Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

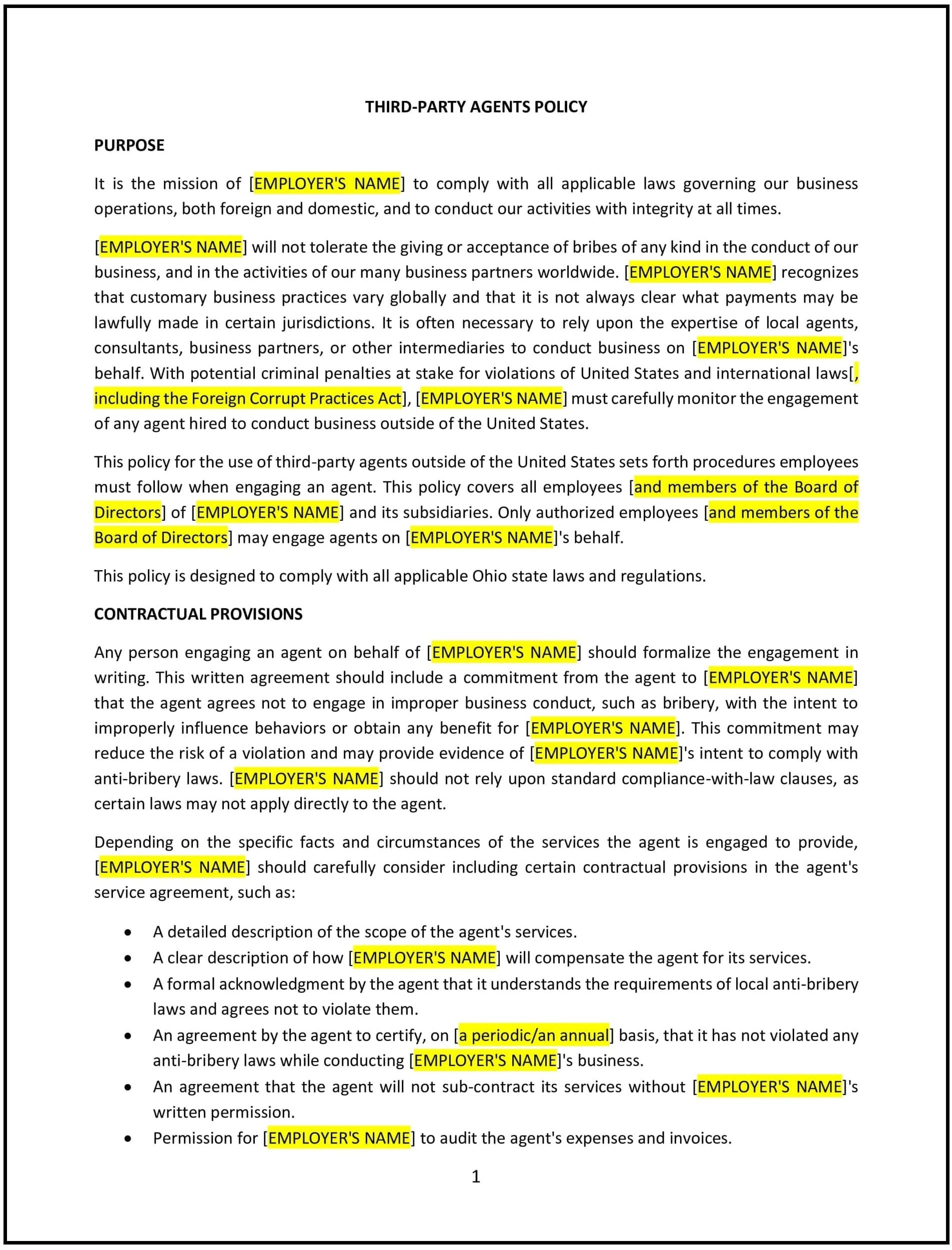

Third-party agents policy (Ohio)

A third-party agents policy establishes the guidelines and expectations for Ohio businesses when working with third-party agents or contractors who provide services or perform functions on behalf of the business. This policy defines the types of third-party relationships covered, outlines the due diligence process for selecting third-party agents, and specifies the responsibilities and compliance requirements of these agents. It also includes provisions to ensure that third-party agents adhere to the business’s values, legal obligations, and security standards.

