Third-party agents policy (Washington): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

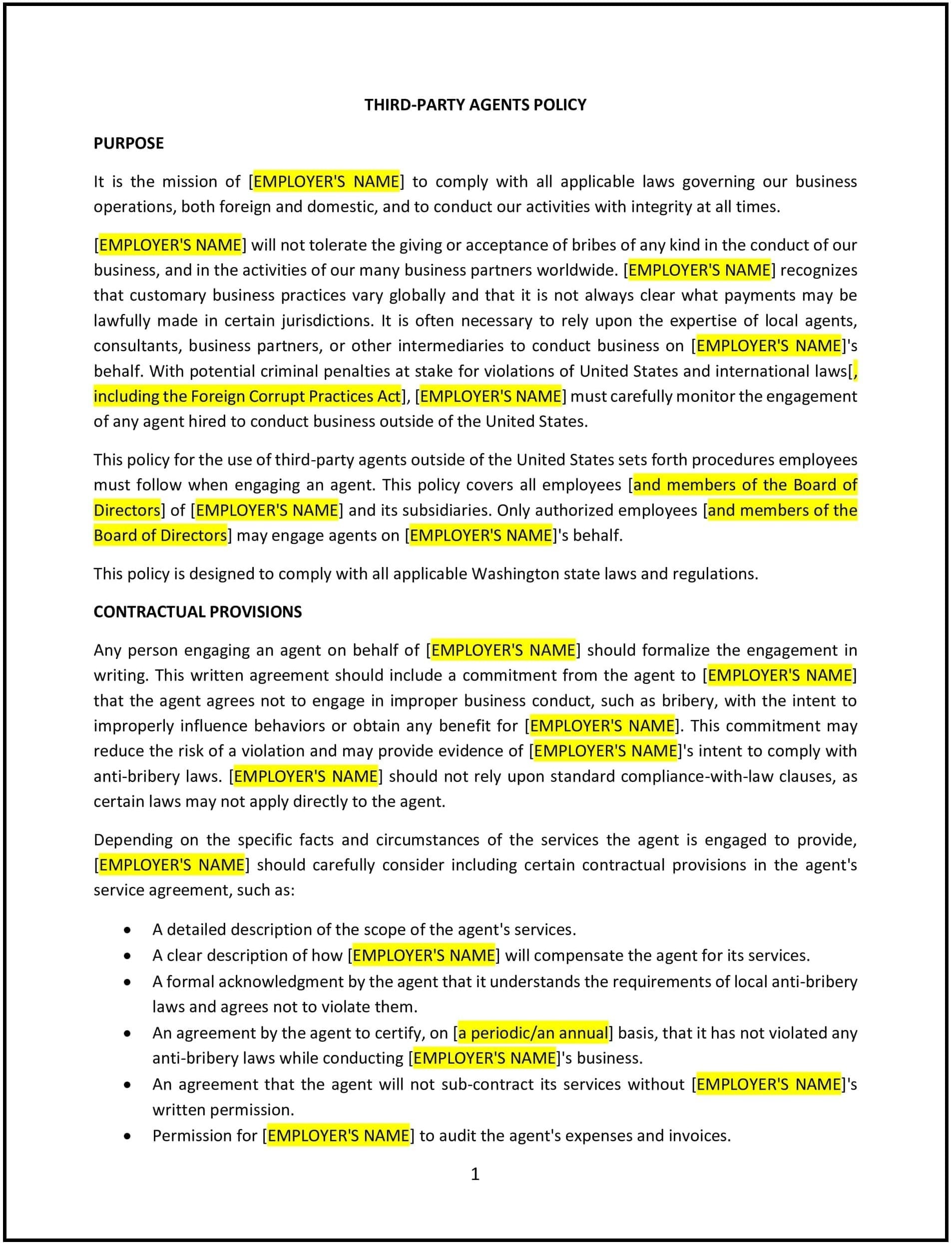

This third-party agents policy is designed to help Washington businesses manage and regulate their relationships with third-party agents, contractors, vendors, and other external parties who provide services to the company. The policy outlines the expectations for third-party agents, the procedures for managing contracts, and the standards for compliance with applicable laws, including Washington state and federal regulations.

