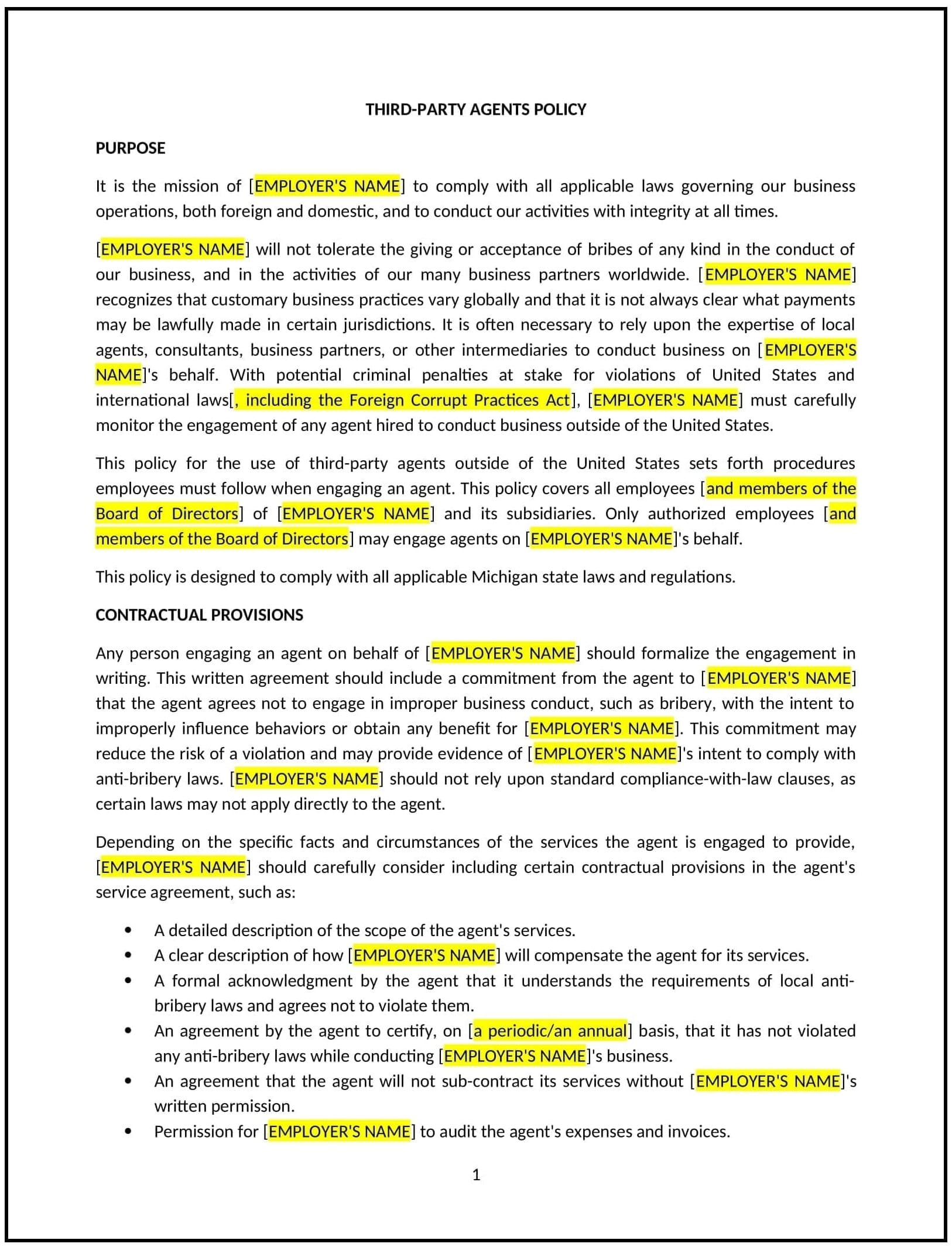

A third-party agents policy provides Michigan businesses with guidelines for managing relationships with third-party agents, contractors, and vendors. This policy establishes clear expectations for due diligence, compliance, and monitoring of third-party activities to ensure they align with the business’s values, legal requirements, and business objectives. It outlines the process for selecting, contracting, and managing third-party agents, with particular attention to risks such as fraud, corruption, and conflicts of interest.