By implementing this policy, Ohio businesses can mitigate risks associated with third-party relationships, ensure that third-party agents meet business standards, and maintain legal and regulatory compliance.

How to use this third-party agents policy (Ohio)

- Define third-party agents: The policy should clarify who qualifies as a third-party agent, including contractors, vendors, suppliers, consultants, and service providers who are engaged to perform work or provide services on behalf of the business.

- Conduct due diligence: The policy should outline the process for vetting third-party agents, including background checks, reviewing their financial stability, assessing their legal and regulatory compliance, and evaluating their business practices.

- Establish compliance requirements: The policy should specify that third-party agents must adhere to the business's compliance requirements, including data security, confidentiality, anti-corruption, and any applicable industry-specific regulations.

- Specify contractual obligations: The policy should outline the need for formal agreements with third-party agents that detail the scope of services, performance expectations, confidentiality provisions, and compliance with legal requirements.

- Monitor and audit third-party agents: The policy should explain how the business will monitor and assess third-party agent performance, ensuring that agents comply with contractual obligations and maintain the business’s standards.

- Address risk management: The policy should specify how risks associated with third-party relationships will be managed, including the use of insurance, indemnification, and the handling of potential disputes or issues that may arise.

- Ensure data protection and confidentiality: The policy should emphasize the importance of protecting sensitive business and customer data when working with third-party agents and require agents to implement appropriate security measures to safeguard information.

- Review and update regularly: The policy should be reviewed periodically to ensure it remains aligned with Ohio state laws, federal regulations, and best practices for managing third-party relationships.

Benefits of using this third-party agents policy (Ohio)

This policy provides several key benefits for Ohio businesses:

- Reduces risk: By setting clear expectations and requirements for third-party agents, the policy helps mitigate the risks associated with outsourcing work or services, including legal, operational, and reputational risks.

- Ensures compliance: The policy ensures that third-party agents are aware of and adhere to the business's compliance standards, reducing the risk of violations or legal issues.

- Protects business interests: By formalizing agreements and monitoring third-party performance, the policy helps protect the business’s intellectual property, confidential information, and reputation from potential misuse or mismanagement.

- Enhances accountability: Clear guidelines for managing third-party agents ensure that agents are held accountable for their actions and responsibilities, maintaining high standards of service and performance.

- Strengthens business relationships: By establishing clear expectations and communication channels, the policy fosters better relationships with third-party agents, which can lead to improved collaboration and service quality.

- Improves operational efficiency: By streamlining the process for selecting, onboarding, and managing third-party agents, the policy helps businesses operate more efficiently and avoid unnecessary disruptions caused by third-party performance issues.

- Supports business continuity: The policy helps ensure that third-party agents are compliant with business requirements, reducing the likelihood of operational disruptions due to non-compliance or performance failures.

Tips for using this third-party agents policy (Ohio)

- Communicate the policy clearly: Ensure that all employees involved in managing third-party agents understand the policy and the process for selecting, monitoring, and evaluating third-party relationships.

- Regularly assess third-party relationships: Periodically review the performance of third-party agents to ensure they are meeting contractual obligations and business standards. This can include performance reviews, audits, and compliance checks.

- Establish clear contract terms: Ensure that all third-party agreements include clear terms outlining the scope of work, performance expectations, compliance obligations, and dispute resolution procedures.

- Train relevant employees: Provide training for employees who manage third-party agents, ensuring they understand the importance of monitoring compliance, maintaining confidentiality, and managing risk.

- Implement strong data protection measures: Work with third-party agents to ensure that they implement appropriate data protection and security measures to protect sensitive business and customer information.

- Stay informed about legal requirements: Keep up-to-date with any changes in Ohio state laws or federal regulations related to third-party agents and update the policy as needed to remain compliant.