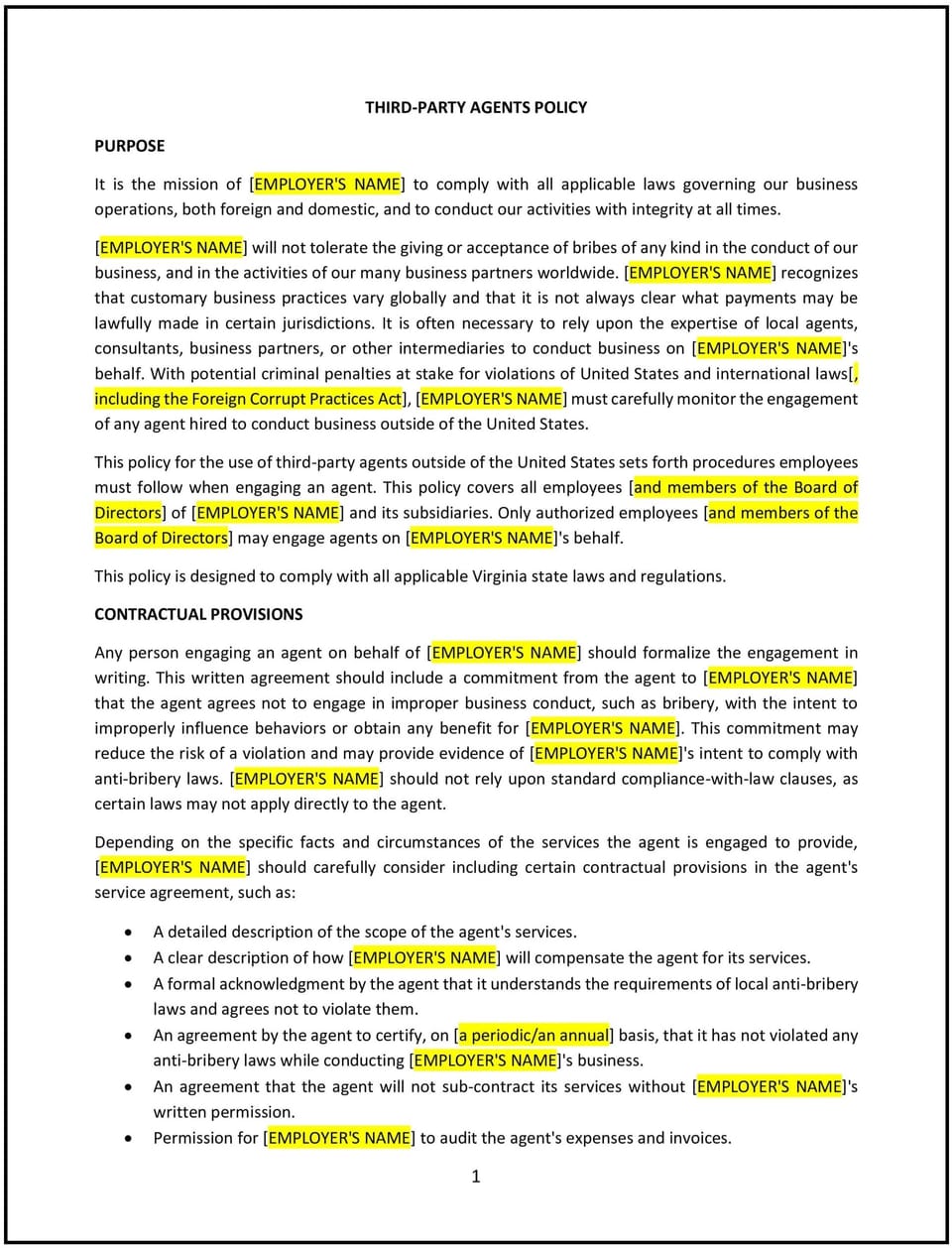

Third-party agents policy (Virginia): Free template

This third-party agents policy is designed to help Virginia businesses establish clear guidelines for engaging with third-party agents, contractors, and vendors. The policy outlines the expectations for selecting, managing, and monitoring third-party relationships to strengthen compliance with company standards, legal requirements, and ethical practices. It also addresses issues related to confidentiality, data protection, and the potential risks associated with third-party engagements.

By adopting this policy, businesses can mitigate risks, ensure accountability, and promote transparency in their third-party relationships.

How to use this third-party agents policy (Virginia)

- Define third-party agents: The policy should clearly define who qualifies as a third-party agent, including contractors, consultants, vendors, and other service providers. It should specify that third-party agents must comply with all relevant laws and company policies when engaging in business dealings with the company.