By adopting this policy, businesses can ensure that third-party agents act in the company’s best interests, comply with relevant laws, and maintain ethical standards in their interactions with the company.

How to use this third-party agents policy (Washington)

- Define third-party agents: The policy should clearly define what constitutes a third-party agent, including contractors, consultants, vendors, and service providers. It should specify the types of agreements or relationships covered by the policy, such as supplier contracts, outsourcing agreements, or joint ventures.

- Set expectations for compliance and ethics: The policy should specify the expectations for third-party agents to comply with all applicable laws, regulations, and company policies. This includes adhering to ethical standards, maintaining confidentiality, avoiding conflicts of interest, and following guidelines for workplace safety, labor standards, and environmental impact.

- Establish contract management procedures: The policy should outline the process for selecting, negotiating, and managing contracts with third-party agents. It should specify who is responsible for reviewing and approving contracts, what information should be included in agreements, and how the company will monitor third-party performance and compliance.

- Address due diligence and risk assessment: The policy should require the company to perform due diligence and assess potential risks when engaging with third-party agents. This may include evaluating their financial stability, reputation, and compliance with legal and regulatory requirements before entering into any agreements.

- Ensure confidentiality and data protection: The policy should address the protection of confidential information shared with third-party agents. It should specify that third-party agents must adhere to confidentiality agreements and take appropriate measures to safeguard sensitive company data and intellectual property.

- Provide guidelines for handling non-compliance: The policy should outline the steps the company will take if a third-party agent fails to comply with the terms of their agreement, including corrective actions, contract termination, or legal action if necessary. It should specify how violations will be reported, investigated, and addressed.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in company operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this third-party agents policy (Washington)

This policy offers several benefits for Washington businesses:

- Mitigates legal and financial risks: The policy helps businesses reduce risks associated with third-party relationships by supporting compliance with relevant laws and regulations. It provides clear guidelines for managing contracts and monitoring third-party agents’ performance.

- Protects company assets: The policy helps safeguard confidential information, intellectual property, and other valuable assets by setting expectations for confidentiality and data protection.

- Promotes ethical business practices: By setting clear standards for third-party agents, the policy promotes ethical conduct, transparency, and accountability in business relationships.

- Improves vendor and contractor relationships: Establishing clear expectations for third-party agents fosters positive relationships, helps avoid misunderstandings, and ensures that all parties understand their responsibilities and obligations.

- Enhances company reputation: A business that follows a clear and well-defined third-party agents policy demonstrates its commitment to compliance, ethical practices, and responsible business operations, which can enhance its reputation in the market.

- Reduces conflicts of interest: By setting guidelines for third-party relationships, the policy helps prevent conflicts of interest and ensures that external agents act in the best interests of the company.

Tips for using this third-party agents policy (Washington)

- Communicate the policy clearly: Ensure that all employees involved in managing third-party relationships understand the third-party agents policy. Include the policy in the employee handbook, review it during onboarding, and provide periodic reminders.

- Perform due diligence: Before entering into any third-party agreements, conduct thorough due diligence to assess potential risks, including financial stability, reputation, and compliance with applicable laws and regulations.

- Monitor third-party performance: Regularly assess the performance of third-party agents to ensure that they are meeting the terms of their contracts and complying with company policies and legal requirements. This may include regular check-ins, audits, or performance evaluations.

- Implement a clear contract review process: Establish a consistent process for reviewing and approving contracts with third-party agents. Ensure that contracts clearly outline the expectations, deliverables, timelines, and compliance requirements.

- Address violations promptly: If a third-party agent is found to be in violation of the policy or their agreement, take immediate corrective action to resolve the issue. This may include renegotiating the contract, issuing warnings, or terminating the relationship if necessary.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s operations. Regular updates will help keep the policy relevant and effective.