By adopting this policy, businesses can mitigate risks associated with third-party relationships, maintain compliance with relevant regulations, and ensure that external partners uphold the business's standards and reputation.

How to use this third-party agents policy (Michigan)

- Define what constitutes a third-party agent: Clearly define the types of third-party agents the policy applies to, including contractors, consultants, suppliers, and other external parties who perform services on behalf of the business.

- Conduct due diligence: Establish procedures for performing background checks and evaluating the reputation, financial stability, and compliance history of potential third-party agents before entering into a business relationship. This process helps minimize risks associated with fraud, corruption, or unethical behavior.

- Set expectations for compliance: Clearly outline the business’s compliance expectations, including adherence to Michigan state laws, federal regulations, and industry-specific standards. Ensure third-party agents understand the importance of complying with these requirements.

- Require written contracts: Ensure all agreements with third-party agents are formalized in written contracts. These contracts should outline the terms of the relationship, expectations for performance, compliance with laws, confidentiality agreements, and dispute resolution procedures.

- Monitor third-party performance: Establish processes for regularly monitoring and reviewing the performance and compliance of third-party agents. This may include conducting audits, assessing deliverables, and ensuring that agents meet contractual obligations and business standards.

- Address conflicts of interest: Include guidelines for identifying and managing conflicts of interest in third-party relationships. Agents should be required to disclose any potential conflicts and avoid situations where their interests could undermine the business’s goals or ethical standards.

- Manage confidentiality and data security: Define how third-party agents should handle sensitive business information, including intellectual property, customer data, and trade secrets. Contracts should specify security measures and confidentiality obligations to protect proprietary information.

- Specify consequences for non-compliance: Outline the consequences for third-party agents who fail to meet contractual obligations or comply with the policy. This may include penalties, termination of the relationship, or legal action if necessary.

- Review and update regularly: Periodically review the policy to ensure it reflects current legal requirements, best practices, and the evolving needs of the business. Regular updates help maintain a strong and effective third-party management strategy.

Benefits of using this third-party agents policy (Michigan)

This policy provides several key benefits for Michigan businesses:

- Mitigates risks: By establishing clear guidelines for managing third-party agents, businesses can reduce the risk of fraud, corruption, and legal violations that can arise from external relationships.

- Enhances legal compliance: The policy ensures that businesses comply with Michigan state laws, federal regulations, and industry standards, reducing the risk of fines, penalties, or legal action.

- Improves accountability: Clear expectations and monitoring processes hold third-party agents accountable for their performance and compliance, ensuring they meet the business’s standards and contractual obligations.

- Protects sensitive information: By specifying confidentiality and data security measures, the policy helps protect the business’s proprietary information and customer data from unauthorized access or misuse by third parties.

- Strengthens business reputation: A well-managed third-party agent policy demonstrates that the business values ethical conduct, compliance, and transparency, which can enhance its reputation among customers, investors, and partners.

- Supports business growth: A solid third-party agent policy allows businesses to confidently expand their network of external partners while minimizing risks, ensuring that relationships contribute positively to business objectives.

Tips for using this third-party agents policy (Michigan)

- Communicate the policy clearly: Ensure all employees, especially those involved in contracting and vendor management, understand the third-party agents policy and its requirements.

- Perform regular due diligence: Continuously evaluate and reassess third-party agents before and during the course of the relationship to ensure they meet the business’s compliance and performance standards.

- Monitor performance and compliance: Regularly track third-party agents' performance and ensure they are meeting all contractual obligations and legal requirements. Conduct audits and reviews as needed.

- Maintain clear and comprehensive contracts: Make sure that all third-party relationships are documented with clear contracts that outline expectations, performance metrics, compliance requirements, and the handling of confidential information.

- Address issues proactively: When problems arise with third-party agents, address them immediately. Use the contract as a guide to resolve disputes and maintain a professional and transparent relationship.

- Review the policy regularly: Update the policy regularly to ensure it reflects any changes in laws, business operations, or risk management strategies.