- Set selection and due diligence requirements: The policy should establish procedures for selecting third-party agents, including conducting background checks, reviewing qualifications, and assessing the agent’s ability to meet the company’s ethical standards and operational needs. This process should include evaluating financial stability, reputation, and compliance with applicable laws.

- Outline the scope of third-party agreements: The policy should specify the types of agreements that will govern third-party relationships, such as contracts, service level agreements (SLAs), and non-disclosure agreements (NDAs). These agreements should clearly define the rights and responsibilities of both parties, as well as the terms of compensation, timelines, and deliverables.

- Address confidentiality and data protection: The policy should include provisions for ensuring that third-party agents maintain confidentiality and protect the company’s sensitive information. This includes ensuring that third-party agents understand and comply with data protection laws and regulations, including those related to cybersecurity and privacy.

- Establish monitoring and performance expectations: The policy should set out how third-party relationships will be monitored and evaluated, including regular performance reviews and audits to ensure that third-party agents meet agreed-upon standards and deliverables. Businesses should be proactive in identifying any issues or risks associated with third-party engagements.

- Define the process for managing conflicts of interest: The policy should require third-party agents to disclose any potential conflicts of interest and provide guidelines for how such conflicts will be handled. This could include the implementation of safeguards or the reassignment of certain responsibilities.

- Ensure compliance with Virginia state and federal laws: The policy should ensure that third-party relationships comply with Virginia state laws and federal regulations, including anti-corruption, anti-bribery, and labor laws. It should address any legal requirements specific to the industry or type of work being performed.

- Review and update regularly: Periodically review and update the policy to ensure it is compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this third-party agents policy (Virginia)

This policy offers several benefits for Virginia businesses:

- Mitigates legal and reputational risks: By ensuring that third-party agents adhere to company standards and legal requirements, the policy helps mitigate the risks associated with vendor relationships, such as legal violations, reputational damage, or financial loss.

- Promotes ethical conduct: The policy establishes clear ethical guidelines for third-party agents, ensuring that they act in the company’s best interests and uphold high standards of conduct in their business dealings.

- Improves transparency and accountability: By setting clear expectations for third-party relationships, the policy ensures that both parties understand their roles and responsibilities, leading to more transparent and accountable business practices.

- Enhances compliance: The policy helps ensure that third-party agents comply with Virginia state laws, federal regulations, and industry-specific standards, reducing the risk of non-compliance and legal disputes.

- Strengthens business relationships: By clearly defining the terms of engagement and performance expectations, the policy helps foster positive, long-term relationships with third-party agents, which can lead to more successful partnerships and improved business outcomes.

- Increases operational efficiency: The policy provides a structured approach to managing third-party relationships, making it easier to identify and resolve issues quickly, which can improve operational efficiency and reduce delays.

Tips for using this third-party agents policy (Virginia)

- Communicate the policy clearly: Ensure that all employees, particularly those involved in managing third-party relationships, are aware of the third-party agents policy and understand their responsibilities. Include the policy in the employee handbook and review it during onboarding and training.

- Conduct thorough due diligence: When selecting third-party agents, perform comprehensive due diligence to ensure that the agent has a good track record of ethical business practices and complies with all relevant laws and regulations.

- Monitor performance regularly: Establish regular performance reviews and audits of third-party agents to ensure that they meet the company’s expectations and continue to comply with legal and contractual requirements. Address any issues as soon as they arise.

- Maintain transparency: Keep records of all third-party agreements, performance evaluations, and communications to ensure transparency and accountability. This will help in the event of any disputes or issues with a third-party agent.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

Q: What is a third-party agent?

A: A third-party agent is an individual or organization that provides goods or services to the company under a formal agreement. This can include contractors, consultants, suppliers, and service providers who are not directly employed by the company.

Q: How does the company select third-party agents?

A: The company selects third-party agents through a thorough vetting process that includes background checks, evaluating the agent’s qualifications, financial stability, and reputation, and ensuring they comply with relevant laws and company standards.

Q: How are third-party agents monitored?

A: The company monitors third-party agents through regular performance reviews, audits, and evaluations. These checks ensure that agents meet agreed-upon deliverables, comply with contractual terms, and uphold ethical business practices.

Q: What happens if a third-party agent violates the terms of their agreement?

A: If a third-party agent violates the terms of their agreement, the company will address the violation in accordance with the contract, which may include issuing warnings, requiring corrective action, or terminating the relationship if necessary.

Q: Are third-party agents required to protect confidential information?

A: Yes, third-party agents are required to protect the company’s confidential information and follow all data protection laws. The policy outlines the confidentiality requirements and ensures that agents understand their responsibilities in maintaining the privacy of sensitive business information.

Q: How often should this policy be reviewed?

A: The policy should be reviewed periodically, at least annually, to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.